Government/Policy

February 28, 2019

Commerce Initiates AD/CVD Investigation on Fabricated Structural Steel

Written by Sandy Williams

The Commerce Department announced Tuesday that it has initiated new antidumping duty (AD) and countervailing duty (CVD) investigations to determine whether fabricated structural steel from Canada, China and Mexico is being sold in the United States at less than fair value, and to find if producers in those three countries are receiving unfair subsidies.

The investigation was launched following a petition by the American Institute of Steel Construction. The petition alleges that Canada has 44 subsidy programs, China has 25 and Mexico has 19 including subsidies on taxes, grants, loans, export insurance and export programs, among others.

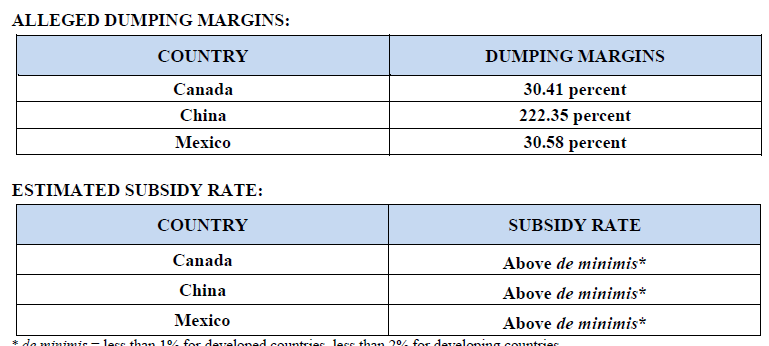

The alleged dumping margins are 30.41 percent for Canada, 222.35 percent for China and 30.58 percent for Mexico.

In 2017, imports of fabricated structural steel from Canada, China and Mexico were valued at an estimated $658.3 million, $841.7 million, and $406.6 million, respectively.

The next step will be a preliminary injury determination by the U.S. International Trade Commission by March 21, 2019.

If there is a reasonable indication that imports of fabricated structural steel from Canada, China and/or Mexico materially injure, or threaten material injury to, the domestic industry in the United States, the investigations will continue. Commerce will be scheduled to announce its preliminary CVD determinations on May 2, 2019, and its preliminary AD determinations on July 16, 2019, although these dates may be extended. If the ITC’s determinations are negative, the investigations will be terminated.