Prices

February 26, 2019

CRU: Iron Ore Prices Decline as Market Awaits News on Chinese Stimulus Measures

Written by Tim Triplett

By CRU Analyst Jordan Permain

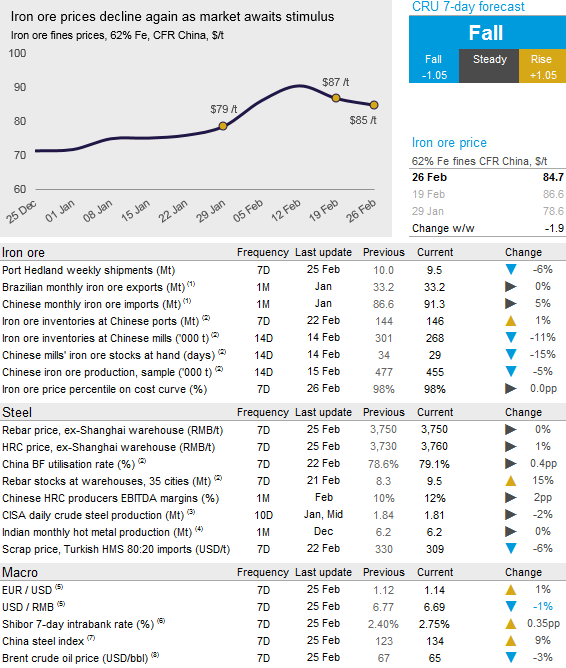

Iron ore prices declined for the second consecutive week as the market awaits the announcement of stimulus measures in China. On Tuesday, Feb. 26, CRU has assessed the 62% Fe fines price at $84.70 /t, down $1.90 /t w/w.

Steel demand has remained weak in China in the past seven days. Rebar inventories increased to the highest level seen so far in 2019 due to weak demand from the construction sector. Market participants have been cautiously waiting for clarity on stimulus measures, which will be announced during the National People’s Congress starting in early-March. Ongoing trade talks between China and the U.S. have added further uncertainty as to how Chinese authorities will proceed with stimulus measures. While there was a slight increase in domestic steel prices, margins remain low and mills have been hesitant to procure raw materials.

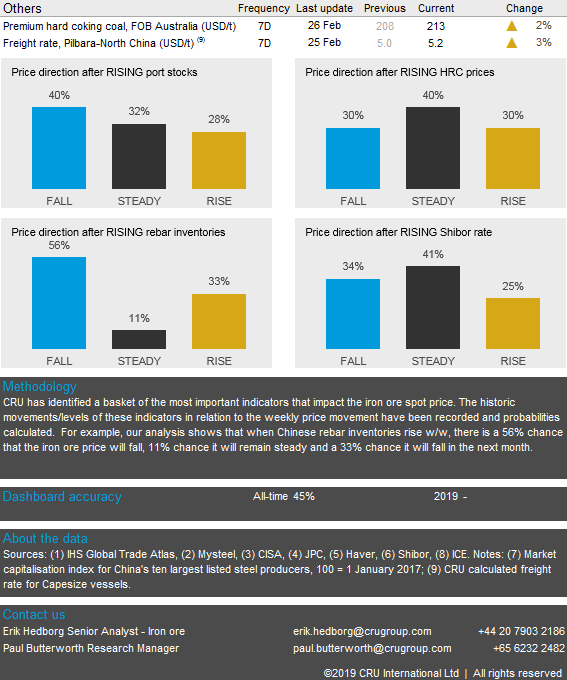

We expect prices to decline again in the coming week due to weak demand and high steel stocks. On the supply side, shipments from Port Hedland decreased slightly in the past week, but were in line with the 2019 average to date and should be stable next week as there are currently no cyclone threats. Port stocks in China increased in the past week and are now at the highest level in 2019, therefore any increases in demand in the coming week will be met by drawing down port inventories. The critical factor will be the outcome from the National People’s Congress; without an announcement of significant stimulus in the next week, overall conditions in China will remain weak.