Prices

February 24, 2019

CRU: Lower Iron Ore Supply to Affect Pig Iron

Written by Tim Triplett

By CRU Latin America Analyst Thais Terzian

On Jan. 25, one of Vale’s tailing dams located in Brumadinho, Minas Gerais, breached. The dam was part of Vale’s Córrego do Feijão mine and its breach tragically caused the death of several hundred people. On Jan. 29, Vale announced the suspension of production at nine mines in its Southern System. The total production loss in this system could be 40 Mt/y. While Vale is expecting production to resume at most of these sites within three years, we do not expect Vale to be able to replace all 40 Mt/y of lost production from other sites in the interim. In addition, the state court in Minas Gerais ordered the suspension of operations at eight tailings dams on Feb. 4, which has forced the idling of the Brucutu mine and beneficiation plant in Vale’s Southeastern System, removing an additional 30 Mt/y of production from the market.

These Southern System mines are the main suppliers of iron ore to nodular pig iron producers located in Minas Gerais state, which is where most Brazilian nodular producers are based. Therefore, the production of nodular pig iron will be directly affected by lower iron ore production from Vale. In fact, we understand from market participants that Vale already informed some producers that it will cease ore supply. Hence, we expect nodular pig iron prices will increase. This is likely to incentivize a swap from steelmaking-grade to nodular pig iron production by CIS producers that have the capability to do so. This swap will reduce steelmaking pig iron supply availability and should support higher prices.

Additional price support for steelmaking pig iron should come from higher iron ore prices as production costs will rise. In fact, since the dam accident, the iron ore price has increased by $11 /t to $87 /t. Immediately after the accident, prices even surpassed $90 /t for a short period of time.

Even though steelmaking pig iron producers in Minas Gerais buy iron ore from local small producers and not from Vale, these small producers take the 62% Fe fines price into consideration when determining their product prices, and thus, some cost pressure will emerge for all Brazilian steelmaking-grade pig iron producers. According to market participants, pig iron producers’ margins are squeezed given the recent movements in the Brazilian Real and pig iron prices, and therefore, we believe any cost increase will be passed on directly to clients.

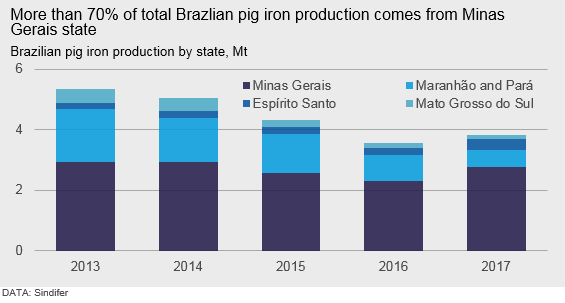

However, some companies are considering reopening idled capacity of steelmaking pig iron in Minas Gerais, which would curb part of the support for prices. According to the last data from Sindifer, there are 34 pig iron producers operating in Minas Gerais state, with production capacity of around 4.5 Mt/y of pig iron and capacity utilization at around 60-65 percent. Currently, Minas Gerais is the main region of merchant pig iron production in Brazil, accounting for around 70 percent of the country’s total production (see chart). In addition, around 600 kt/y of nodular pig iron alongside 500 kt/y of foundry/grey pig iron are produced in the state.