Market Data

February 21, 2019

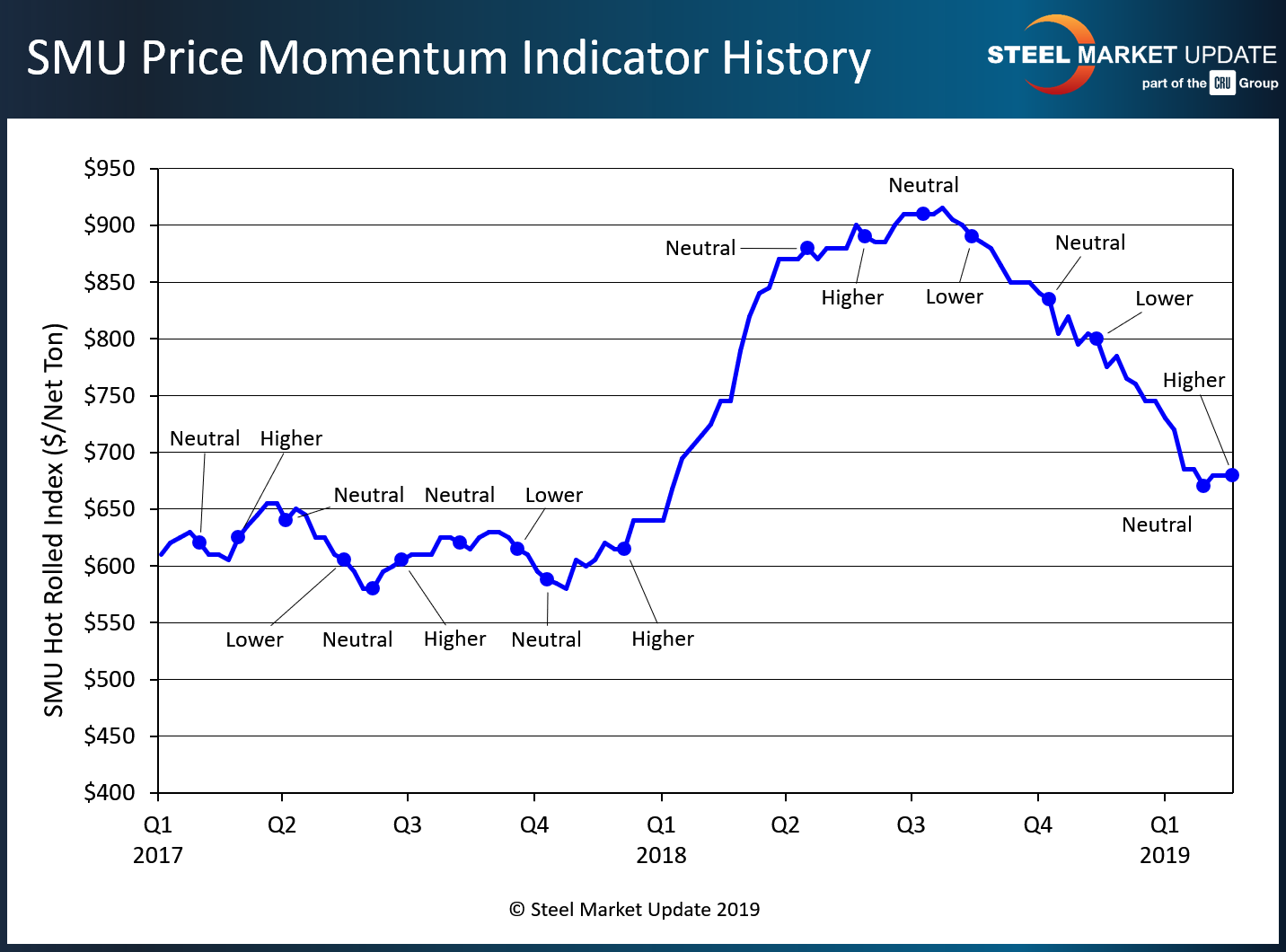

SMU Price Momentum Indicator Adjusted from Neutral to Higher

Written by John Packard

This morning, Steel Market Update adjusted our Price Momentum Indicator on flat rolled from Neutral to Higher. Our Price Momentum Indicator was last adjusted on Jan. 28, 2019, when we moved from Lower to Neutral as the domestic steel mills, led by Nucor, began announcing price increases. It is normal for SMU to adjust our indicator to Neutral when price announcements are made. Then we wait for signs from the market to see if the increases will be collected and if momentum has been altered.

![]() There have been two price increase announcements totaling a minimum of $80 per ton since the Jan. 28. We have only seen a slight improvement in benchmark hot rolled prices ($5-$15 per ton) since coming off the lows. However, the mills appear determined to get the spot base price to $700 per ton ($35.00/cwt), and we are hearing from most steel buyers that they expect the $700-$720 levels to stick over the next few weeks. However, few think the market is strong enough to go to $730 per ton.

There have been two price increase announcements totaling a minimum of $80 per ton since the Jan. 28. We have only seen a slight improvement in benchmark hot rolled prices ($5-$15 per ton) since coming off the lows. However, the mills appear determined to get the spot base price to $700 per ton ($35.00/cwt), and we are hearing from most steel buyers that they expect the $700-$720 levels to stick over the next few weeks. However, few think the market is strong enough to go to $730 per ton.

We heard from a steel buyer in Texas who told us his opinion was for prices to move higher. “All the input costs are rising. World pricing is rising. Demand is good for domestic mills, especially with the large OCTG projects coming to fruition in Texas this year to move oil from West Texas to Louisiana as well as the Port Arthur/Houston areas.” He went on to say he thinks it will take a few weeks for prices to rise. “Lead times pushing out is starting to raise the eyebrows of buyers.”

Lead times moving out is one reason for our move to Higher from Neutral. As lead times move out, steel buyers must plan further out and need to buy more steel. The mills are telling SMU that their bookings have been strong over the past couple of weeks.

Steel input costs are rising. Scrap is expected to go up when March negotiations are done. Iron ore prices are up due to the Vale dam disaster. We are hearing slab prices are up $30 to $40 per metric ton.

There are fewer foreign flat rolled tons coming into the U.S. and steel buyers have not been enamored with the latest price offers on most items. If the tons that went foreign are now going domestic, that increases the load on the domestic steel mills, pushes lead times out and keeps momentum moving higher.

We are also entering the time of year for strong seasonal demand. This demand will only get stronger once winter breaks in the north.

All of these factors have led us to our decision to move SMU Price Momentum to Higher.