Prices

February 21, 2019

Hot Rolled Futures: Q2'19 to Q4'19 Backwardation Gets Steeper

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Market chatter suggests that February has been a fairly active month for HR physical steel sales as spot price indexes have pushed below $680/ST. Another $40/ST price increase for flat rolled prices by a number of steel mills this week has added a bit more uncertainty to the mix. Increased volumes on indexed contract sales this month could be a harbinger of light March HR spot physical sales. Thus, recorded steel mill spot sales activity will likely be at higher prices next month with few takers. Also, heavy sales this month will probably lead to increased steel mill lead times moving forward. Some mills have already closed their March books. Add to this global prices moving higher.

One plausible driver for consumer skepticism is a looming USMCA ratification, which looks likely only to pass with removal of the Section 232 tariffs.

It stands to reason that HR futures trading has been fairly brisk since the beginning of February with the majority of futures trading occurring in Mar’19, Q2’19 and Q4’19. Over 230,000 ST has traded so far this month with a number of very busy days and some light trading days. While the indicated spot trading price had not yet moved above the mid $680/ST price we saw in the last week of January 2019, we have seen some upward price pressure on the near end of the futures curve especially in Mar’19 and Q2’19 on the back of the announced price increases. Yesterday’s CME settlement had Mar’19 HR valued at $725/ST, roughly $6/ST above February 1st settlement value at $719/ST. For Q2’19 HR, the market settlement for those same dates rose about $13/ST. Some of this price pressure is probably related to some calendar spreading from Q2’19 HR to Q4’19 HR. The move higher in Q2’19 HR and the move lower in Q4’19 HR has steepened the backwardation from the beginning of February by $20/ST. The calendar spread on February 1st was valued at 12 back ($725 Q2 vs $713 Q4) versus yesterday’s 32 back value ($738 Q2 vs $706 Q4).

The HR price increases announced, assuming they are reflected in the indexes, should dampen the roughly $45/ST contango we have seen between the indicated spot sales and Q2’19 HR future ($680 spot vs $725 Q2’19 value Feb. 15).

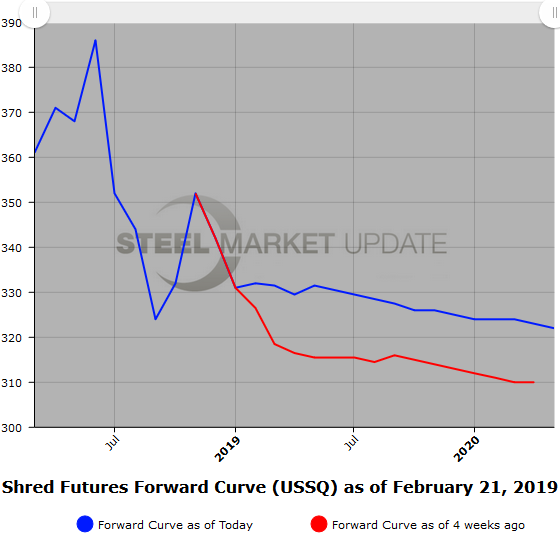

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

On the heels of a $20/GT drop from Jan’19 to Feb’19 BUS, the market is already looking for a full price retracement. Between the HR price increases and anticipated weather-related logistics problems, we could see Mar’19 BUS prices move $20/GT to $30/GT. This past week, Mar’19 BUS has been $365/GT bid. In spite of slower 80/20 sales off the mid-Atlantic coast this past week, $330 plus bids for Mar’`19 Shred could put upward pressure on BUS given that Shred was sideways for the Jan’19-Feb’19 ($320/GT). Q2’19 BUS has been more active with the period about $10/GT higher than early February values. The backwardation in HR futures above is also reflected in the BUS futures curve. Q2’19 BUS vs Q4’19 BUS, which was last valued at $38 back ($381/GT vs $343/GT), has steepened from 16 back ($372/GT vs $356/GT) on February 1st.

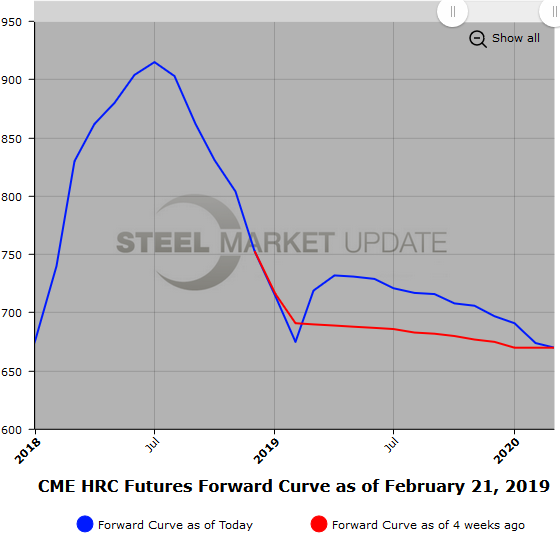

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

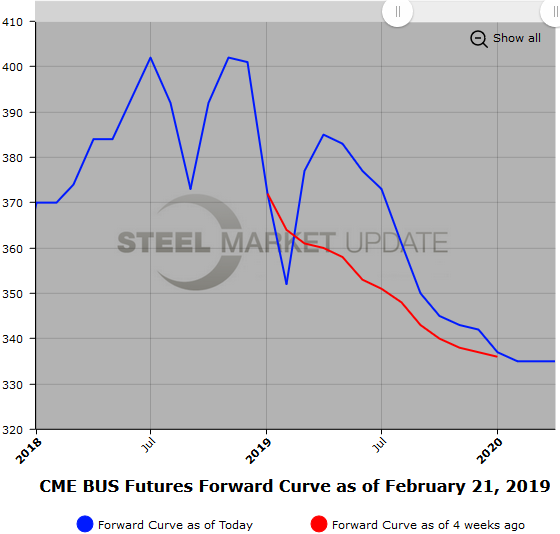

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.