Prices

February 19, 2019

CRU: Iron Ore Prices in Correction as Demand Stays Weak

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

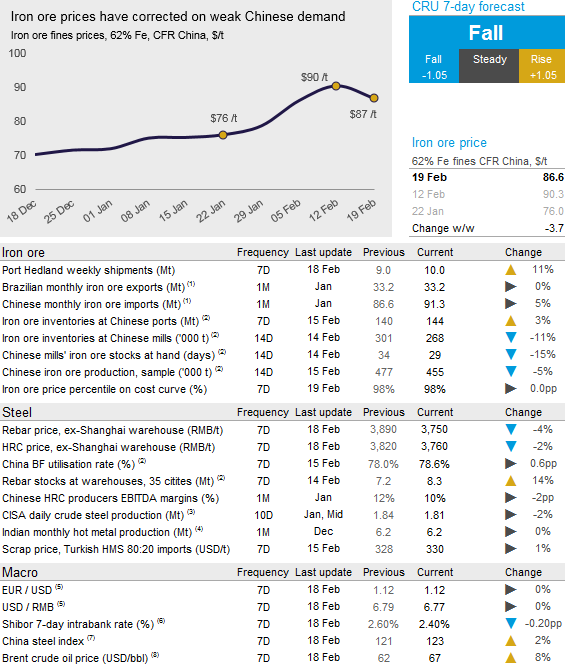

During the past week, iron ore prices fell somewhat as weak Chinese demand continued to weigh on the market. On Tuesday, Feb. 19, CRU assessed the 62% Fe fines price at $86.60 /t, down $3.70 /t w/w.

Again, the Vale dam accident dominated the talks in the market. Although there have been no updates on further supply cuts, the Brazilian authorities have announced that upstream dams in Brazil will now have to be decommissioned by 2021. This is slightly earlier than Vale’s time plan and it will also force other miners in Brazil to take further action. On Friday, Vale also announced that there has been a fire at their blending terminal in Malaysia. The fire will stop transportation to and from the terminal for about 15 days and could have a slight impact on availability of BRBF. However, our sources suggest that this will not have a significant impact on the market as Australian supply is improving and there is still plenty of BRBF at ports in China.

In China, demand has been weak in the past seven days. We have observed attempts at stimulus measures in China, which have resulted in lower interest rates and higher equity prices, as indicated by our China steel index below. However, we expect the market to remain quiet until the National People’s Congress in early-March, for which the market is expecting more clarity on the government actions to tackle a weakening economy.

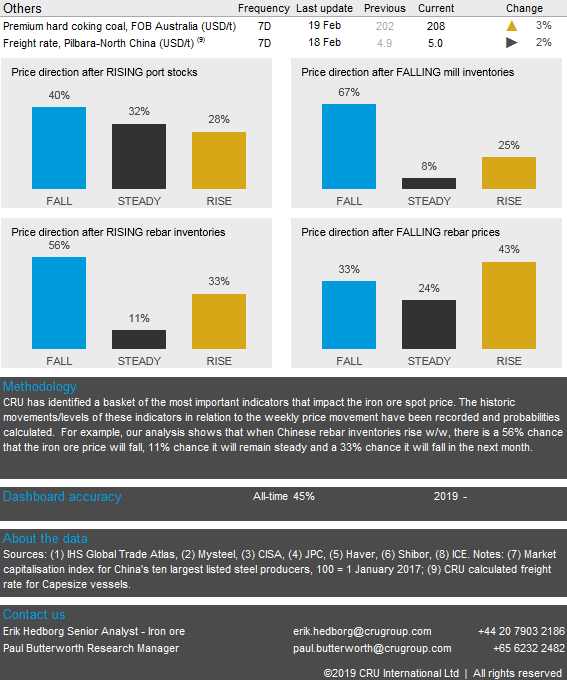

With weak demand side, we expect prices to continue to decline in the coming week. Australian supply has improved and there are currently no threats of cyclones in Northwestern Australia. Port stocks are high at the moment, which means any short-term rise in demand can by met by destocking at ports.

Explore this topic further with CRU.