Market Data

February 18, 2019

SMU Currency Analysis: U.S. Dollar Weakens in the Last Three Months

Written by Peter Wright

The following statement was extracted from the Federal Reserve website: “Effective on Feb. 4, 2019, the Federal Reserve Board staff has made major changes to the methodology used to construct the trade-weighted dollar indexes in the H.10, G.5, and G.5A releases. These changes affect the calculation of index weights and country composition. The new dollar indexes go back to (and are indexed to) January 2006. For more information, see Revisions to the Federal Reserve Dollar Indexes and Technical Q&As.”

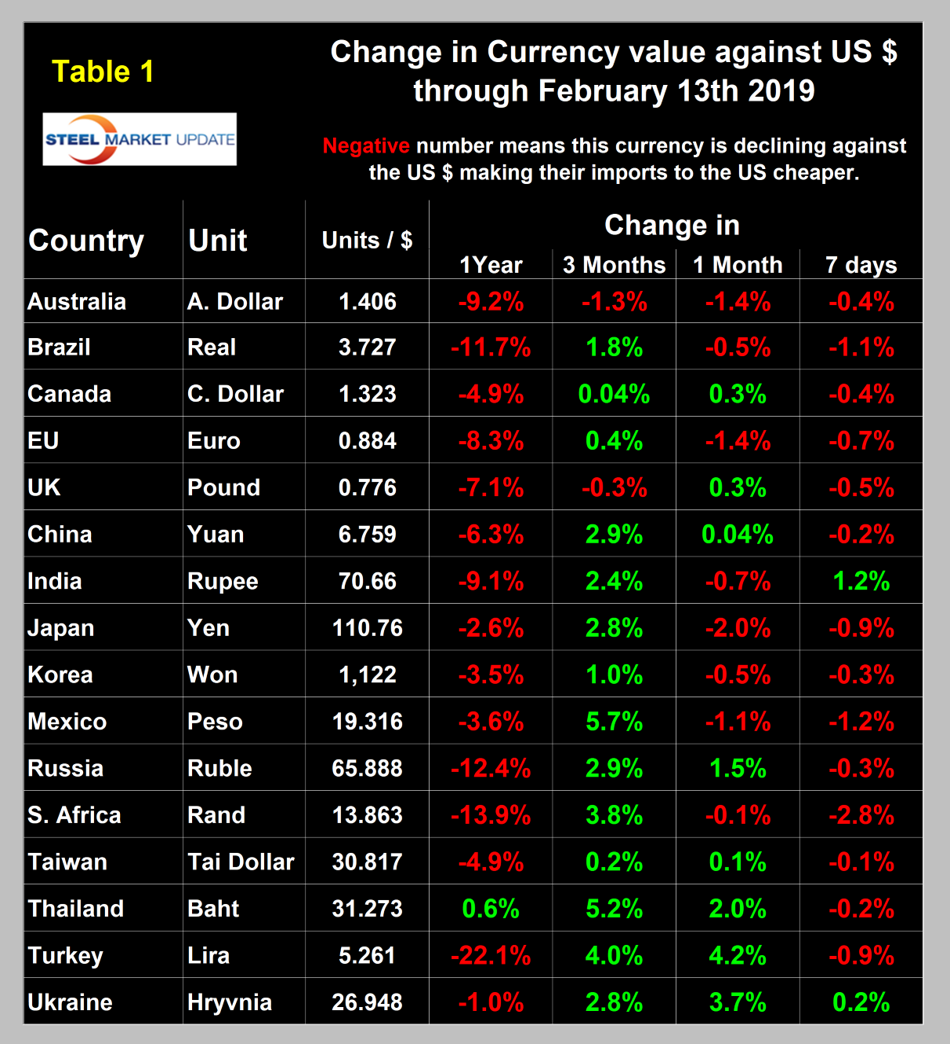

In the last three months, the dollar weakened against 14 of the 16 currencies that Steel Market Update tracks. Since last July, when the dollar strengthened against all 16, there has been a progressive weakening. At the one-month level, the dollar broke even, strengthening against eight and weakening against the other eight. At the seven-day level, the dollar strengthened against 14 of the 16. This is an illustration of currency market volatility. For that reason, we don’t pay much attention to seven-day changes. Please see the end of this report for an explanation of data sources.

![]() The last month has been quiet in terms of publications by currency analysts. As we produce this update, we look for expert opinion to flesh out the values of the 16 steel trading nations that we track, but this month the pickings have been slim.

The last month has been quiet in terms of publications by currency analysts. As we produce this update, we look for expert opinion to flesh out the values of the 16 steel trading nations that we track, but this month the pickings have been slim.

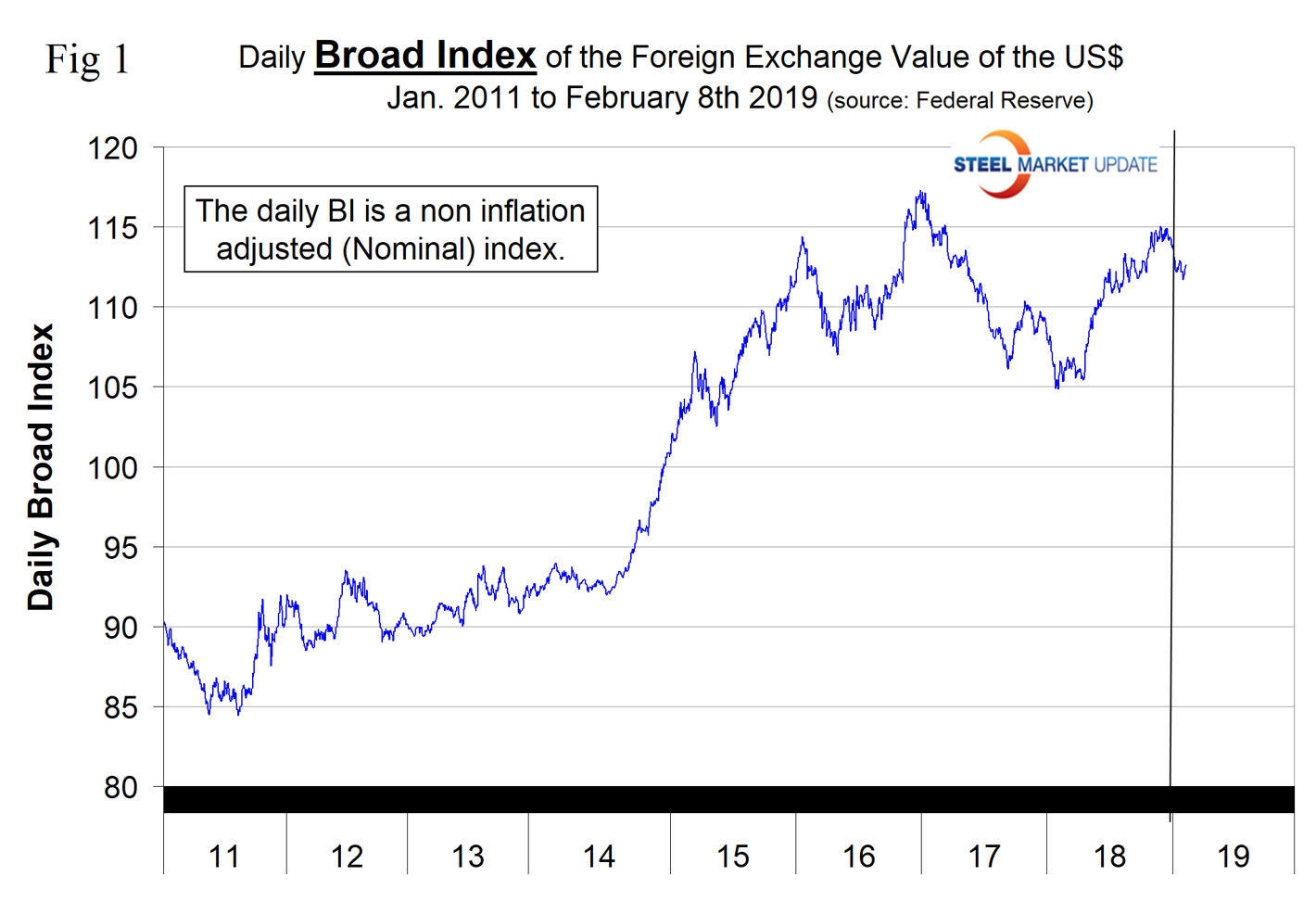

The Broad Index value of the U.S. dollar is reported several days in arrears by the Federal Reserve; the latest value published was for Feb 8. Figure 1 shows the index value since January 2011. In our Dec. 20 report, we stated that the dollar had its highest value in November since March 2002. Because of the weighting changes released on Feb. 4 this is no longer a true statement. The dollar value on Nov. 27, 2018, at 115.03 was the highest since Jan. 27, 2017. On Feb. 8, the index value was 112.63. One of the primary drivers of the value of the U.S. dollar is the differential between U.S. interest rates and those of our major trading partners. Another is the fear index that causes a flight to a safe haven (the U.S. dollar) when traders are nervous.

Each month, SMU publishes an update of Table 1, which shows the value of the U.S. dollar against the currencies of 16 major global steel and iron ore trading nations. The table shows the change in value in one year, three months, one month and seven days through Feb. 13. Currencies that weakened against the U.S. dollar are color coded in red. Green indicates currencies that strengthened against the U.S. dollar.

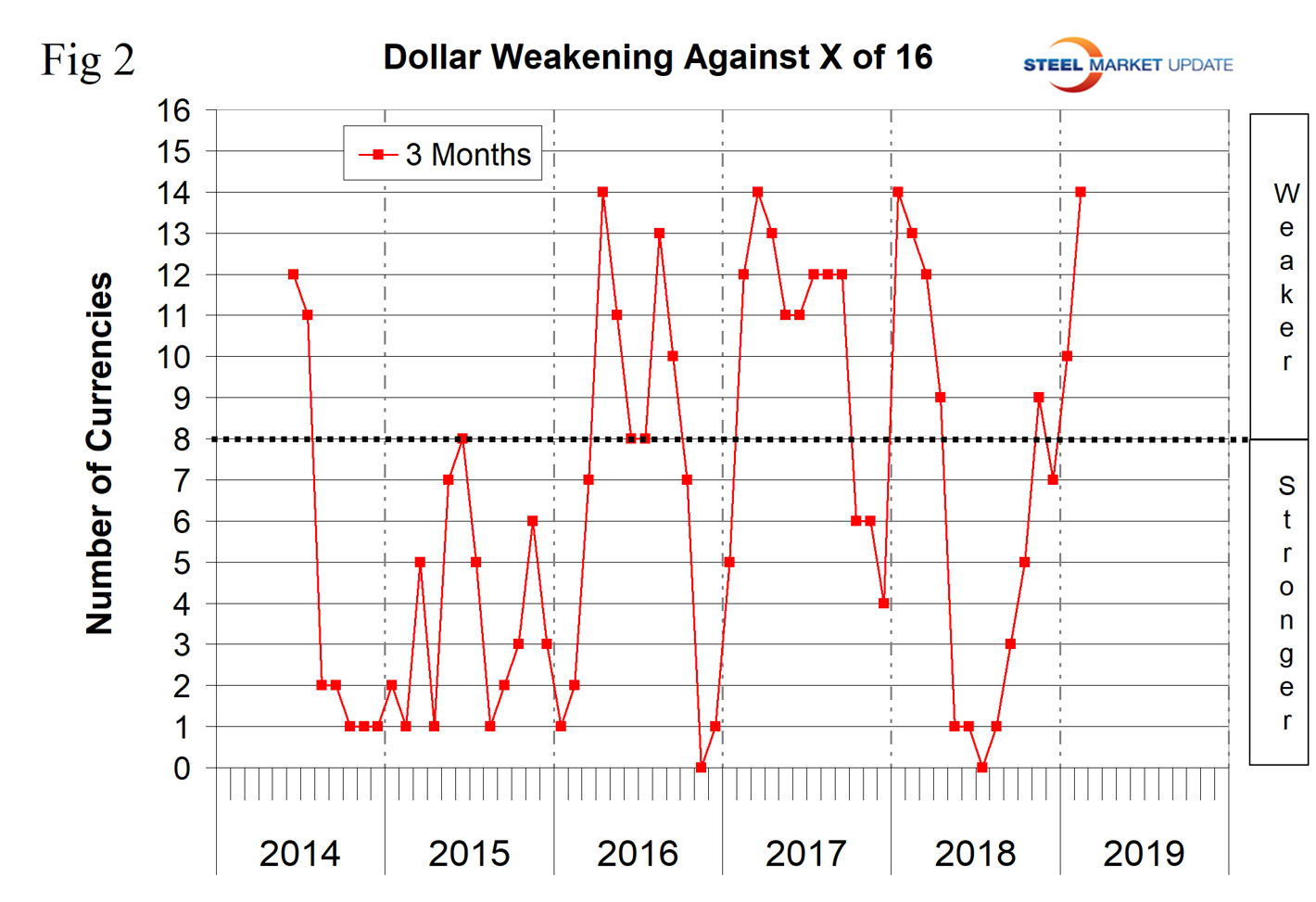

Figure 2 gives a longer-range perspective and shows the extreme gyrations that have occurred in the last three years at the three-month level. Through Feb. 13, the dollar weakened against 14 of the 16 in three months and strengthened against the other two.

A falling dollar puts upward pressure on commodity prices that are greenback denominated. We regard strengthening of the U.S. dollar as negative and weakening as positive because of the effect on the trade balance of all commodities and on the total national trade deficit.

In each of these reports, we describe the history of several of the 16 steel and iron ore trading currencies listed in Table 1 and over a period of several months will give details on all of them. Charts for each of the 16 currencies are available through Feb.13 for any premium subscriber who requests them.

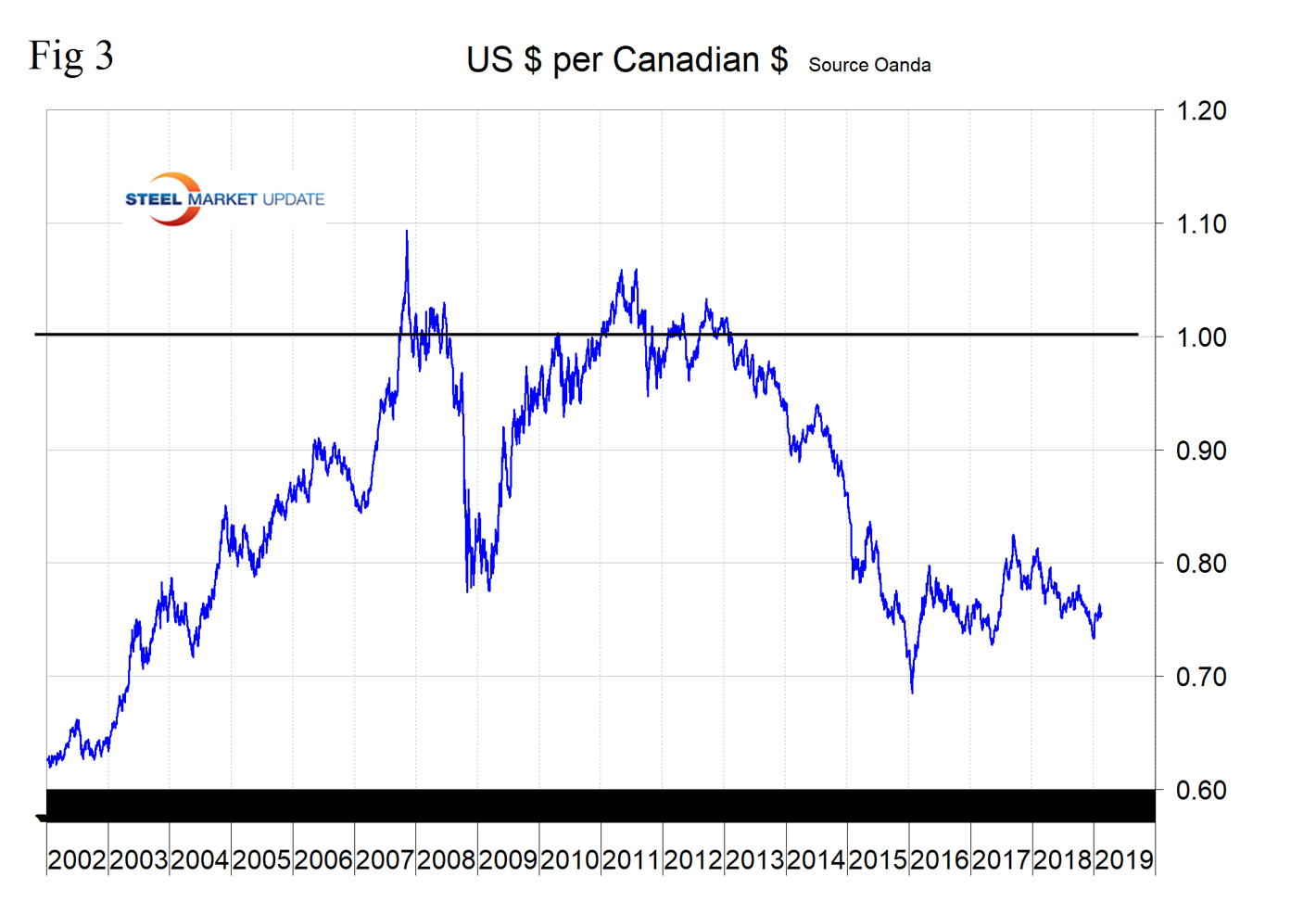

The Canadian Dollar

Canada’s dollar was worth 75.6 U.S. cents on Feb. 13. It has declined erratically since July 29, 2017. It strengthened very slightly at 0.04 percent in the last three months and by 0.3 percent in the last month (Figure 3).

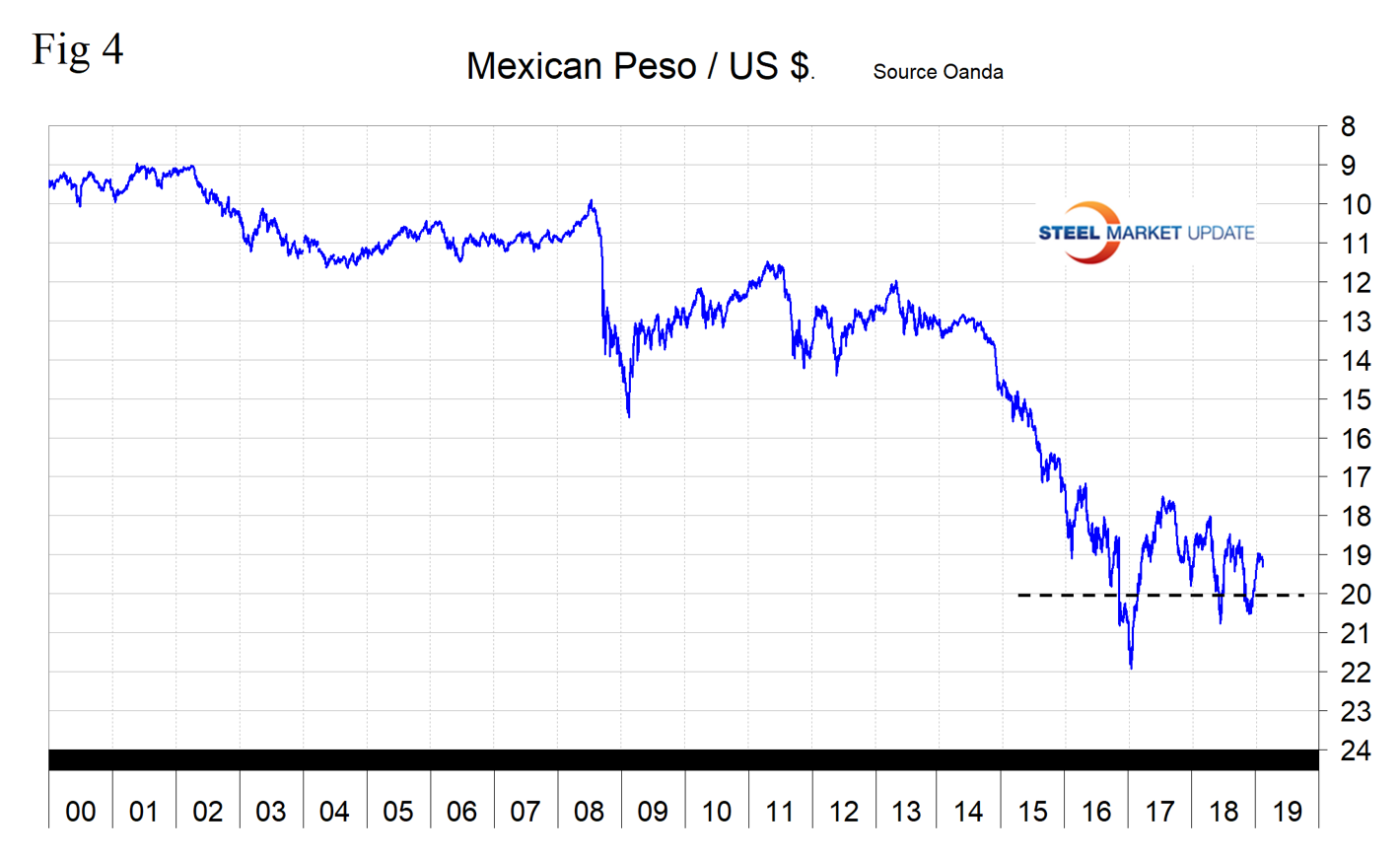

The Mexican Peso

Mexico’s peso was worth 5.18 U.S. cents on Feb. 13. The peso declined strongly from April 2013 through December 2016, bounced back in the first half of 2017, then erratically declined through the latest data. In the last three months, the peso strengthened by 5.7 percent and gave back 1.1 percent in the last month (Figure 4).

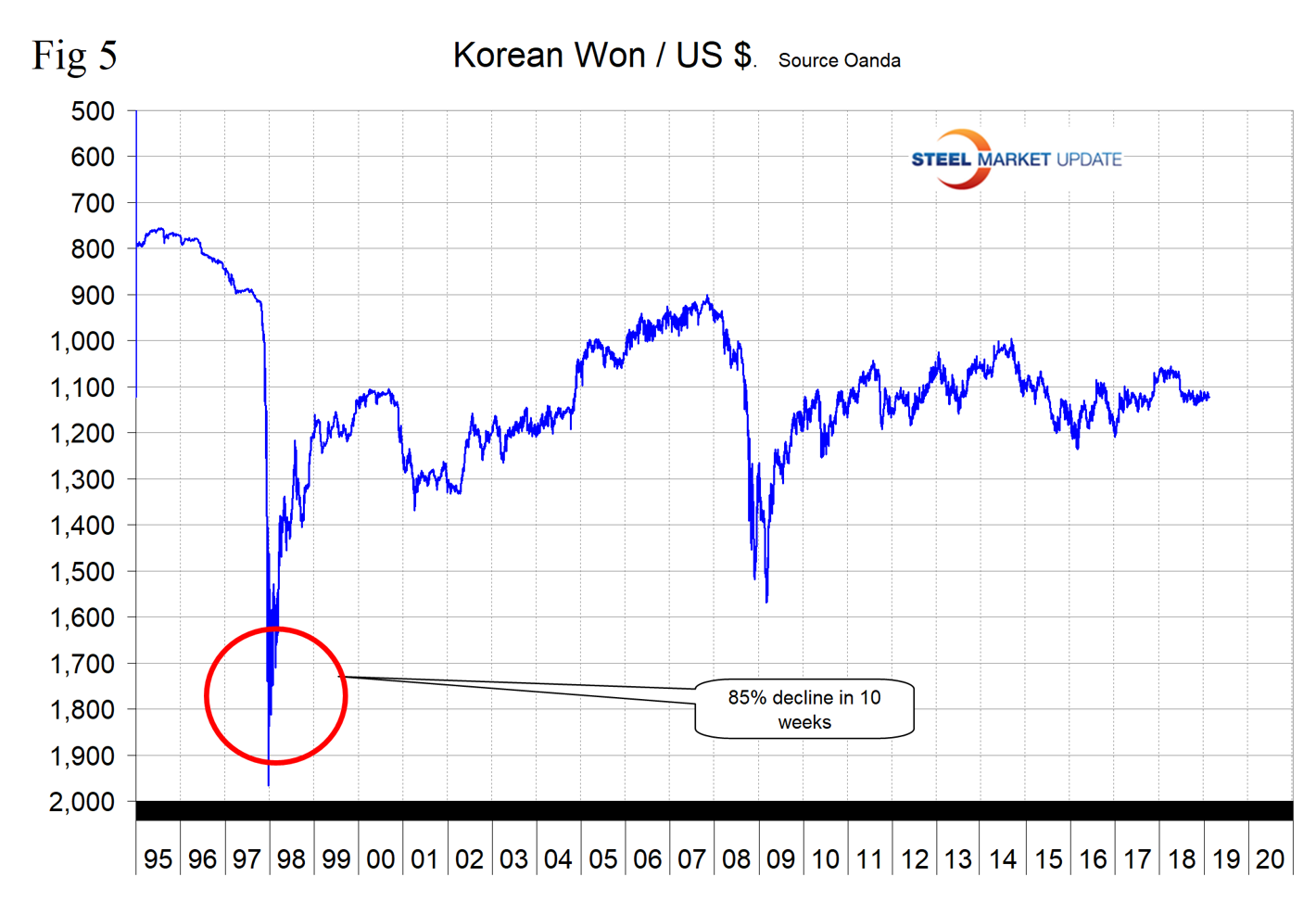

The Korean Won

Korea’s won has been relatively stable in the last three years with a minor strengthening tendency. On Feb. 13, the U.S. dollar was worth 1,122 won. In the last three months, the won strengthened by 1.0 percent and gave back 0.5 percent in the last month (Figure 5).

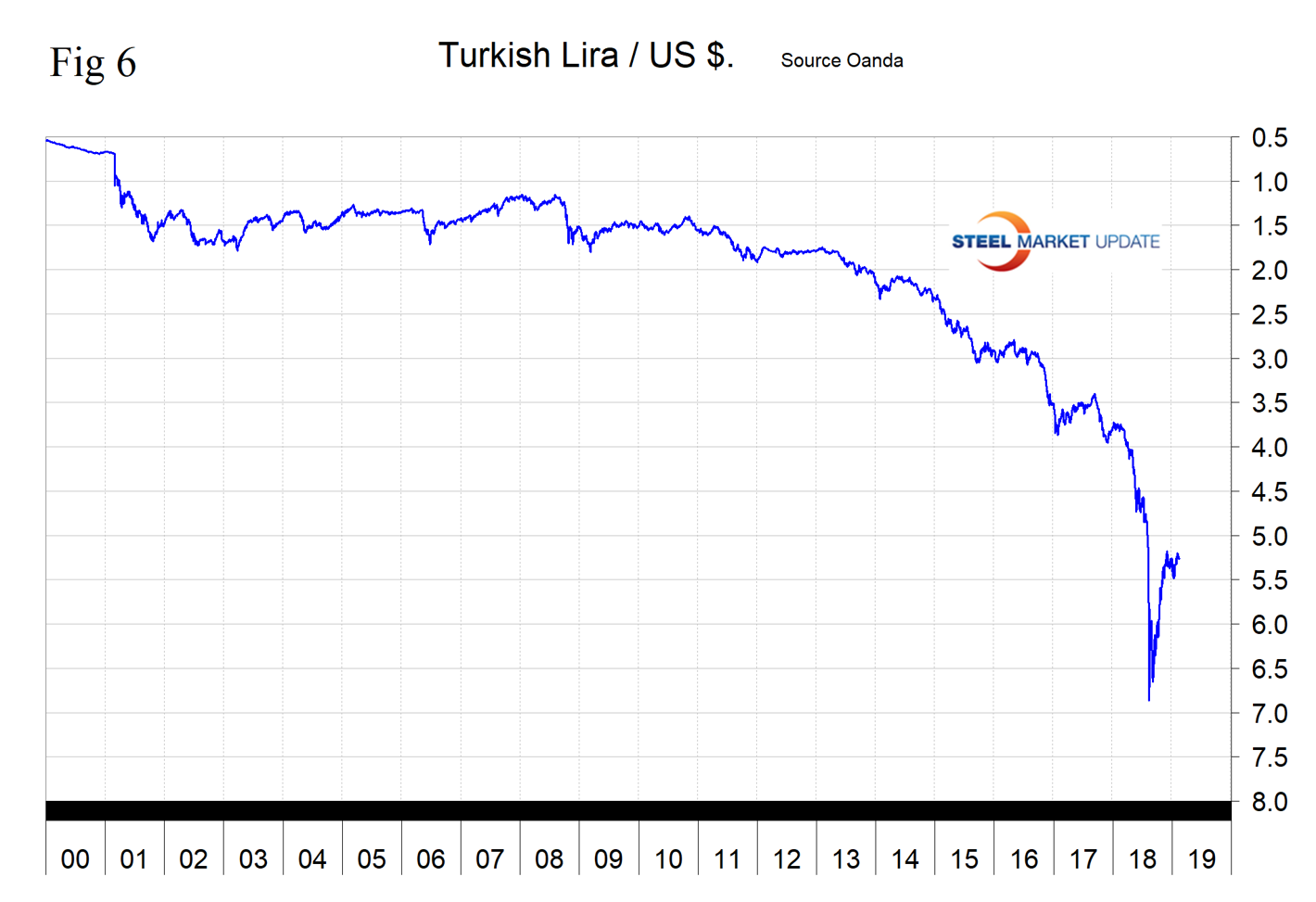

The Turkish Lira

Turkey’s lira collapsed in 2018 through Sept. 4, rallied through the end of November and has been treading water since then. On Feb. 13, one dollar was worth 5.26 lira. In the last three months, the lira has strengthened by 4.0 percent, all of which occurred in the last month (Figure 6).

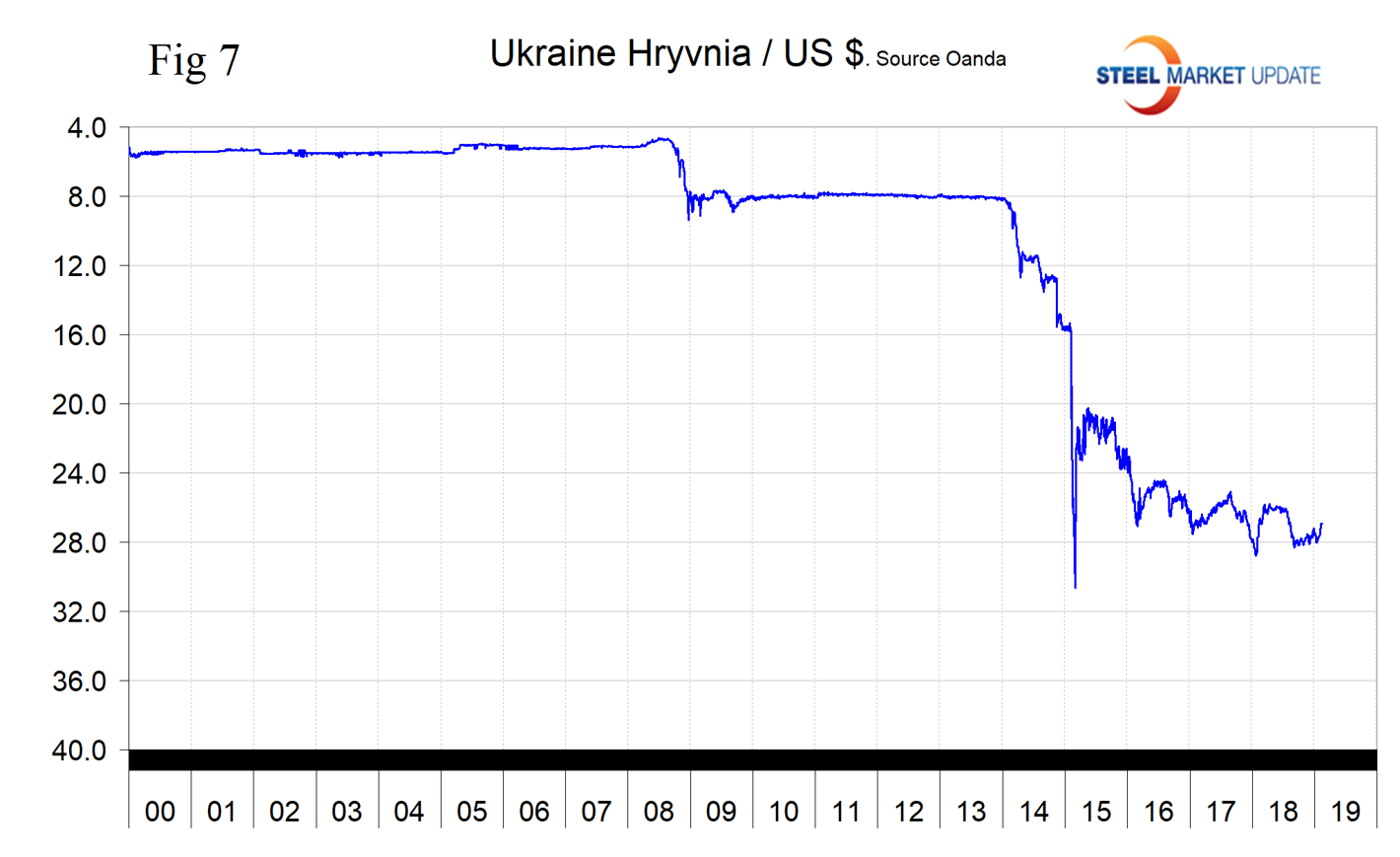

The Ukraine Hryvnia

Ukraine is not a big factor in U.S. steel trade, but internationally is a major player, therefore we include the hryvnia in this report (Figure 7). On Feb. 13, the U.S. dollar was worth 26.9 hryvnia, which has strengthened by 3.7 percent in the last month. On Jan. 23, Christine Lagarde, managing director of the IMF reported: “I had a good and constructive meeting with President Poroshenko and his team, during which we discussed recent economic developments and prospects for Ukraine, as well as the implementation of the measures under the Stand-By Arrangement approved by the IMF Executive Board on Dec. 18, 2018. I reiterated that the IMF stands ready to continue to support Ukraine, along with other international partners, in its reform efforts under President Poroshenko’s leadership. I also highlighted the urgency for Ukraine to accelerate reforms and transition to stronger growth, which is needed to improve people’s living standards in a sustainable manner.”

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU, we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the U.S. dollar against that of 16 steel and iron ore trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion U.S. dollars are traded every day on foreign exchange markets.