Prices

February 12, 2019

CRU: 2019 Pellet Premia Certain to Rise Following Vale’s Dam Breach

Written by Tim Triplett

By Erik Hedborg, CRU Senior Analyst

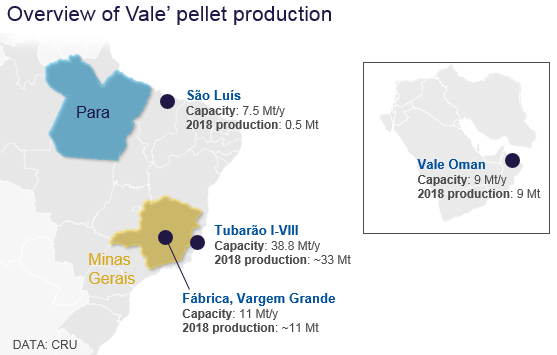

The recent dam breach in Brazil will complicate iron ore pellet premia negotiations and is likely to lead to steel mills eventually accepting sharp premia increases. As a result of the dam breach, Vale has suspended 11 Mt/y of pellet production in the Southern System and the recently revoked operating license for Vale’s Lanjeiras dam means that 18 ~Mt/y of pellet feed is likely to be lost from the market. This will impact Vale’s ability to produce pellets in Tubarão.

Recent weakness in the steel market has resulted in a falling high-grade premium and the spot pellet premium in China falling from close to $90 /t in September to just below $40 /t currently. At the same time, key pellet suppliers demanded a sharp increase to pellet premia in 2019 due to strong demand in important pellet-consuming regions such as Europe, MENA and JKT (Japan, Korea, Taiwan). In addition, the negotiations have also been complicated further by a proposed shift from the benchmark 62% Fe price to the 65% Fe price as the underlying iron ore price.

How is Vale’s Pellet Production Affected?

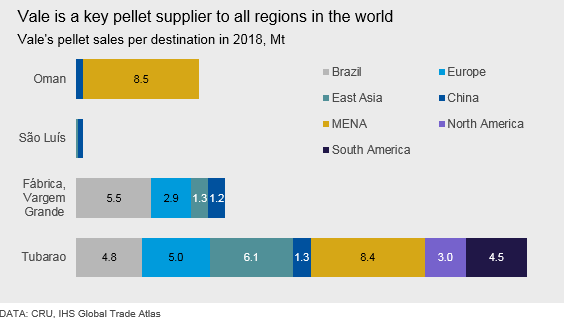

Vale’s recent suspension of its two pellet plants in Minas Gerais, Fabrica (4 Mt/y capacity) and Vargem Grande (7 Mt/y capacity) is having a significant impact on both the domestic and the seaborne pellet market. CRU understands that these two plants only produced BF pellets, ~50% of which were sold on the domestic market. Of the remaining volumes, ~30% were sold to Europe and ~20% to the Far East. However, Brazil remains the primary market for Vale as the pellets are sold at higher prices than on the seaborne market. Therefore, we expect the company to redirect sales from its Tubarão plants to the domestic market. This will eventually result in lower sales to both Europe and the Far East, depending on how long the Fábrica and Vargem Grande pellet plants will be idled.

The recent suspension of the Lanjeiras mine will have an impact on pellet production in Vale’s Tubarão complex. Our research shows that ~18 Mt/y of pellet feed was produced from the complex, volumes that feed into the eight Tubarão pellet plants and potentially Vale’s two plants in Oman. However, Vale’s SS does have infrastructure flexibility and it is likely that pellet feed supply from other mines can be redirected to the Tubarão plants. Therefore, we are more cautious on the time frame and magnitude of the lost volumes from Vale’s Tubarão plants.

The suspension of Vale’s pellet production comes at an unfortunate time for BF pellet buyers. CRU understands that most 2019 pellet contracts in MENA have been agreed, but the negotiations in Europe and East Asia have been prolonged due to disagreements on both the level of the premium and the underlying fines price to be deployed. Earlier in the negotiations, Vale pushed hard for a transition in the underlying fines price from the benchmark 62% Fe price to the 65% Fe price. This shift has been agreed upon by most MENA customers, whereas steelmakers in Europe and JKT remain reluctant to the change.

In addition, CMP in Chile is still unable to ship pellets after the shiploader at its biggest port was damaged at end-December. The company supplied 2–3 Mt of pellet to Asia and shipments are unlikely to resume in the first half of 2019.

2019 Pellet Premia Expected to Rise by ~20%

Despite recent weakness in the Chinese pellet market, high-grade premia and steel margins, we maintain our view of the 2019 BF pellet premium will settle ~$70 /t on a 62% Fe basis. The European and East Asian mills, that have yet to agree to premia, will be the most affected by the suspension of pellet production at Vargem Grande and Fábrica. MENA is a prioritized market due to higher pellet premia and the fact that several MENA customers have already agreed to contracts for 2019. Similar to 2018, we expect the DR pellet premium to end up slightly above the BF pellet premium as weak DR pellet supply has led to an urgency among the MENA customers to settle contracts early, thereby resulting in the DR pellet premium being agreed upon prior to the BF pellet premium.

As mentioned in the previous Insight, this dam accident is likely to further delay Samarco’s return to the market, which we expect will result in the elevated pellet premia remaining in the market longer than in our previous forecast.