Market Segment

February 7, 2019

Tariffs a Boon to ArcelorMittal

Written by Sandy Williams

Section 232 tariffs propelled ArcelorMittal to its best results in nearly 10 years, the company reported to analysts and investors today. The 25 percent tariffs on steel imports helped drive up steel prices, adding to company revenue from its U.S. assets. Average steel selling price in North America rose 15 percent year-over-year.

Net income for the company grew 1.7 percent to $5.1 billion from the prior year and was the highest net income since 2010. EBITDA increased 22.1 percent to $10.3 billion.

“But these results could and should have been better,” said ArcelorMittal in its press release. “A combination of external factors and internal production disruptions led to a decline in steel shipments. We are determined to improve in this area in 2019 as we target further gains on our Action2020 improvement plan.”

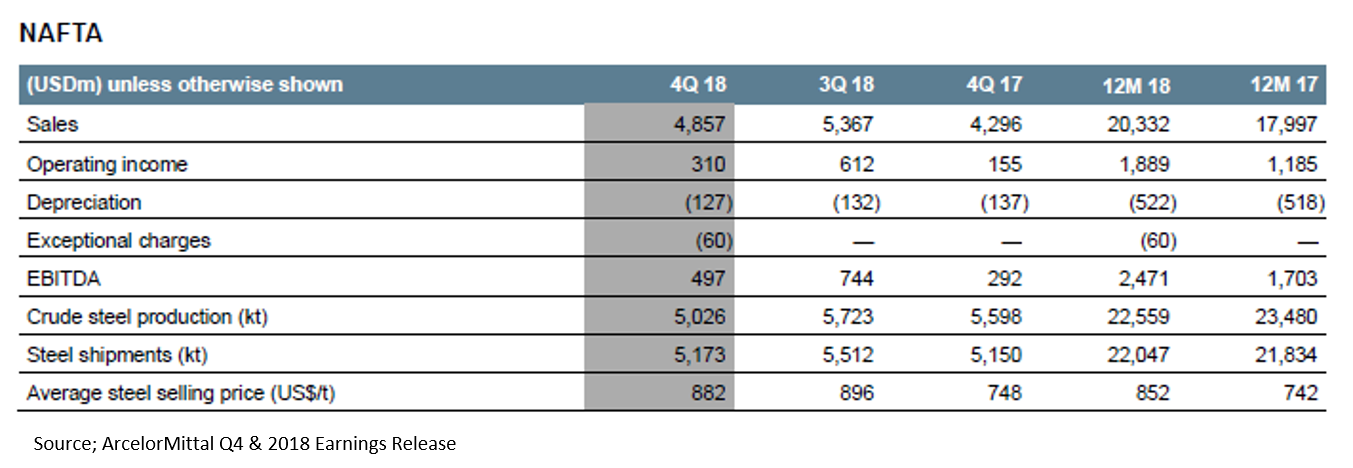

NAFTA sales, which include facilities in Canada, Mexico and the U.S., totaled $20.3 billion in 2018, up from $18 billion in 2017. Steel shipments of 22 million metric tons increased by 220,000 tons from the prior year. The jump in steel selling price from $742 to $852 per average ton drove the increase in revenue. Crude steel production for the year was 22 million metric tons compared to 21.8 million meric tons in 2017.

About two-thirds of the company’s NAFTA segment production is in the United States. The tariffs on steel imports from Canada and Mexico to the U.S. offset some of the gains made from higher steel selling prices in the U.S.

During the earnings call, CEO Lakshmi Mittal said that ArcelorMittal Dofasco is paying roughly $100 million per quarter of additional tariffs for steel sold into the United States.

ArcelorMittal is confident that trade measures by the U.S. and Europe will continue to protect the steel market from excess imports.

“It’s clear that Section 232, if you’ll just look at from a capacity addition, has been a success because the idea was to maximize capacity utilization and to encourage investments in the steel business in the U.S.,” said CFO and President Aditya Mittal. “So, there’s a little bit of a chicken or egg where you have the capacity now because of Section 232, and therefore hopefully it demonstrates to U.S. stakeholders that it is important to keep 232 for a longer period of time.”

“While the issue of global overcapacity persists, the structural change we have seen in the industry over the past two years has delivered positive changes, resulting in a healthier doable utilization rate,” added Lakshmi Mittal.

ArcelorMittal’s fourth-quarter shipments in the NAFTA segment decreased by 6.2 percent to 5.2 million metric tons as compared to 5.5 million tons in 3Q 2018, primarily due to seasonality and weak market conditions in the U.S. Sales fell 9.5 percent to $4.9 billion compared to the third quarter, mostly due to a 6.2 percent decrease in shipments and a 1.5 percent decline in average steel selling prices. Prices for flat products declined 0.7 percent and long products were down 4.0 percent. Sales in 4Q 2018 decreased by 9.5 percent from Q3 to $4.9 billion.

Crude steel production decreased by 12.2 percent to 5.0 million metric tons in the NAFTA segment during Q4, attributed to market slowdown and a blast furnace reline delay in Mexico. Construction is progressing with the 2.5 million metric ton hot strip mill in Mexico that will help meet anticipated demand and bring ArcelorMittal Mexico production capacity up to 5.3 million metric tons. Completion is expected in 2020.

ArcelorMittal is expecting steel demand growth in all its market in 2019. Apparent steel consumption (ASC) in the U.S. is expected to grow 0.5 to 1.5 percent in 2019 due to steady automotive demand and continued, but weaker, demand in machinery and construction. Europe ASC is forecast to grow 0.5 percent to 1.0 percent.

Global ASC is expected to be weaker in 2019, in the range of 0.5 to 1.0 percent, compared to 2.8 percent in 2018.

ASC in China is expected to decline by -0.5 percent to -1.5 percent in 2019 (versus growth of +3.5 percent in 2018), but could show stronger demand.

Aditya Mittal commented, “Almost every year, based on the data that we have at that point in time, we forecast a moderate apparent steel consumption or apparent steel consumption of zero. And China surprises on the upside. The same happened in 2018. I think there is some discussion on some of those measures and construction coming back quite strongly. So, there is a potential that it actually surprises on the upside.”