Prices

February 7, 2019

HRC Futures: Iron Ore Rally, Mill Price Increases & Tariff Uncertainty

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

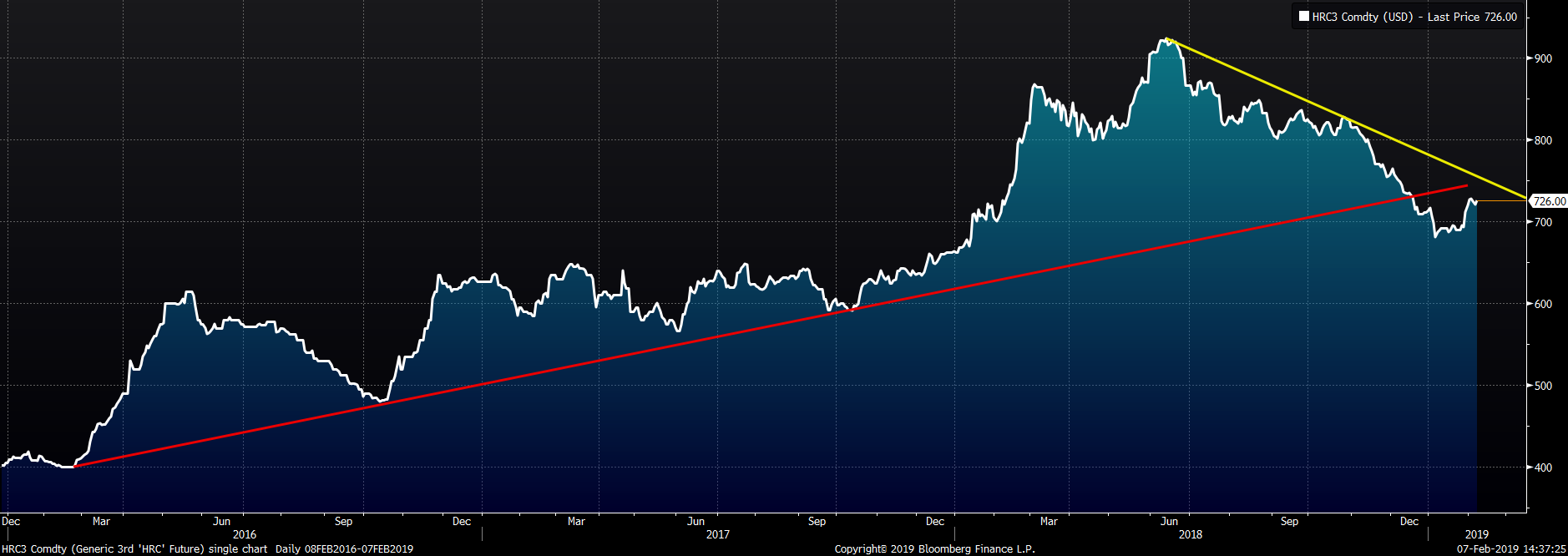

In response to the trade war, the Chinese government has been stimulating their economy on multiple fronts since early last year. Some of those funds are flowing into their old economy of infrastructure and property development. After bottoming in December, Chinese finished steel and iron ore prices have been rallying, offering about the only bright spot in the global steel market. Vale’s dam break and the consequences of that disaster have dumped jet fuel on the iron ore rally, which has gone vertical with the 2nd month SGX iron ore future closing today at $91/t, the highest level since early 2017.

2nd Month SGX Iron Ore Future

Iron ore broke above a seven-year trendline in Q4 of 2018. While the price of iron ore has remained below $100/t since 2014, it reached its all-time high at $180/t in 2011. Since 2004, Chinese economic policy has caused a number of epic commodity rallies, especially in ferrous-related product, that have reverberated across the globe, leading U.S. flat rolled prices to astronomical levels. However, the likelihood of another breakneck rally in ore with so much excess production capacity is probably low. Maybe, this time it’s different? Considering the Chinese are on their Lunar New Year holiday, much of this rally may be due to illiquidity. Then again, maybe it’s not, so keep a close eye on ore going forward, especially the futures market Sunday night as China returns from holiday.

2nd Month SGX Iron Ore Future

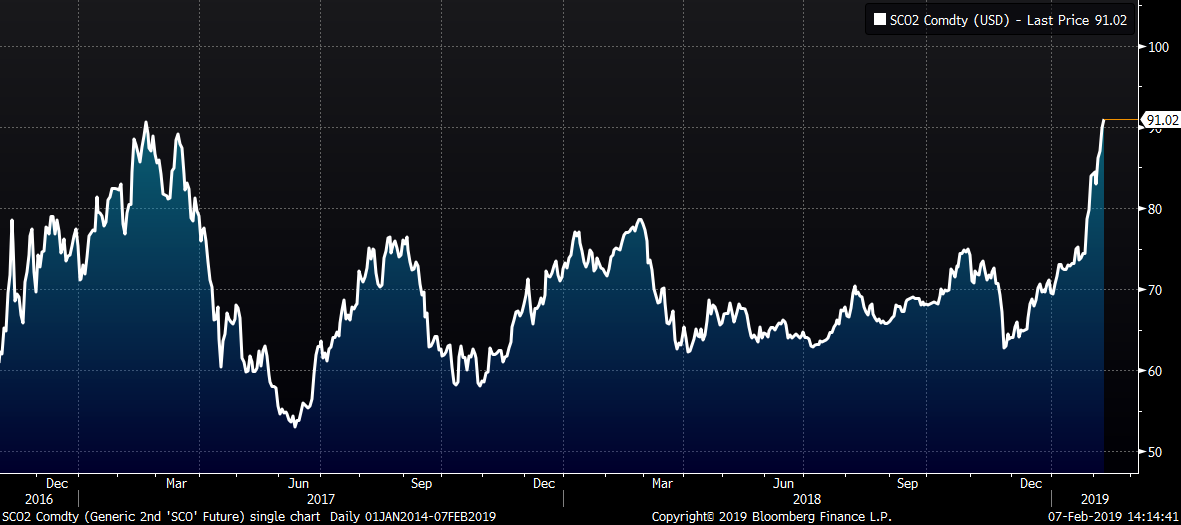

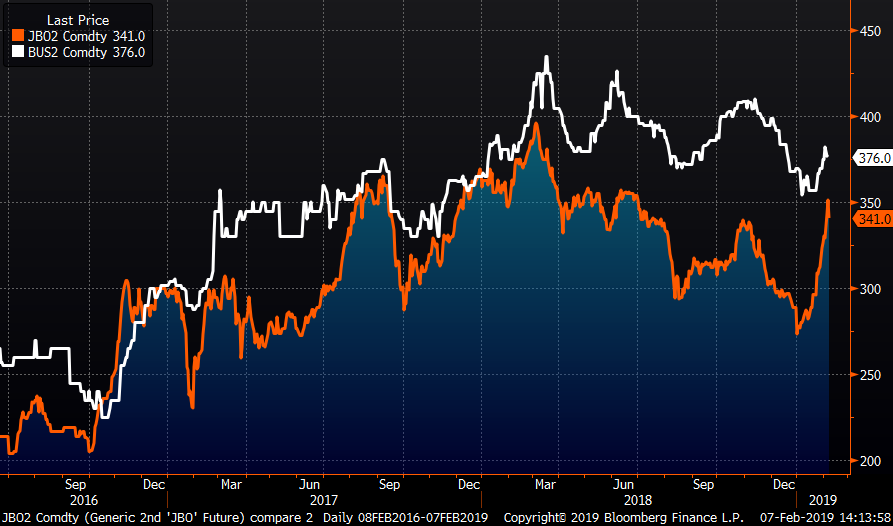

Turkish scrap futures have rallied along with iron ore. Since the Vale dam disaster, the March LME scrap has rallied as much as $24/t settling at $351 last night, but then dropped to $341 today. However, the CME busheling future has seen almost no change during that same time. The spread between busheling and Turkish scrap has compressed dramatically to $25 last night from as much as $80 just two weeks ago.

2nd Mo. LME Turkish Scrap & 2nd Mo. CME Busheling Futures

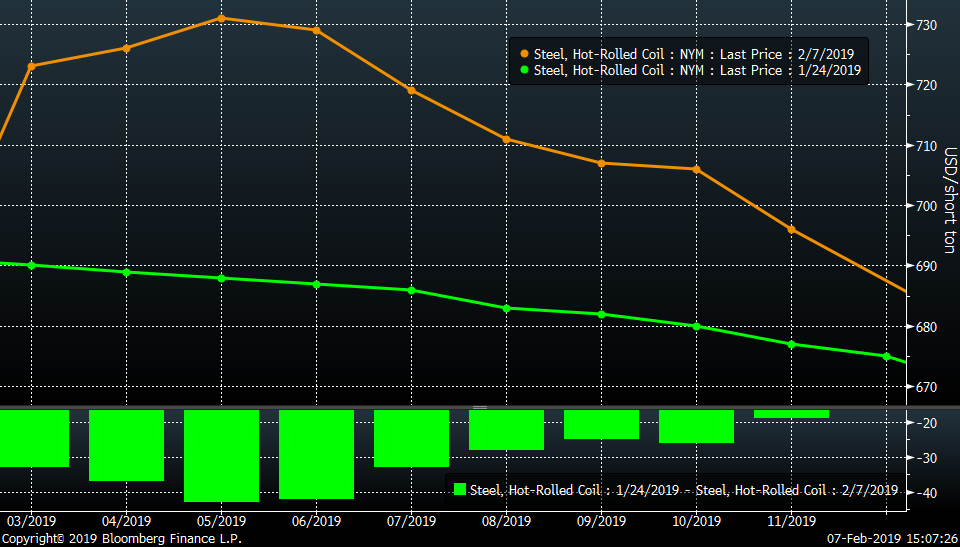

The CME Midwest HRC futures have rallied sharply, boosted by both the jump in ore as well as the domestic mill price increase announcements over the past two weeks. The May and June HRC futures have rallied over $40/st since Jan. 24, pricing in all of the $40 price increase.

CME Midwest HRC Futures Curve

If you have been following this article and reading the WoW on our website, I have been pointing out a number of diverse charts showing multi-year uptrends being broken. In hot rolled, the futures and multiple HRC indexes have also broken below their multi-year uptrends. I have been declaring a bear market in hot rolled in response. Bear markets are characterized by deleveraging, illiquidity, absence of buyers and rapid price depreciation, but they also have increased volatility including sharp “bear market” rallies, such as the one seen last week in HRC futures. The yellow down trendline in the charts below must be broken to end the bear market.

Rolling 2nd Month CME Midwest HRC Future

The down trendlines sit in the $750 – $755 area for HRC2 and HRC3. If prices get up there, expect resistance. Examining risk vs. reward, shorting the curve looks attractive as the upside looks capped by slowing U.S. demand (construction, auto and energy) and an increase in steel production (Granite City, JSW and inventory levels), which is also a catalyst to the downside over the medium term. However the increased bipartisan pressure to remove tariffs on Canada, Mexico and the E.U. that came to a head last week provides a major downside risk that could surprise the market.

On Feb. 15, 2018, HRC2 settled at $776/st and the Platts Daily Midwest HRC Index settled at $750. On May 30, HRC2 settled at $885 and Platts HRC Index settled at $889. On May 31, 2018, President Trump surprised the world by removing exclusions for Canada, Mexico and the E.U. HRC2 spiked $50 to $935 in eight business days, while the Platts Index jumped $31 to its peak of $920 on July 2. In regards to government policy, the pendulum has officially swung from upside price risk to downside price risk seen this time last year. If the tariffs were removed, a sharp abrupt move lower should occur. The uncertainty of this risk in and of itself could hold back a great deal of purchases.

Rolling 3rd Month CME Midwest HRC Future