Market Data

February 7, 2019

CRU: Steel Tariffs Shift U.S. PC Strand Buyers’ Focus Abroad

Written by Tim Triplett

By CRU North America Steel Analyst Ryan McKinley

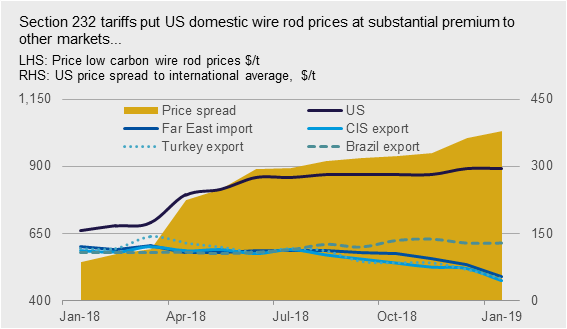

Since Section 232 tariffs have come into force, U.S. wire rod prices have increased more than other markets. As a result, domestic PC strand (prestressed concrete steel strand) producers have seen costs increase, inviting more competition from abroad.

Higher Prices Affecting Competitiveness

Rising U.S. domestic wire rod prices have increased input costs for PC strand producers. Unlike wire rod, PC strand is not subject to duties under Section 232, leading to an increase in imports as manufacturers from outside the U.S. start to gain a competitive edge. The increase in PC strand imports has correlated strongly with gains in U.S. domestic wire rod prices as domestic manufacturers have no option but to pay a higher cost for their key feedstock, wire rod. Wire rod prices in the U.S. are now trading at a more than four-fold premium to other markets relative to January 2018 (see chart below).

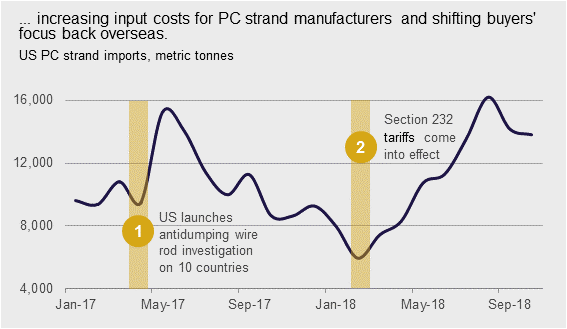

Trade Action has Influenced Buyers Further Down the Supply Chain

Trade action on wire rod appears to be the cause of an increase in PC strand imports, and there are two examples of this since 2017. The first spike in imports came shortly after the anti-dumping investigation of wire rod imports against 10 countries was launched by the U.S. Department of Commerce in April 2017 (see chart). The Section 232 announcement precipitated the second surge, with imports nearly doubling between January and October 2018 (the latest available data). Indeed, the July 2018 peak was the highest level seen in a decade.

What’s Next?

Barring government intervention that specifically targets PC strand, we expect the short-term correlation between a higher U.S. premium on wire rod and increased PC strand imports to persist. Still, this premium may start to erode as downstream steel buyers in the U.S. increasingly seek lower-priced alternatives abroad, weighing on demand for domestically produced wire rod.