Market Data

February 3, 2019

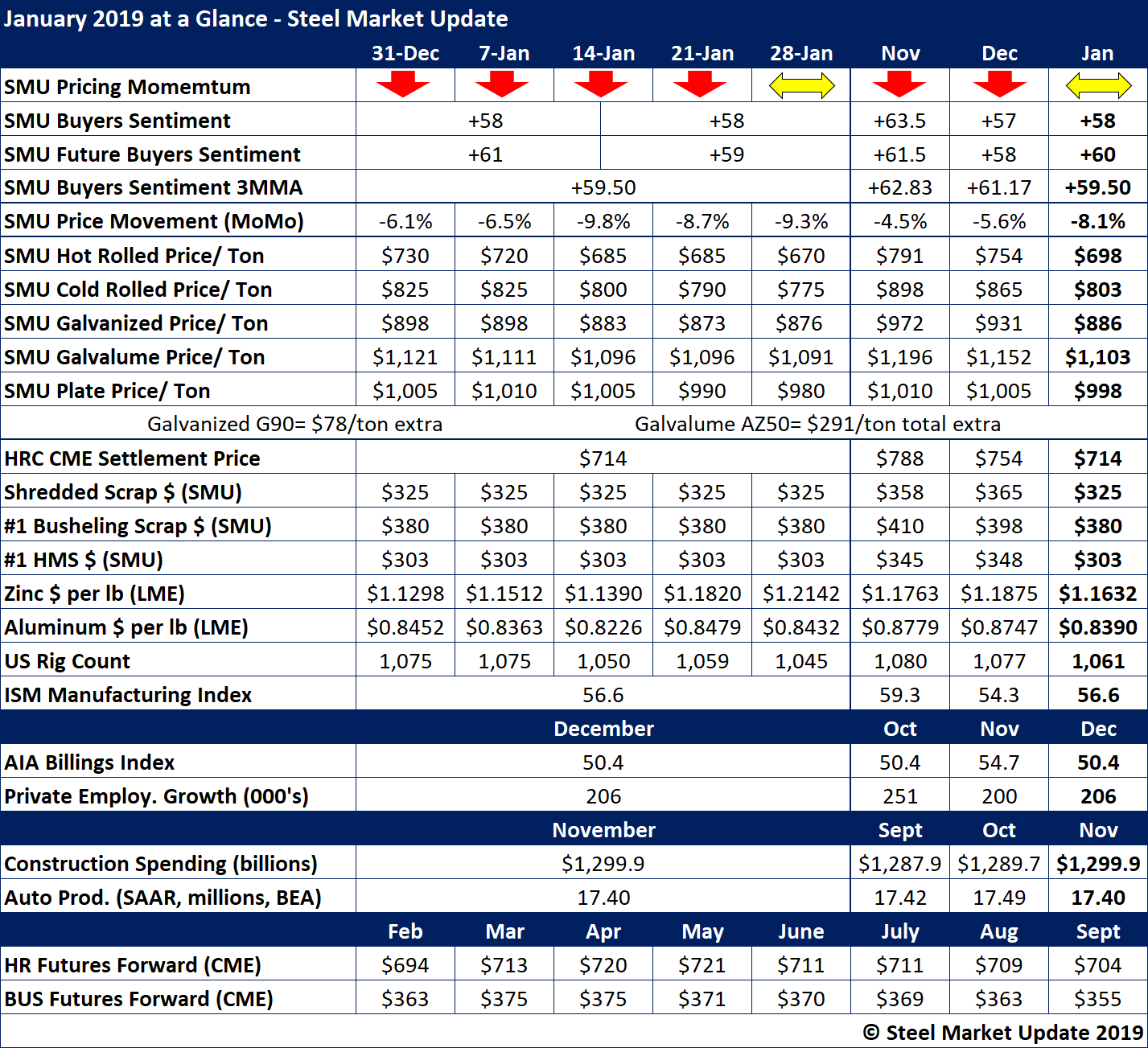

January at a Glance: Year Off to a Tenative Start

Written by Brett Linton

January got off to a tentative start as steel prices continued to decline, leaving buyers with a cautious perspective on the months ahead.

Steel Market Update’s Buyers Sentiment Index shows buyers slightly less optimistic than they were in November. Sentiment factors into buyers’ decision-making about such factors as purchasing, inventory levels, capital investment and hiring. The continued erosion in the three-month moving average reflects the high level of uncertainty in the market.

In January, spot market steel prices continued the slide that began last summer. The price for hot rolled dipped below $700 per ton and cold rolled approached $800 per ton. Even plate, which has been in short supply, has seen its price begin to weaken, and is now selling below $1,000 per ton. In the aggregate, steel prices dipped by more than 8 percent in January from the prior month.

Factoring into the declining steel prices are scrap prices that have also been trending downward. Shredded and prime scrap grades all saw declines in January, which is unusual. Scrap typically rises in January as winter weather tightens supplies and mills stock up for the stronger quarter ahead. Experts attribute the downturn to weak scrap demand overseas, which has impacted the export price.

On the demand side of the equation, most of the indicators remain positive. ISM’s Manufacturing Index showed continued growth in January with a reading of 56.6. Construction and automotive finished 2018 strong.

See the chart below for other key indicators in January.

To see a history of our monthly review tables, visit our website here.