Market Segment

January 31, 2019

U.S. Steel Triples Earnings in 2018

Written by Sandy Williams

U.S. Steel’s full-year net earnings nearly tripled from 2017 to 2018, but company executives were disappointed in fourth-quarter results for the Europe and tubular segments.

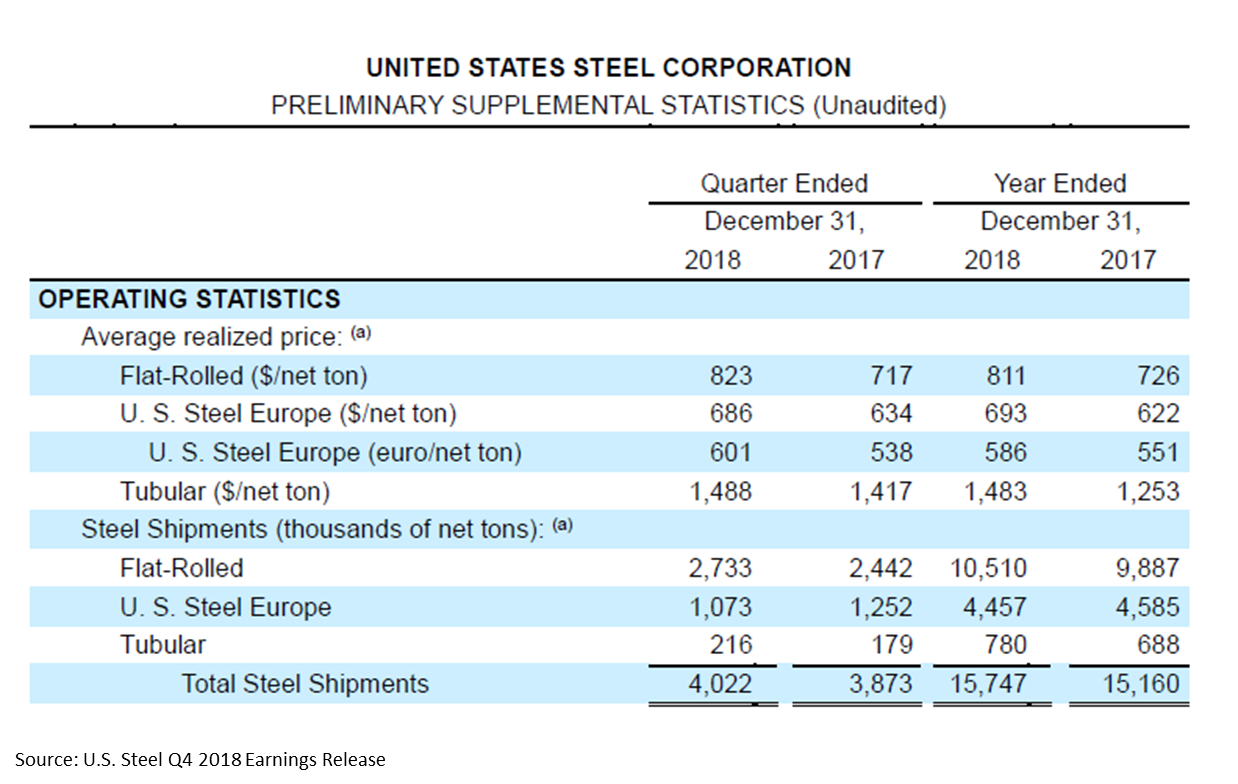

Net earnings for the year totaled $1.1 billion compared to $387 million for 2017. Adjusted EBITDA was $1.76 billion compared to $1.15 billion a year ago, including $1.25 billion generated from the flat rolled segment.

Fourth-quarter earnings were $592 million compared to $291 million in the third quarter and $159 million in Q4 2017. Earnings for the flat rolled segment were $328 million, up from $305 million in the third quarter and $82 million in Q4 2017.

The tubular segment suffered a fourth-quarter loss of $3 million compared to earnings of $7 million the previous quarter. Higher steel substrate costs offset higher average realized prices and volumes.

Steel Europe earnings fell to $62 million for the quarter compared to $72 million in Q3 as margins continued to be challenged. Higher average realized prices in Europe were offset by decreased volumes, higher iron and coal costs, higher costs for energy and CO2 credits, outages and an unfavorable U.S. dollar/euro exchange rate.

“Europe is under a lot of pressure,” said CEO David Burritt, “and that’s a big change for us. We’re seeing margin compression, prices are down there, and input costs are up.”

Europe is going through trade issues with imports similar to those in the U.S. Although trade measures have been taken, Burritt noted, “We’re seeing a lot of pressure on Europe that wasn’t anticipated.”

“It’s definitely bigger than we thought it was going to be,” he added.

The ever-present inquiry about the Fairfield EAF arose during the earnings call. Burritt said the company is working though some local issues. “I believe I’m optimistic that we will find the path forward and would like to be able to announce that this year,” he added.

U.S. Steel estimates completion of the Fairfield EAF will require a $150 million outlay, plus additional capex for an air separation unit and work on a rounds caster. Once the project resumes, it will be 18-20 months until completion.

Burritt said the company has done well renegotiating sales contracts, though some of the talks have carried over passed the Jan. 1 deadline. “We believe we did well on them, except that when 60 to 65 percent of our tons are really very close to spot, it’s hard to offset that with just 35 to 40 percent of your [contract] volumes.”

Burritt said the company is optimistic that Section 232 will continue. “We don’t see the administration blinking on any of this,” he said. “This is absolutely essential to national security, and we need to make sure we have this level playing field. So, we have a high degree of confidence that 232 will not be pulled back.”

U.S. Steel believes it can compete with any new capacity coming online in the United States. “It’s not about capacity additions for us,” said Burritt. “It’s about utilizing our assets in the most effective and efficient way possible, and that’s why we’re able to do the revitalization program. And how we’re getting the extra tons not by adding excess capacity, but instead capitalizing on what we have.”

Guidance

“We expect slight growth in steel consumption in 2019, and we also expect import volumes to decrease in 2019,” said Burritt. “Given this combination of supply and demand changes, we have every reason to believe that the buying activity will accelerate as the quarter progresses. In fact, we are already beginning to see this take place in our Flat-roll segment as our January daily order entry rates are running above fourth-quarter levels.”

U.S. steel predicts first-quarter 2019 EBITDA will be approximately $225 million. Higher average selling prices are expected to be partially offset by increased raw material costs. The Europe segment is expected to ship lower volumes and be impacted by higher raw material costs and an unfavorable change in the exchange rate, resulting in a lower year-over-year EBITDA. Higher EBITDA for the tubular segment is anticipated for the first quarter.

U.S. Steel expects to incur $40 million in repairs and associated costs in the first quarter related to the December fire at Clairton Coke Works.

U.S. Steel expects another strong year for the flat rolled segment. Flat-rolled shipments are expected to increase to approximately 11.5 million tons in 2019, up from 10.5 million tons in 2018. Shipments will benefit from full-year availability from Granite City and be partially offset by higher planned outages at Gary Works, Great Lakes Works and Mon Valley Works.

Maintenance outages and decreased demand for semi-finished products in 2019 will reduce shipments from U.S. Steel Europe to approximately 4.0 million to 4.2 million tons from 4.5 million tons in 2018.

Tubular segment shipments are expected to be unchanged or up slightly.