Market Data

January 31, 2019

Steel Market Trends: Views on Demand, Capacity

Written by Tim Triplett

Whether the mills succeed in collecting the $40 increase on flat rolled they announced in recent days depends a lot on how strong demand proves to be in the first quarter.

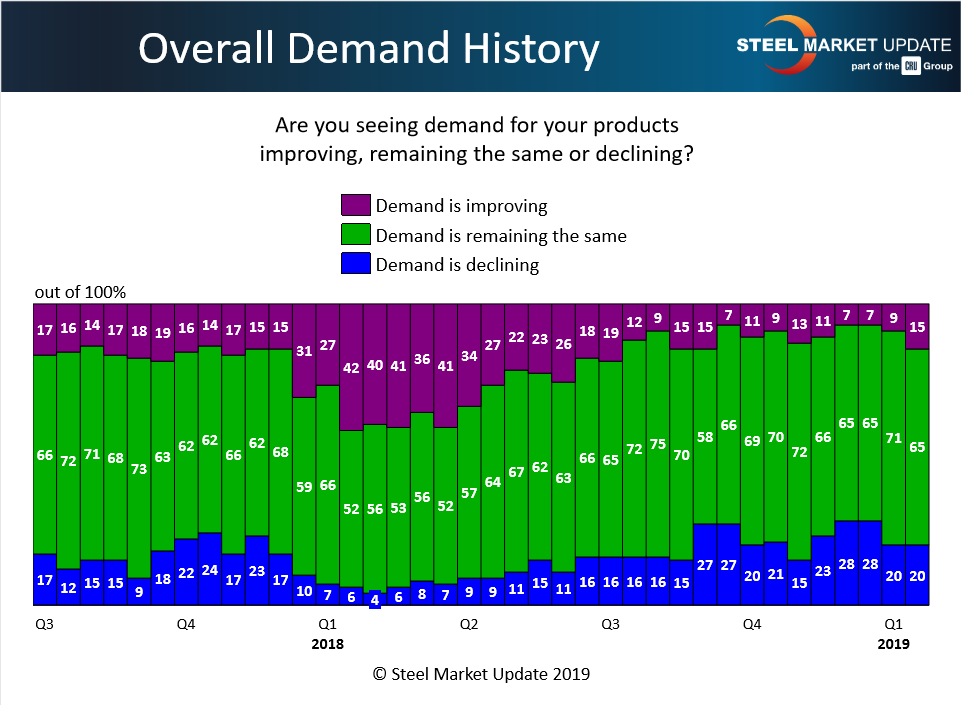

Such price hikes are common in January as the mills anticipate a pickup in business following the seasonal slowdown in the fourth quarter. Service centers often stock up in the first quarter in anticipation of new business in the spring. This year appears to be shaping up a bit differently, however. Many buyers remain on the sidelines, hoping for some clarity on the big questions of the day: Trump trade policies, another government shutdown, the staying power of Section 232, and the U.S.-Mexico-Canada Agreement, among other uncertainties. Steel Market Update data suggests that demand currently stands at a high level—but more buyers see it worsening than improving.

Steel Market Update asked: Are you seeing demand for your products improving, remaining the same or declining? For 65 percent of those responding to SMU’s market trends questionnaire last week, demand is steady. Another 15 percent see demand improving. But for 20 percent, demand is on the decline.

Following are some respondents’ comments:

- “Fence-sitting is the main issue and some weather-related events, but the forward outlook looks OK.”

- “Although early returns look slightly ahead, it’s too early to tell much.”

- “Demand is about the same, but due to trade risks customers are not looking to take large positions on future buys.”

- “The winter slowdown is an issue, plus the waiting game for prices to level.”

- “HR demand and inquiries are off. All others are the same.”

- “So far, we’re down 10-15 percent YOY.”

- “It will improve in the next 60 days.”

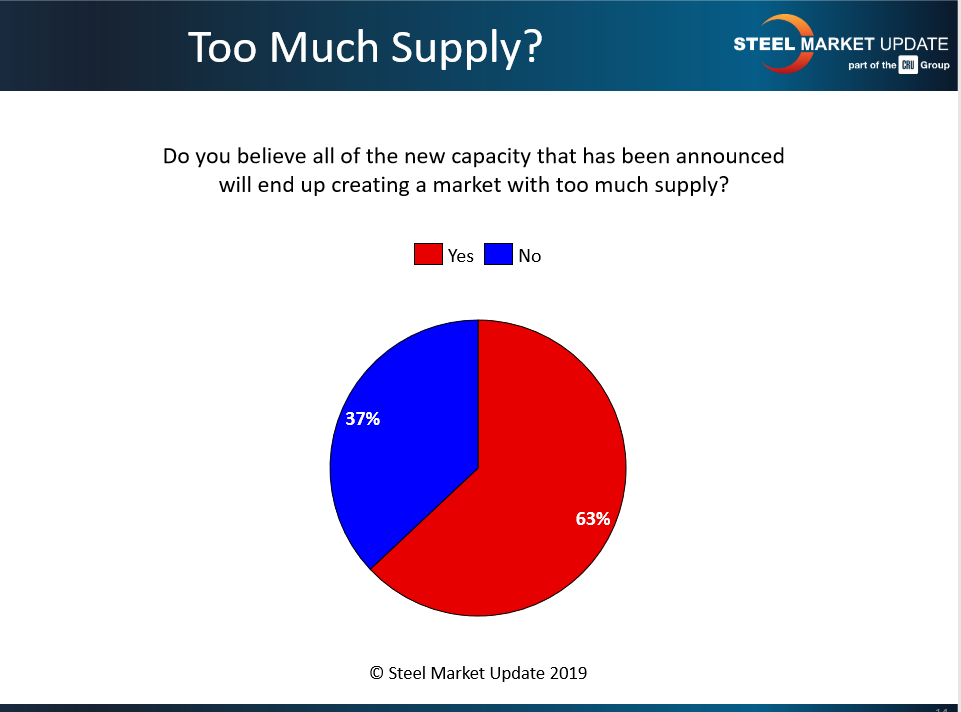

Oversupply in the Works?

Steel Market Update asked: Will all the new capacity being announced create a market with too much supply? Nearly two out of three (63 percent) of respondents to last week’s questionnaire fear capital investments by Nucor, U.S. Steel, SDI, JSW USA and others will increase domestic production capacity to the point that supply exceeds demand and provides a drag on steel prices in the years to come.

Following are some respondents’ comments:

- “Yes, [there will be oversupply] at least in the short term. What do the mills know that most buyers don’t know? This is the largest increase in capacity that I’ve seen in my career buying steel.”

- “Unless older inefficient capacity is removed or there are mergers, the market will be oversupplied.”

- “With HRC, particularly.”

- “Domestic prices have to be competitive with foreign or there will be too much domestic supply. If prices are competitive with foreign, then supply levels will be OK. So far, foreign keeps finding ways in.”

- “Longer term, the U.S. steel industry needs to work in a world market. Import restrictions on base materials will hurt manufacturing here. And a competitive manufacturing base is key for longer-term survival of the steel mills that are adding capacity.”

- “No, the new capacity will cannibalize imports and inefficient production.”