Prices

January 31, 2019

CRU: Vale Dam Disaster Leaves 40Mt Hole in Seaborne Ore Market

Written by Tim Triplett

By CRU Senior Analysts Erik Hedborg and Andrew Gadd

The death toll after the tailings dam accident at Vale’s Córrego do Feijão mine continues to climb, as 84 people are now confirmed dead and close to 300 are still missing. Five people have been arrested; three managers at the Córrego do Feijão mine site and two engineers from the German consulting company TUV SUD that approved the dam’s safety in September 2018.

We expect to see a significant loss of seaborne ore supply as there is limited ability by Vale as well as other producers to raise supply in the short term. This dam breach is expected to have an impact on iron ore prices in 2019 and the coming years.

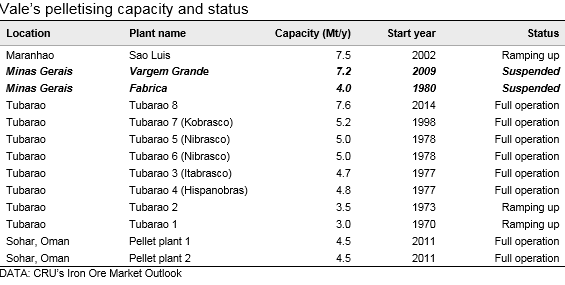

On Jan. 30, Vale also announced the suspension of production at several mines at all three complexes in its Southern System and the two pelletizing plants, Fabrica and Vargem Grande. The total loss in this system will be 40 Mt/y, of which 11 Mt/y is pellet. While Vale is expecting production to resume at most of these sites within three years, we do not expect Vale to be able to replace all 40 Mt/y of lost production from other sites in the interim. Vale’s halt of pellet production at Fabrica and Vargem Grande will reduce seaborne pellet supply by ~10%.

Dam Breaches in a Historical Context

Tailings dams are used to hold mine waste from the wet beneficiation processes. Tailings consist of very fine iron ore and impurities in a suspension of water, which also contains traces of flotation agents. In tailings dams, the solids settle at the bottom of the dam and consolidate, while water either evaporates from the dam surface, is drained and recycled or discharged.

Tailings dams are common in most types of mining. The more wet beneficiation that is required, the larger the amount of tailings. In the iron ore industry, wet beneficiation often takes place when the mined iron ore is of significantly lower grade than the finished product. This process is, therefore, common among magnetite producers in Southern Brazil where the Itabirite ore type typically has an iron content between 30-58 percent. By contrast, in Australia and Northern Brazil, the operating mines mostly consist of hematite, which has a higher iron content, of 58-65 percent, and therefore requires minimal wet beneficiation.

In the 2000s, there have been over 40 tailings dam breaches worldwide, eight of which have had deadly outcomes. In the past 19 years, there have been seven breaches of iron ore tailings dams, including four in Minas Gerais, Brazil. A death toll exceeding 300 would make this the deadliest tailings dam breach since the 1960s, when several severe accidents occurred in the United Kingdom, Bulgaria and Chile.

Overview of the Impacted Area

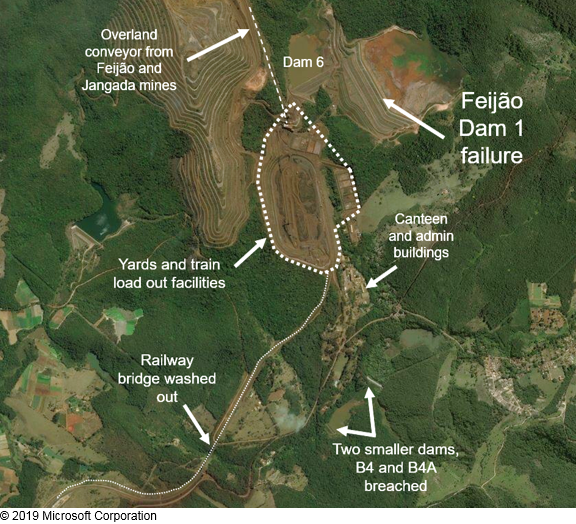

Vale’s dam breach occurred near its Feijão mine in the company’s Southern System. The tailings flooded the infrastructure used by both the Feijão and Jangada mine before destroying the canteen and administrative buildings. As the tailings flowed in a southwesterly direction, two smaller dams, B4 and B4A, were also breached and the railway bridge connecting the complex to the rail line that brings the ore to the ports was washed out.

Upstream Tailings Dams in Question

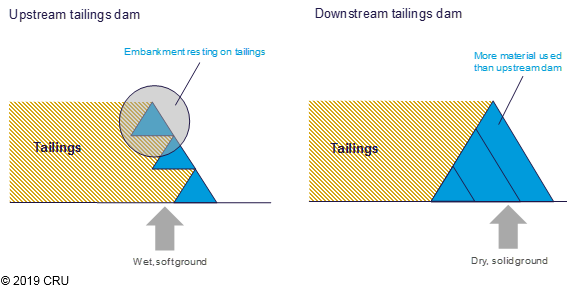

The dam wall that contains the tailings can be constructed by different methods. Three of the most common designs are upstream, downstream and centre line, which describe the positioning of subsequent berms that are built to increase tailings dam capacity. The upstream design is cheaper, but its stability is reliant on consolidated tailings supporting the berms. This construction is also sensitive to seismic movements, which contributed to the breaches of upstream dams in Chile in the 1960s and to the Samarco accident in 2015. The downstream and centre line construction methods are more expensive and generally use more construction material, but they are not reliant on tailings stability and provide greater dam capacity.

The upstream design was used in both the Feijão dam, which failed last week, and Samarco’s Fundão dam. The upstream tailings construction type of dam is not permitted in many countries and Brazil aimed to ban the construction after the Samarco accident. However, many upstream tailings dams in Brazil were constructed decades ago and are therefore still in use today.

Decommissioned dams still pose a risk of failure. Feijão itself was decommissioned three years ago. We anticipate that significant remediation work will be undertaken by Vale to stabilize its other upstream tailings dam sites across their operations regardless of the operational status of the dams. This is likely to have an additional production impact beyond what has been announced by Vale today.

It is also understood that the area was subjected to high rainfall before the failure, which may have been a contributing trigger for the failure. There have also been reports of minor seismic activity around the Feijão dam around time of the accident, but it is still not known if this is what caused the breach.

What Happens Next?

The production halts announced by Vale are all in the Southern System and will impact production of pellet, concentrate and, to a lesser extent, fines. A greater impact on concentrate and pellet is expected due to the loss of tailings capacity and associated reduction in wet beneficiation.

There is likely to be a negative impact on fines chemistry as Vale uses concentrate from wet beneficiation to raise the quality of the fines from the Southern and Southeastern System (SS/SES) operations. This will mostly impact the Southern System Fines Tubarao (SSFT) and Southern System Fines Guaiba (SSFG) products and, to a lesser extent, the Brazilian Blended Fines (BRBF) product. Most noticeably, silica will increase and the iron content will decrease and the product is likely to become coarser.

We have concerns around the decommissioning of tailings dams. There is a possibility that the process will be complex and expensive and longer timeframe may be required to stabilize these sites, compared with Vale’s announcement today. It is also a possibility that other decommissioned tailings dams may need remediation in other parts of SS/SES.

There is still a high degree of uncertainty around Vale’s ability to offset the production impact. Despite being able to relocate and redeploy some assets to other sites (workers and trucks), fixed supply chain constraints may limit the upside at many sites (rail line capacity, ore loading/crushing throughput). There is currently spare capacity in the Northern System, but we do not expect any significant increase in volumes from this system as S11D is still in the ramp-up phase and Vale is probably unable to speed up this process. Instead, we are likely to see destocking of Vale’s inventories held in Brazil, Malaysia and China.

While the company has stated that an increase in production in other systems is likely, we do not expect Vale to be able to fully compensate for the 40 Mt/y of production loss. Significant losses of seaborne supply will occur as a result and we see limited ability by other producers to raise supply in the next couple of years. Therefore, we expect this dam breach to have an impact on iron ore prices in 2019 and the coming years. Vale’s halt of pellet production at Fabrica and Vargem Grande will reduce seaborne pellet supply by ~10 percent. This will be a key point to watch in the negotiations for the 2019 pellet premia, a process that is still ongoing.

Vale’s nominal pelletizing capacity is currently 67 Mt and the company had planned to reach close to full production in 2020 with ~65 Mt. After the suspension of Fabrica and Vargem Grande, the company’s pelletizing capacity will be limited to 56 Mt/y. We estimated that production in 2018 was 54 Mt and this suspension will lead to lower total pellet output in 2019 as the loss in pellet supply will be greater than the ability for Tubarao I, II and Sao Luis to ramp up.