Market Data

January 25, 2019

Slowing Economy May Put China in a Negotiating Mood

Written by Peter Wright

The growth of China’s economy has slowed partly as a result of the tariff war with the United States, and China may be in a mood for serious negotiation.

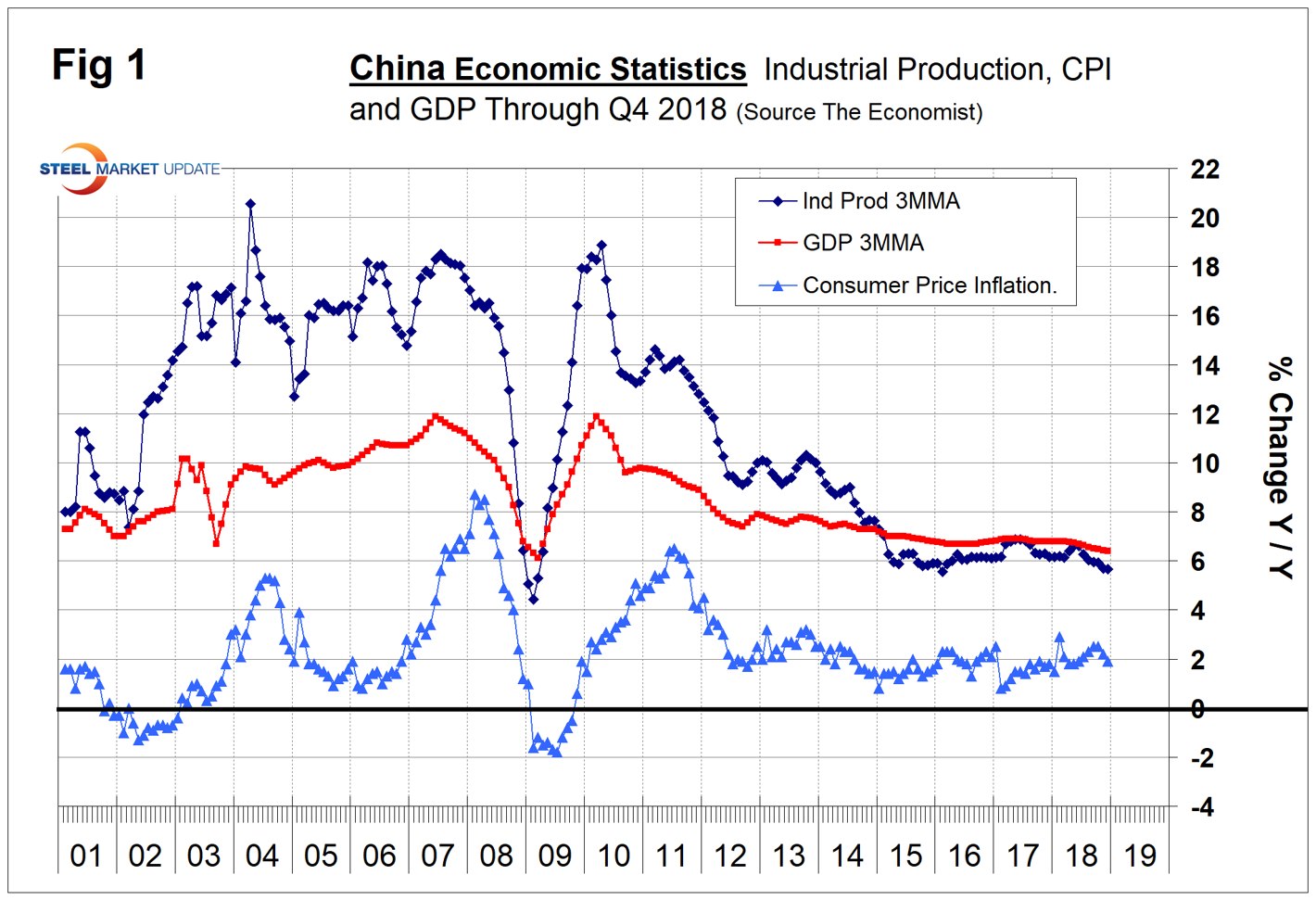

Once each quarter, we publish the official statistics for Chinese GDP, industrial production, consumer price inflation and fixed asset investment. Many analysts don’t believe these self-serving Party figures, but we include them in our reports because of the importance of China in the global steel scene, and these numbers are all that’s available. China’s economic statistics are never revised, which makes analysts suspicious, considering the U.S. routinely makes revisions back decades. Figure 1 shows published data released this week for the growth of GDP, industrial production and consumer prices through the fourth quarter of 2018. The GDP and industrial production portions of this graph are three-month moving averages.

Last month, ING Economic and Financial Analysis wrote: “2019 will be a difficult year for China in terms of economic growth and the increasingly tricky political relationships with its trading partners. An escalation in trade tensions is the key risk to China in 2019 – and this seems like the most probable scenario. This will hurt exporters, manufacturing and logistics services, therefore slowing economic growth directly. Indirectly, the bilateral trade conflict between China and the U.S. has resulted in multilateral trade and investment disputes. This is exacerbated by international voices blaming the Belt and Road Initiative as a debt pile-up exercise for poorer economies. It has become more difficult to maintain existing relationships with trade and investment partners. The recent APEC meeting showed these economies having difficulties positioning themselves between China and the U.S. On Jan. 18, economy.com reported: “China has offered to go on a six-year buying spree to ramp up imports from the U.S. By increasing goods imports from the U.S. by $1 trillion over that period, China would seek to reduce its trade surplus from $323 billion to zero by 2024. This isn’t set in stone and could be simply a trial balloon, but we imagine China would likely boost imports of soybeans, LNG, aircraft and possibly medical equipment.”

China’s GDP grew at a rate of 6.4 percent in the fourth quarter, down from 6.7 in the first quarter. Growth has gradually slowed from 7.0 percent in the first and second quarters of 2015. Moody’s reported that for the full year, China’s economy grew 6.6 percent in 2018, in line with our expectations, and the weakest pace of growth in almost three decades. A major drag was investment, which cooled noticeably though 2018, reflecting earlier tightening measures by the central bank to curb credit excesses, especially in shadow lending, as well as the ongoing battle to reduce overcapacity in heavy industry and tighten environmental standards. But there were tentative signs of stabilization in December, with fixed asset investment growth remaining at 5.9 percent year over year, up from the recent low of 5.3 percent in August, thanks to an improvement in public investment and stabilization in manufacturing investment.

The growth of industrial production slowed from 7.0 percent in April to 5.4 percent in November before edging back up to 5.7 percent in December. The three-month moving average (3MMA) slowed from 6.40 percent in April to 5.67 percent in December. There has been a decline in sentiment across the Chinese economy as investors await the outcome of the reciprocal trade actions with the United States. On Jan. 20, Moody’s reported: “China’s industrial production growth edged up to 5.7% y/y in December, following November’s 5.4% reading. The data were broadly in line with expectations. Mining contributed 3.6%, up from 2.3% in the prior month, while manufacturing grew 5.5%, compared with 5.6% in November. Auto production has continued to be a weak spot for manufacturing, falling by 4.1% in December after a 3.2% drop in November. Industrial production has tracked manufacturing and manufacturing sentiment lower over the year amid softer conditions in domestic and offshore demand, and we expect further moderation of growth in industrial production in 2019.”

Inflation pressures are subdued in China. The continued downtrend in consumer prices will lead to further softening and will probably result in additional stimulus in 2019 to increase domestic demand. Consumer price inflation has declined from 2.5 percent in September and October to 2.2 percent in November and 1.9 percent in December.

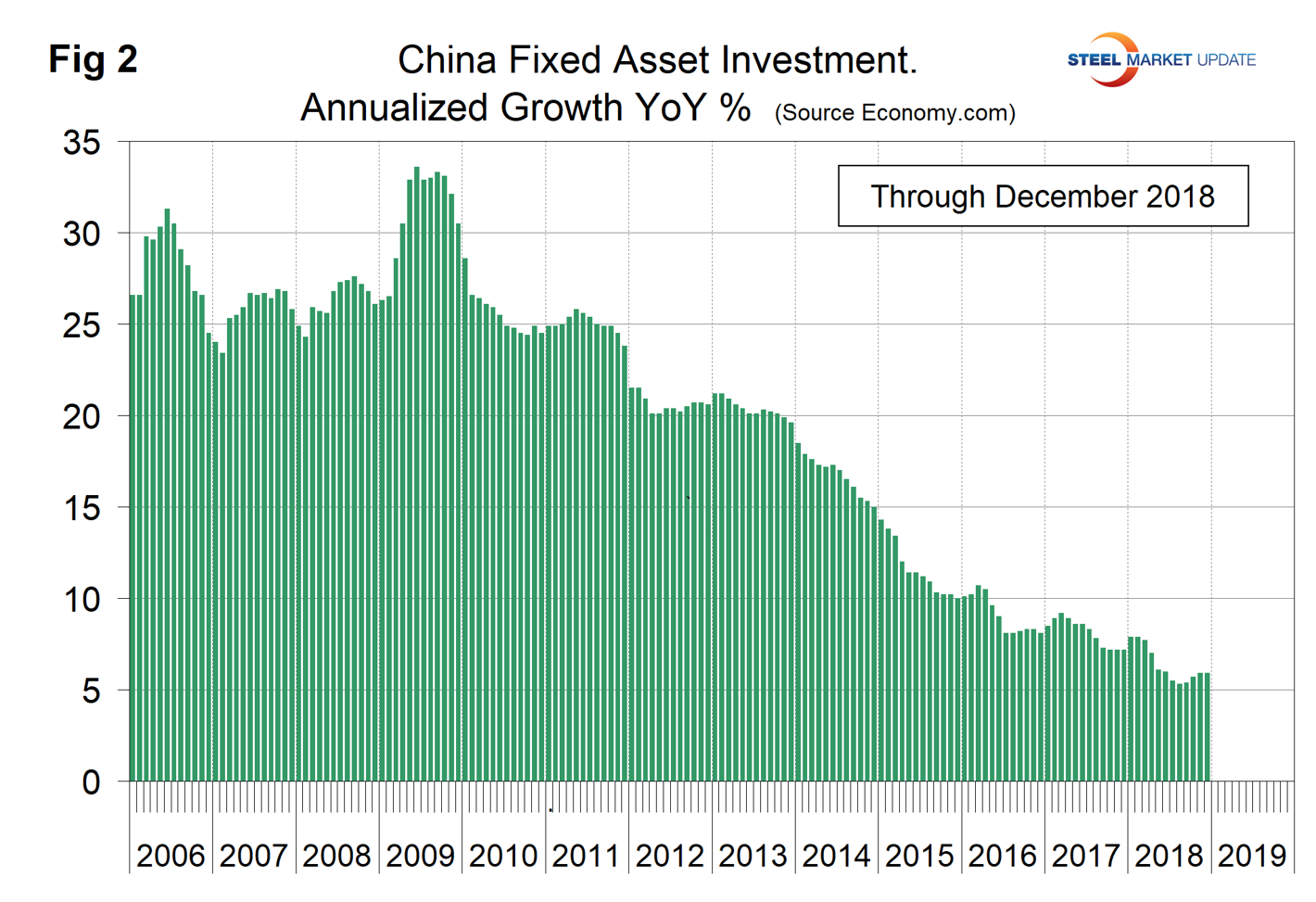

Figure 2 shows the growth of fixed asset investment year over year. In December, FAI grew at 5.9 percent, the same as November but down from 7.9 percent in January. Beijing recently announced additional tax cuts, which should boost investment and consumption throughout 2019.

On Jan. 21, Dividend Sensei reported: “Last week came news of a potential breakthrough in U.S./China trade negotiations. The Chinese trade proposal could set the stage for a permanent resolution of the trade war in 2019 and would result in a game-changing boost to long-term U.S. economic growth that could keep our economic expansion and bull market going for several more years. On Thursday, Jan. 17, the Wall Street Journal reported that U.S. Treasury Secretary Steven Mnuchin had proposed lifting all or some of the tariffs on Chinese imports while D.C. and Beijing continue negotiating. According to Bloomberg, China has proposed eliminating the U.S./China trade deficit entirely by 2024 by increasing U.S. imports by over $1 trillion over the coming six years. In 2018, that deficit was $323 billion, and Trump has stated that one of his main goals is to reduce it significantly. Ironically, the trade war has thus far done the opposite, with the U.S./China trade deficit soaring to its highest levels in history. But as Bloomberg explains: The offer implies raising the annual (China) import total from $155 billion to around $200 billion in 2019 and in increasing steps thereafter reaching an annual total of about $600 billion by 2024. The negotiations are still ongoing, with Chinese Vice Premier Liu He scheduled to arrive in Washington in late January to continue high-level talks.”

SMU Comment: Interesting times. It seems that China is taking the trade talks seriously, but the downside is that this is not a zero sum game. If China increases imports from the U.S., it will reduce them from other nations with resulting unintended consequences. Of course, they may also be “playing” us.