Prices

January 17, 2019

HRC Futures: Bear Market Just Getting Started

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

Happy New Year!

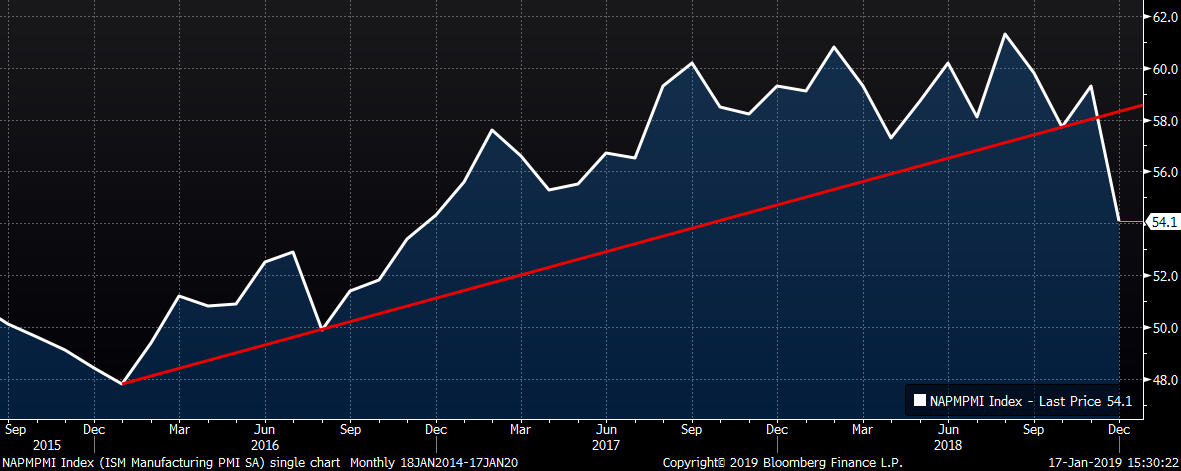

My last article was written on Dec. 20. In that article, I had written about a troubling pattern of multi-year uptrends being not only broken, but broken with authority. Crude oil and U.S. new home sales were two of these. The ISM Manufacturing PMI was one that had yet to break, but was on the watch list. December’s ISM PMI was dreadful crashing spectacularly through its three-year trendline.

ISM Manufacturing PMI

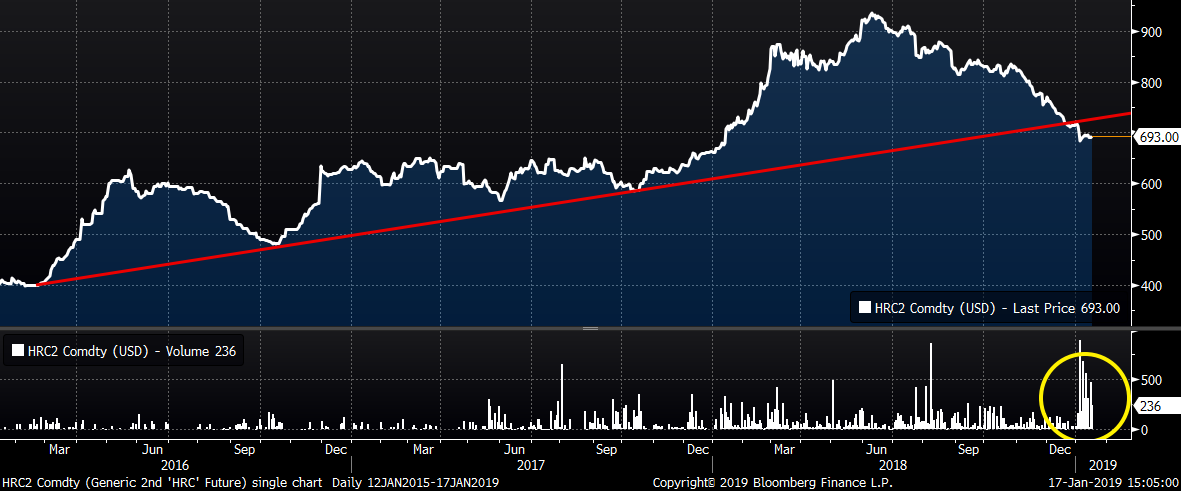

The 2nd month CME Midwest HRC future was another chart with a multiyear uptrend broken in recent weeks trading as low as $682. This chart wasn’t broken with as much velocity as the others, but the spike in volume, indicated in the yellow circle below, is a strong signal that this break should be taken very seriously.

Rolling 2nd Month CME Midwest HRC Future

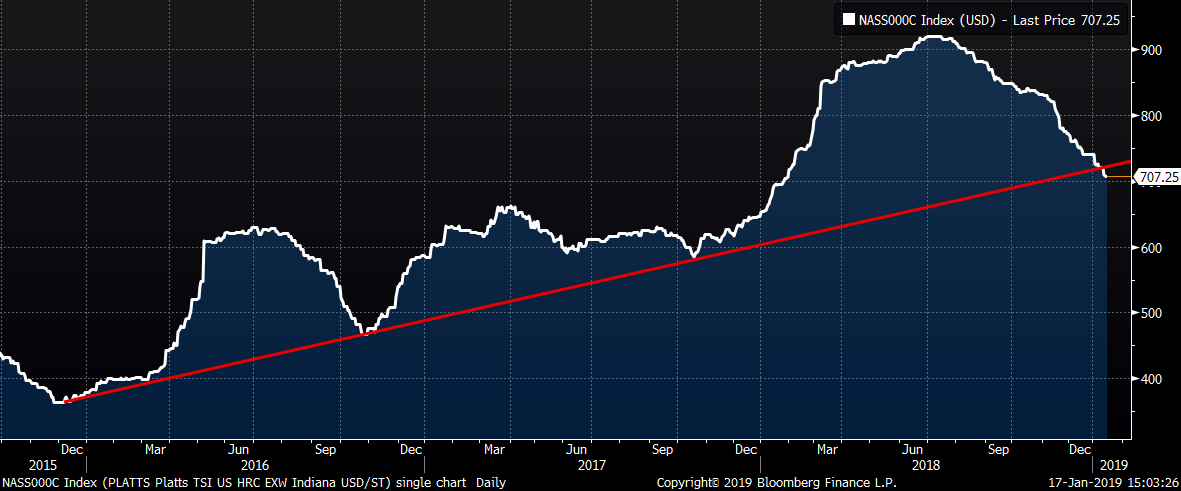

Last week, the SBB Platts Midwest HRC Index broke below its trend.

SBB Platts Midwest HRC Index

Some comments from yesterday’s Federal Reserve Board’s Beige Book:

“Auto sales were flat on balance. The majority of Districts indicated that manufacturing expanded, but that growth had slowed, particularly in the auto and energy sectors. New home construction and existing home sales were little changed, with several Districts reporting that sales were limited by rising prices and low inventory. Commercial real estate activity was also little changed on balance. The energy sector expanded at a slower pace, and lower energy prices contributed to a pullback in the industry’s capital spending expectations. The agriculture sector struggled as prices generally remained low despite recent increases.”

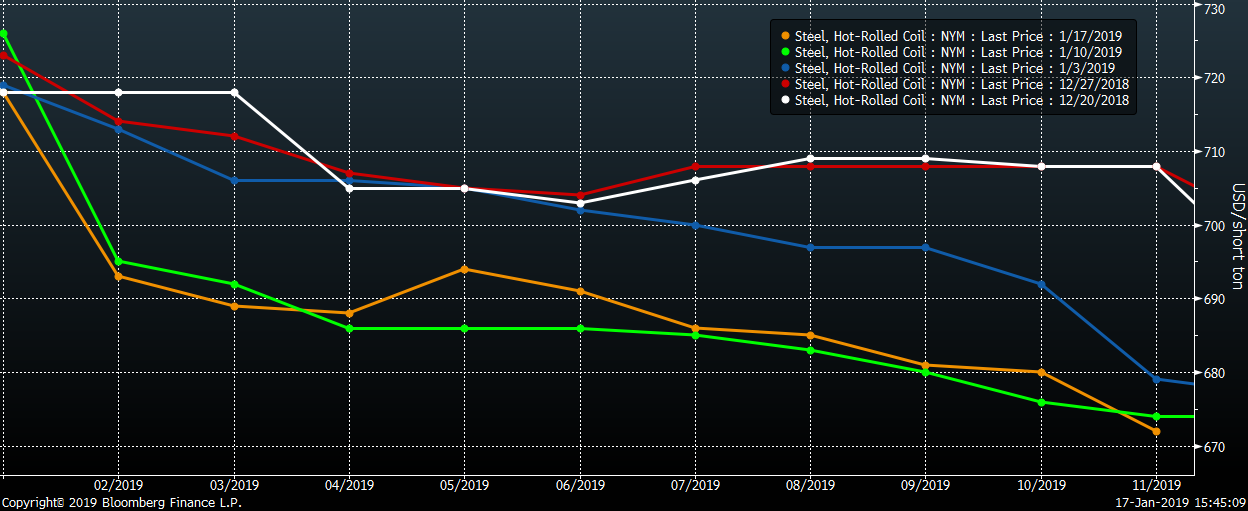

Back of the envelope steel demand is roughly 40% construction, 30% automotive, 10% energy and 20% other. Flat or slowing growth in 2019 will be met with a significant increase in domestic supply. Economics 101 taught us decreased demand and increased supply leads to lower prices. Below is the HRC curve, which has shifted from a flat curve to a slightly backwardated curve down $25-$35 per ton since Dec. 20.

CME Midwest HRC Futures Curve

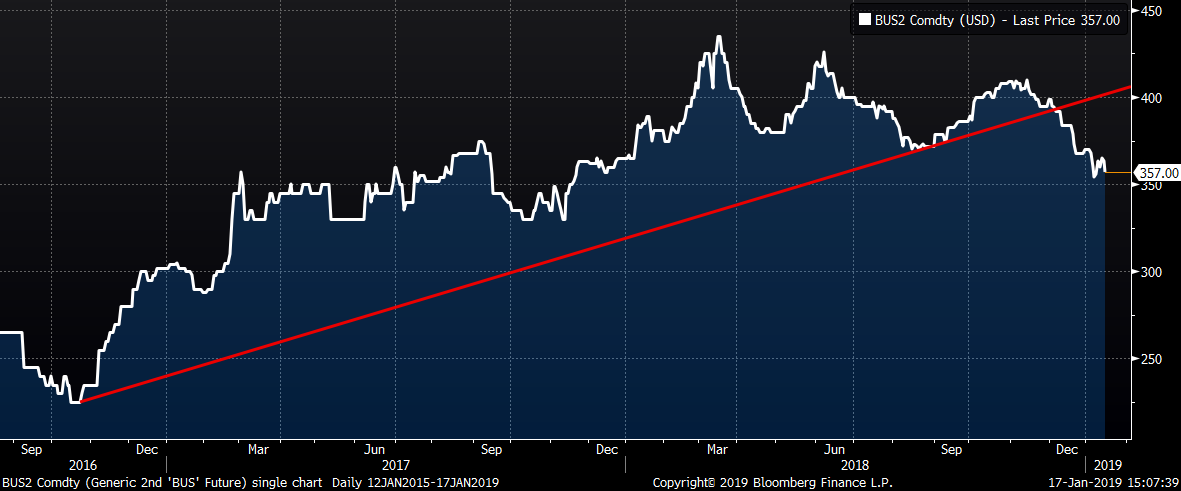

Another long-term trendline break was seen in the 2nd month CME Midwest busheling future. The January AMM Midwest busheling future printed down $29.35 to $372.11.

Rolling 2nd Month CME Midwest Busheling Future

A slowing U.S. and global economy, an almost 30-day government shutdown, global trade war and contentious bipartisan politics likely preventing any hope of a much needed infrastructure plan, let alone solving the shutdown, all point to uncertainty, risk aversion and weak fundamentals. Combine these weak fundamentals with bearish technical patterns consistent across the financial landscape and it sure looks like we are in a bear market for hot rolled.

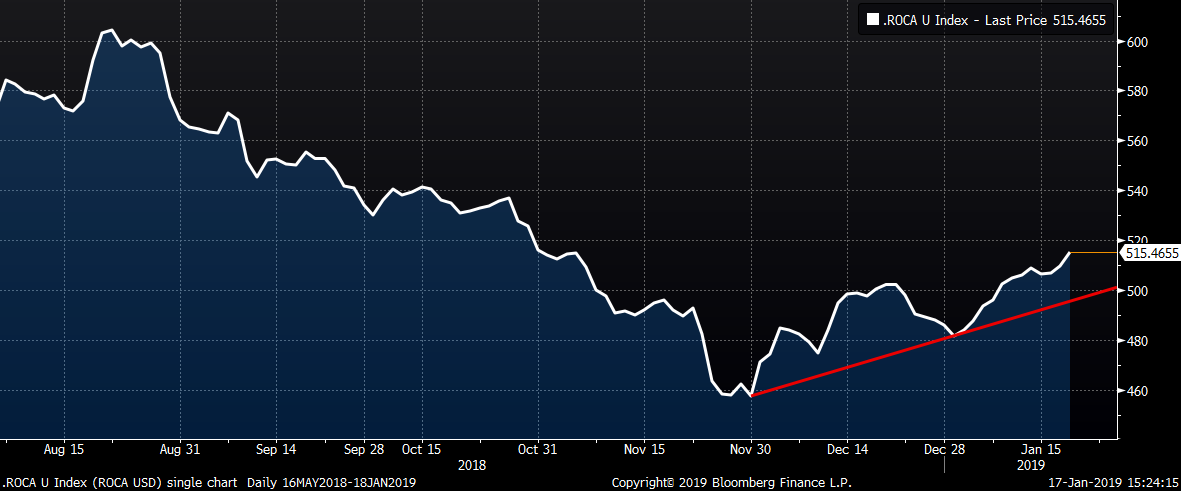

Of course, it’s never that easy. The lone bright spot has been in a nascent rally in iron ore and Chinese Shanghai HRC futures.

2nd Month Iron Ore Future

May Shanghai Chinese HRC Future (yuan)

Friday morning will provide insight into what the service centers covered by the MSCI did with their inventory as prices fell into year end. Some might have dug in and held on to their steel hoping for a price rebound while others simply moved the steel.

It’s a lot easier to move the steel when the steel price is hedged. In fact, whether it be an OEM, service center or steel mill, 2018 was much easier for firms that implemented a hedging strategy than for those that did not.;

As 2019 begins, uncertainty rules the day. What we do know is the year has gotten off to a very weak start.