Prices

January 15, 2019

CRU Price Report: Iron Ore Steady, Coke Down

Written by Tim Triplett

Analysts at the CRU Group share their latest information on the global iron ore and coking coal markets.

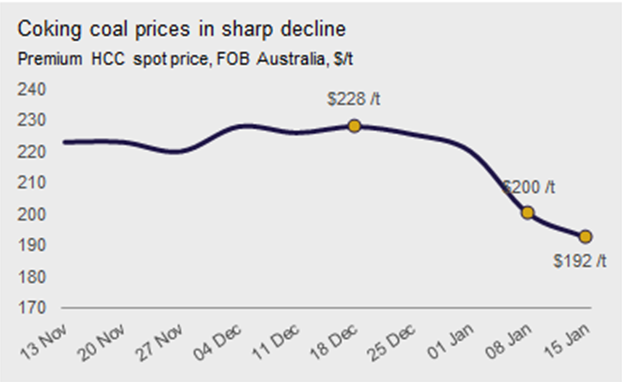

Iron Ore Prices Steady on Short Supply

Weak seaborne supply kept iron ore prices elevated during the past week. The market is also closely following the development of the fire at Rio Tinto’s Cape Lambert port, which will result in a temporary port. CRU on Tuesday, Jan. 15, assessed the 62% Fe fines price, CFR China, at $75.20 /t, up $0.20 /t w/w.

The market has been quiet on the demand side. Steel prices in China are flat w/w and stimulus measures in China such as a lower reserve requirement ratio (RRR) and a stronger Chinese renminbi have failed to have any material impact on steel demand. Iron ore demand, however, has been solid as steel mills have been restocking ore prior to the Chinese New Year holiday, which this year takes place Feb. 4-10.

On the supply side, shipments from Port Hedland have remained at a low level, which is normal at the start of a quarter. Shipments from BHP have fallen in the past week and FMG’s export have been in the past two weeks as they have shipped at an annualized rate of ~135 Mt/y. The big news in the market is the fire at Cape Lambert. CRU expects the port to be shut entirely for a few days while investigations into the cause of the fire are ongoing. Most of the damage took place at the screening plant, which will limit Rio Tinto’s exports of its low-grade Robe Valley fines for the duration of the repair, which we expect could take up to one month. Rio Tinto’s Robe Valley products have low phosphorus and most of the volumes are sold to Japanese customers. Rio Tinto’s Pilbara Blend Fines (PBF) shipments will continue as normal once the investigation is completed.

We see mixed signals on the market for the price direction in the coming week. Mills restocking iron ore typically lead to higher prices, but weak demand, indicated by rising rebar stocks in China, are a bearish signal. Because of these mixed signals, we expect prices to remain around $75 /t in the coming week.

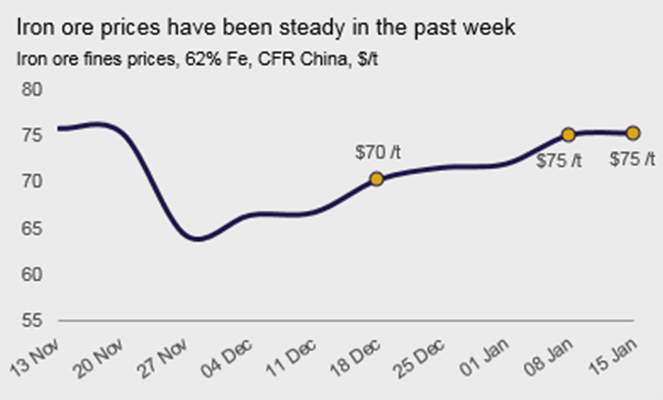

Coking Coal Price Fall Continues

Seaborne coking coal prices have continued their descent in 2019, pressured downward by low steel margins and weak buying interest, especially from Indian buyers. Although Chinese steelmakers started some restocking in early January, coking coal stocks held by them have now reached comfortable levels and remain significantly high y/y. According to our sources, Indian steelmakers are also well stocked at the moment and thus the traders have become fairly inactive on the spot market in anticipation of further price declines.

In terms of supply, Australian shipments have increased substantially m/m. However, due to a coal mine accident in Shanxi province this week, the Chinese authorities are looking to relaunch their campaign of more stringent mine safety inspections. If the restocking in China continues before the Chinese New Year, the downward correction in the coal prices will temporarily come to a halt. We expect coking coal prices to remain stable during the next month.

On Jan. 15, CRU assessed the Premium HCC, $7.70 /t lower w/w at $192.30 /t, FOB Australia.