Market Data

January 13, 2019

Steel Market Trends: Price Hike Coming?

Written by Tim Triplett

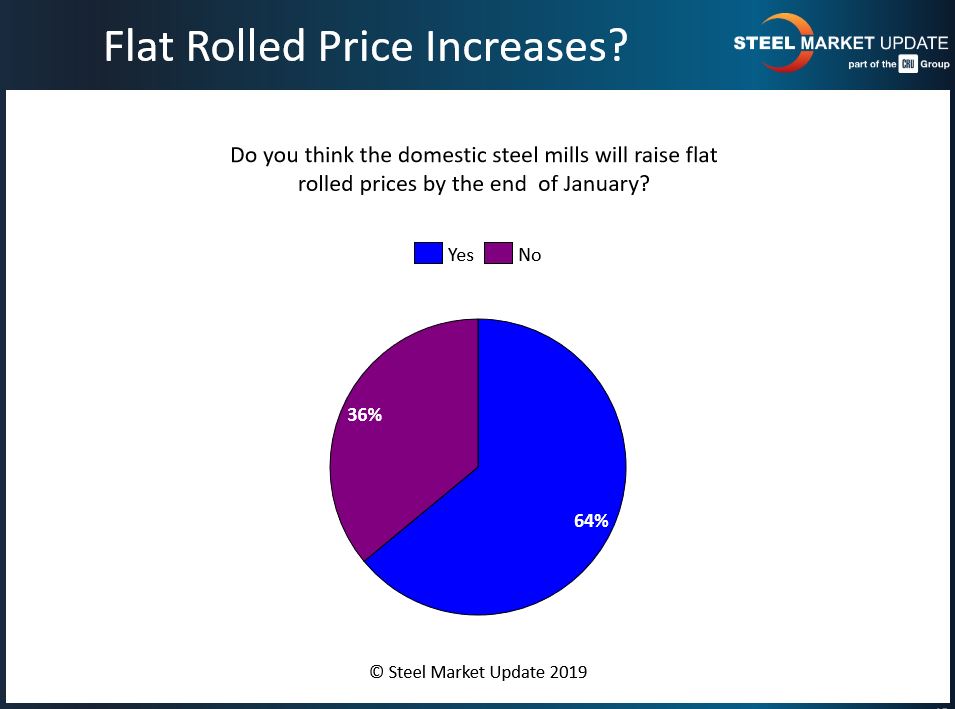

If the prevailing view in the market proves correct, steel mills will announce a price increase soon—but it won’t stick. Two out of three steel executives responding to Steel Market Update’s market trends questionnaire this past week believe the mills will announce an increase in flat rolled prices by the end of January. But given the current market conditions, many are skeptical the mills will be able to collect.

Flat rolled steel prices declined steadily in second-half 2018 and are now 10 to 20 percent lower than their peaks last summer. SMU data shows hot rolled currently selling at around $720 per ton, down from its 2018 high of $915. Cold rolled is at $825, down from $1,015, and galvanized has slid to $820 from its high of $1,020.

Whether the mills will announce a price hike and whether the market will accept it are two different questions. Price increases are not uncommon in January to kick off the new year. The mills have announced increases on flat rolled products for the past three Januarys in a row. Their incentive to make it four is strong as they feel increasing pressure to stop the slide. But lead times on spot orders of most products, with the exception of plate, are as short as they have been in over a year. Lead times of less than four weeks for hot rolled and around six weeks for cold rolled and coated products suggest that the mills are less busy and that supply may be exceeding demand.

Ferrous scrap prices, which factor into how much the mills charge for their products, have been on the downswing. The benchmark price for shredded scrap is now around $330 per ton, down from its April 2018 high of $380. Much of the decline in scrap is attributable to the weak export market as demand overseas has waned. Scrap that would otherwise have been loaded on a ship for China or Turkey is now finding its way onto a train for the trip from the East Coast to the Ohio Valley and Midwest. Combined with mild winter weather that has allowed material to flow unimpeded into dealers’ scrap yards, scrap supplies in the U.S. are outpacing demand, even with the domestic mills operating at over 80 percent of their capacity.

Signs of a Decline in Demand?

Obviously, the price of finished steel is ultimately a function of demand from steel users in the industrial sector. The surprisingly robust U.S. economy has sustained steel demand though various disasters, natural and political, for the past several years, leaving the market to wonder: How much longer can the good times last?

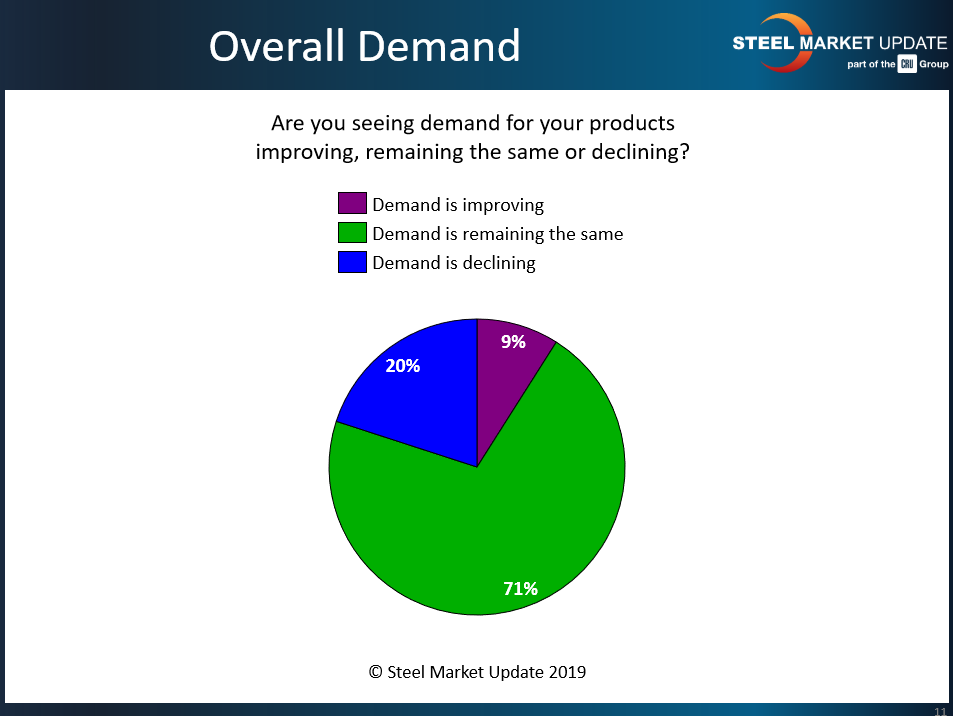

Indeed, there are signs of a shift in market sentiment. True, 71 percent of the respondents to SMU’s market trends questionnaire this week see little change in the demand picture as the new year begins. But among those who see a change in demand, twice as many view the trend as negative. For 20 percent, declining demand is a concern heading into 2019, compared with just 9 percent who feel steel demand is improving. “Demand is still soft starting the New Year. No one is rushing to buy in a downward price market,” commented one executive. “I would classify it as fence-sitting rather than demand-declining,” observed another.

What Respondents are Saying

While two out of three respondents expect a price increase to be announced, one-third believe the mills will consider the unfavorable market conditions and hold off for the time being. Many of those who anticipate a price hike expect it to be unsuccessful. Here’s what some of them had to say:

- “They will certainly attempt to raise prices.”

- “By early February is my guess.”

- “They have to stop the slide.”

- “They may announce, but will not be successful.”

- “They will announce one, but whether they can collect, I doubt it.”

- “I think they will ‘try’ to raise prices to stop them from dropping further. But there just doesn’t appear to be a whole lot of optimism out there right now. I hope I’m wrong!”

- “Only if their books are full and demand looks strong.”

- “It won’t do them any good to raise prices if lead times are as short as they are now.”

- “What is going to stop the slide? Oil? Demand? I think we will fall until construction season starts.”

- “They might try, but it’s hard to know the basis for it. Or if it will have any success.”

- “I think they will try to raise prices, but it will not happen. I am being offered lower prices for February now.”

- “What are base prices and transaction prices right now? There is no clear picture or consistency in published prices versus actual prices, and imports are getting more aggressive as world demand has softened and China has slowed a lot!”

- “They will try, but with scrap still dropping and HR lead times in some cases below three weeks, it will be tough for it to stick.”

- “The mills will attempt to raise prices with price increase announcements. I don’t believe the price will actually rise.”

- “They will try, but I’m not sure how successful they will be.”

Even at their reduced numbers, steel prices are still at relatively healthy levels compared with historical averages. Their staying power depends in large part on the health of the U.S. economy and industrial production in 2019.