Prices

January 10, 2019

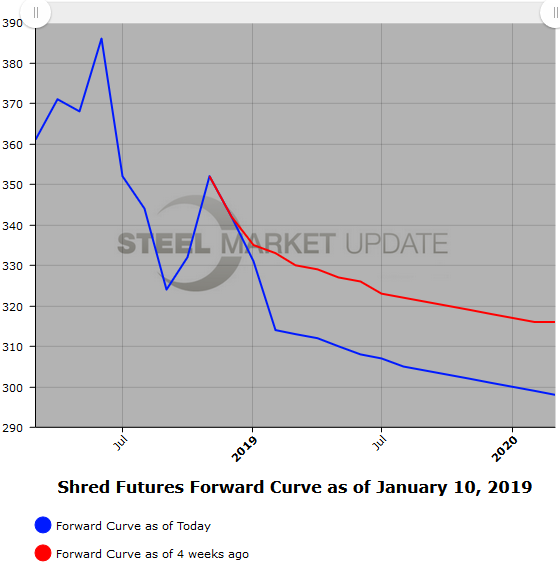

HRC Futures: CME Steel Futures Comments

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Since the beginning of the year, the forward curve in CME HR futures has shifted down roughly $25/ST on average for the Feb’19 through Dec’19 HR contracts. The backwardation in price for this strip of contract months has narrowed from $27/ST back on Jan. 2 [$720/ST Feb’19 minus $693/ST Dec’19] to $17/ST back on Jan. 9 [$691/ST Feb’19 minus $674/ST Dec’19].

The latest HR index surprised with a slight uptick. Jan’19 futures, which were trading sub-$720/ST, have bounced back above. The main focus so far this month has not been the spot month future, but has been the spot +1 and +2 (Feb’19 and Mar’19 HR contracts). Open interest (new contracts) in Feb’19 and Mar’19 has risen over 2,000 lots since the beginning of the month out of a 2,740 contract increase. There has been strong two-way interest in the Feb’19 HR contract, which was reflected in a wider than normal trading range of over $20/ST. In addition, HR futures have traded 123,840 ST so far this month reflecting strong near-end interest, as well as pretty healthy calendar spreads volumes.

We have had a good amount of buyer inquiries as buyers look at potentially locking in forward prices. However, participants have been holding off as the longer date forward offers indicated on their hedge amounts are above the current curve of smaller offers. Hedgers are also holding off due to no expectations of a shift in demand and soft mill lead times that have been hovering around three weeks.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

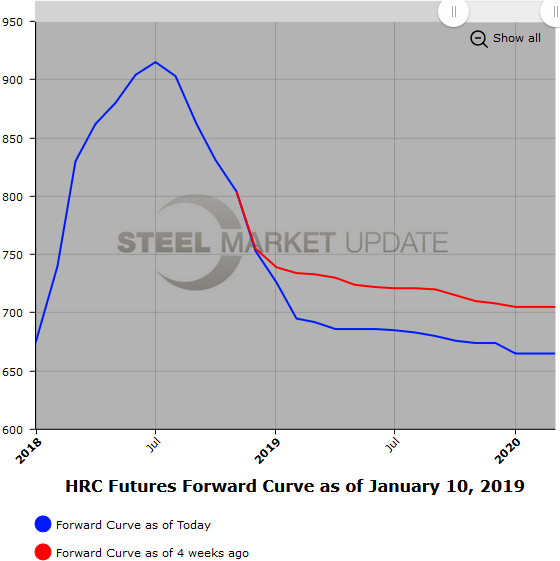

Scrap

Prime scrap futures (BUS) prices have dropped over $18/GT since the beginning of the month. Market expectations have Jan’19 BUS declining by about $30/GT to around $373/GT. Latest Feb’19 BUS is trading at $363/GT. The curve is a bit more backwardated with the Feb’19 to Dec’19 at roughly $27 back [$363/GT Feb’19 minus $336/GT Dec’19]. Volumes have been modest so far this month with buyers well below market selling interest. $365/GT traded today in Feb’19-Mar’19 as part of a metal margin spread [HR $695/ST- BUS $365/GT = $330].

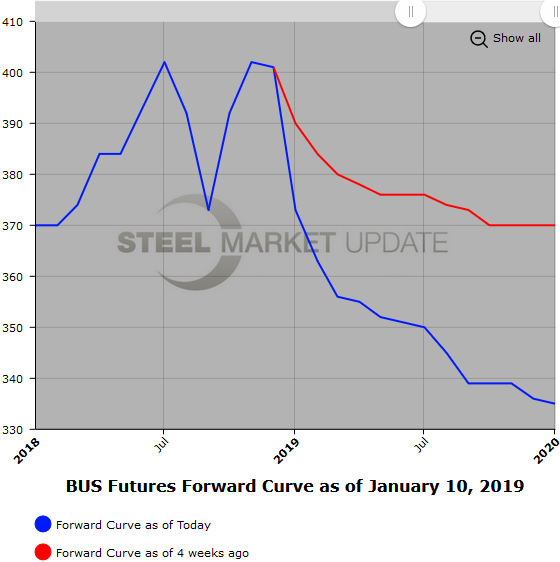

Latest Shred Futures have also declined with the Feb’19 USSQ offered at $315/GT last.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.