Product

January 8, 2019

HARDI: HVAC Market Looks Positive in New Year

Written by Tim Triplett

The new year has gotten off to a positive start, though declining steel prices remain a concern for members of the Heating, Air-conditioning and Refrigeration Distributors International, who supply steel products to the HVAC market. As one HARDI member commented during the trade group’s monthly conference call on Tuesday, “Some of us feel like Alabama’s football team today, a bit nauseated. Selling steel that you bought when the price plateaued is not for the faint of heart. But demand is still decent. Contractors have a lot of work going on.”

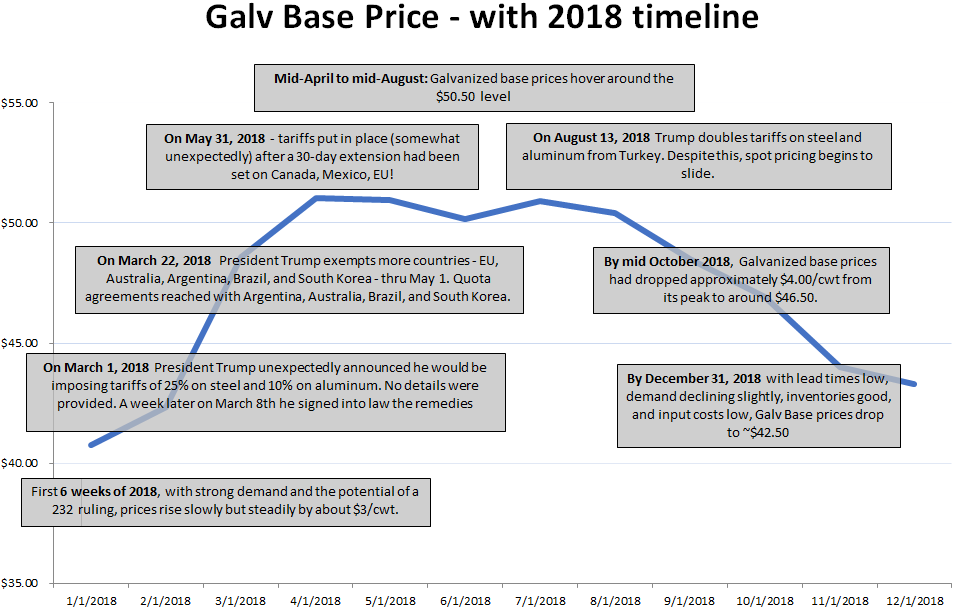

![]() Steel prices have been on the decline since mid third quarter, reported John Packard, Steel Market Update president and publisher. Lead times for galvanized are short at less than seven weeks as the mills remain willing to negotiate on spot orders. The price of galvanized has dropped below $40/cwt as domestic producers have priced their products aggressively to compete with imports. “And I think there is room for prices to fall even further,” Packard said. “Scrap is settling down $30-40 a ton for January. That does not behoove the mills to go out for a price increase right away.”

Steel prices have been on the decline since mid third quarter, reported John Packard, Steel Market Update president and publisher. Lead times for galvanized are short at less than seven weeks as the mills remain willing to negotiate on spot orders. The price of galvanized has dropped below $40/cwt as domestic producers have priced their products aggressively to compete with imports. “And I think there is room for prices to fall even further,” Packard said. “Scrap is settling down $30-40 a ton for January. That does not behoove the mills to go out for a price increase right away.”

On a positive note, the HARDI members agreed that demand is generally strong in most parts of the country. “If you are not looking at the stock market, things are pretty healthy. It’s hard to get an accurate read on demand around the holidays, but we have been steady since then,” said one distributor.

Demand looks to be upbeat in January following some seasonal slowing during the holidays, agreed another HARDI member. With the winter weather relatively mild and contractors with backlogs, the order rates in January have been strong. “At least the first half of 2019 will be good,” he said, “based on conversations we’ve had with contractors.”

“We thought we might see some hesitancy in the market, but people remain fairly busy. So far in 2019, we are seeing consistent requests for quotes and jobs on the table. 2019 is shaping up fairly well. It just depends on how the mills decide to play this,” commented another executive.

Until the next price increase is announced, distributors must manage their inventories and replacement costs carefully, cautioned another HARDI veteran. It’s a delicate balance while waiting for the price to find a bottom. “If lead times push out when the milder weather comes, hopefully the price will turn around,” he said.

Steel Market Update participates in a monthly steel conference call hosted by HARDI. The call is dedicated to a better understanding of the galvanized steel market. The participants are HARDI member companies who are wholesalers, service centers and manufacturing companies that either buy or sell galvanized sheet products used in the HVAC industry.

Graphic courtesy Conklin Metal Industries

Graphic courtesy Conklin Metal Industries