Market Data

January 3, 2019

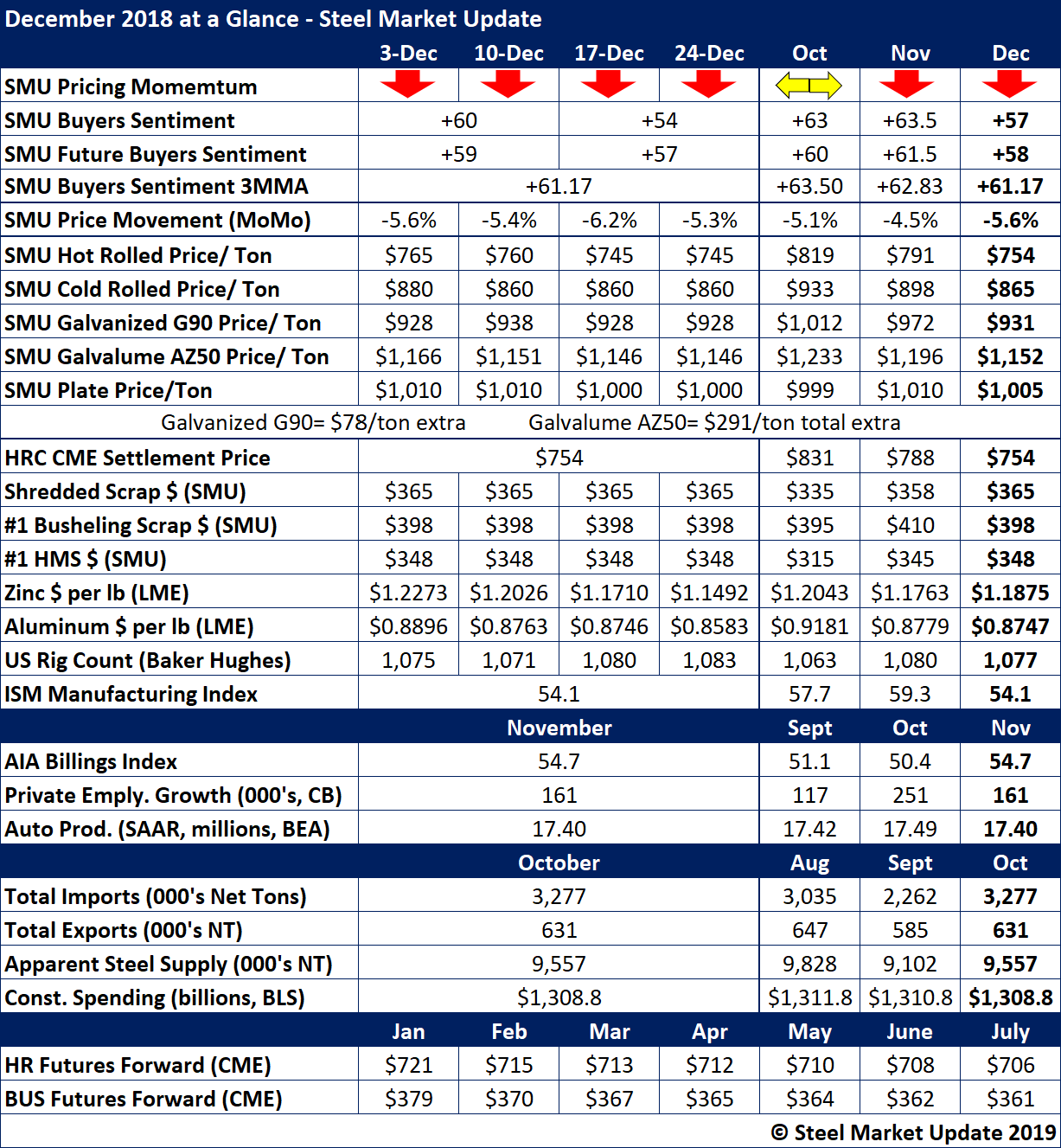

December at a Glance: Downward Momentum

Written by Brett Linton

The year ended on a cautionary note with steel demand, prices and buyers’ sentiment showing downward momentum in December.

Prices for flat rolled products continued their fourth-quarter declines with hot rolled dipping to $754, cold rolled to $865 and galvanized to $931 in December. Plate is the notable exception, holding steady around $1,000 per ton, plus or minus, as it has for the past few months. Were it not for ferrous scrap prices that saw modest increases in November and December, the declines in finished steel prices could have been greater.

Weaker flat rolled prices may reflect weakening demand. The Institute for Supply Management’s Manufacturing Index for December registered 54.1—still showing growth at a reading over 50—but down five points from 59.3 in the prior month. The market will be watching closely in the first quarter to see if the December decline was seasonal or if steel demand will continue to trend down in 2019.

While still at optimistic levels historically, SMU’s Steel Buyers Sentiment Indexes showed signs of erosion in December as concerns about steel demand and pricing, and perhaps the turmoil in Washington and on Wall Street, weigh on buyers’ attitudes.

See the chart below for other key market metrics.

To see a history of our monthly review tables, visit our website here.