Market Data

December 20, 2018

SMU Market Trends: 2019 Risk List More Naughty Than Nice

Written by Tim Triplett

Continual controversy over trade and tariffs, volatile steel prices and unrest on Wall Street have clearly left many in the industry anxious and pessimistic about the year to come.

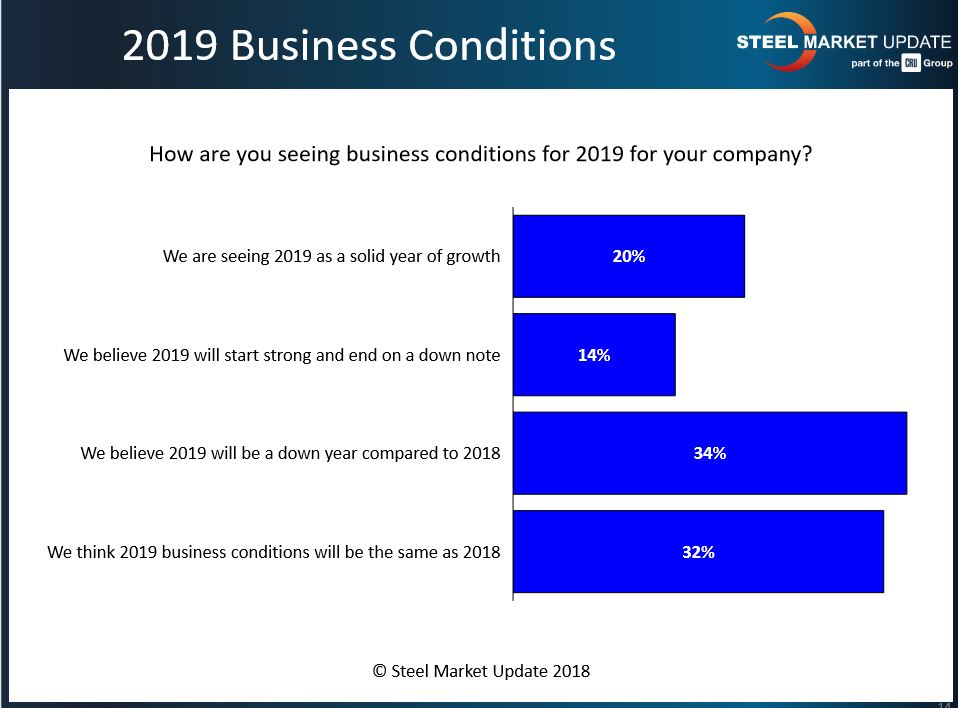

Only about 20 percent of the steel executives who responded to Steel Market Update’s latest market trends questionnaire expect 2019 to be a solid growth year for their companies. About 34 percent believe 2019 will be a down year compared with 2018. Another 14 percent predict 2019 will start strong but end on a down note. The rest, 32 percent, see business conditions remaining about the same.

“There are lots of economic and geopolitical headwinds,” commented one respondent. “Our industry is very efficient at lowering selling prices and very inefficient at raising prices, leading to a losing proposition,” said another.

Asked what they consider the biggest risk to their companies in 2019, an economy that dips into recession was the top concern, cited by 29 percent. About 19 percent pointed to U.S. mill pricing that is too high compared with the rest of the world. Around 10 percent consider all the uncertainty surrounding President Trump to be the biggest risk factor.

Many have concerns about tariffs. About 10 percent fear the effects of the Section 232 tariffs, Another 5 percent fear what would happen if President Trump withdraws the Section 232 tariffs. About 3 percent are wary of extending the Section 232 tariffs to automotive imports and the Section 301 tariffs to more goods from China.

For 24 percent of those responding to SMU’s poll, their 2019 risk list includes “all of the above.”

Various comments from industry executives reveal the discomfort they feel over the higher-than-normal level of uncertainty entering the new year:

• “Uncertainty kills growth!”

• “Tariffs have caused steel pricing to be too high. The uncertainty has caused us to keep inventories lower, thus we have missed some short delivery opportunities.”

• “With this much uncertainty and volatility in the market and country, I believe most people will be very conservative in 2019.”

• “The trades cases are starting to drag down the economic growth and are spooking Wall Street.”

• “Section 232 remains the elephant in the room. The other issues are all valid concerns and are not to be taken lightly, but for our business it’s about 232.”

• “Primarily Section 232, but more importantly the uncertainty from Trump’s trade protectionism.”

• “There are too many variables to predict 2019, but until then it is business as usual. Hopefully we are in a more cautious and prepared status then 2009.”

• “All issues are interrelated. North American pricing is artificially high, so at some point there will be a correction. We are headed for an economic slowdown, so steel demand will fall. Uncertainty over tariffs, trade deals, etc., will lead to lack of investment. Right now, everything is headed in the wrong direction.”

• “Between the Fed rate hike goals, the Section 301 trade war and the uncertain future and environment surrounding Section 232 (tariffs, no tariffs, quotas?), there is an unhealthy economic undercurrent churning about that is becoming a threat to business success. Every year is a challenge and 2019 will not fail to disappoint in that regard.”

• “Economy ‘Trumps’ everything!”

As one wise service center executive noted in a recent conversation with SMU, such negative perceptions are in danger of being self-fulfilling. “Folks have already decided that next year won’t be so good. We are falling on our own sword. Letting the air out of our own balloon. This is an odd marketplace.”