Prices

December 6, 2018

HRC Futures: Prices Under Pressure

Written by Gaurav Chhibbar

Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this new role, he and his firm design and execute risk management strategy for clients along with providing process and analytical support.

In Gaurav’s previous role, he was a Trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. He can be reached at Gaurav@MetalEdgePartners.com for queries/comments/questions.

The past two weeks have seen pressure on Q1 and Cal’19 HRC prices. With the headline index continuing to drop, it is no surprise that the market has come off. The curve has traded down in the wake of weaker numbers on steel and iron ore in China, expectations of more supply in the U.S. and concerns around demand.

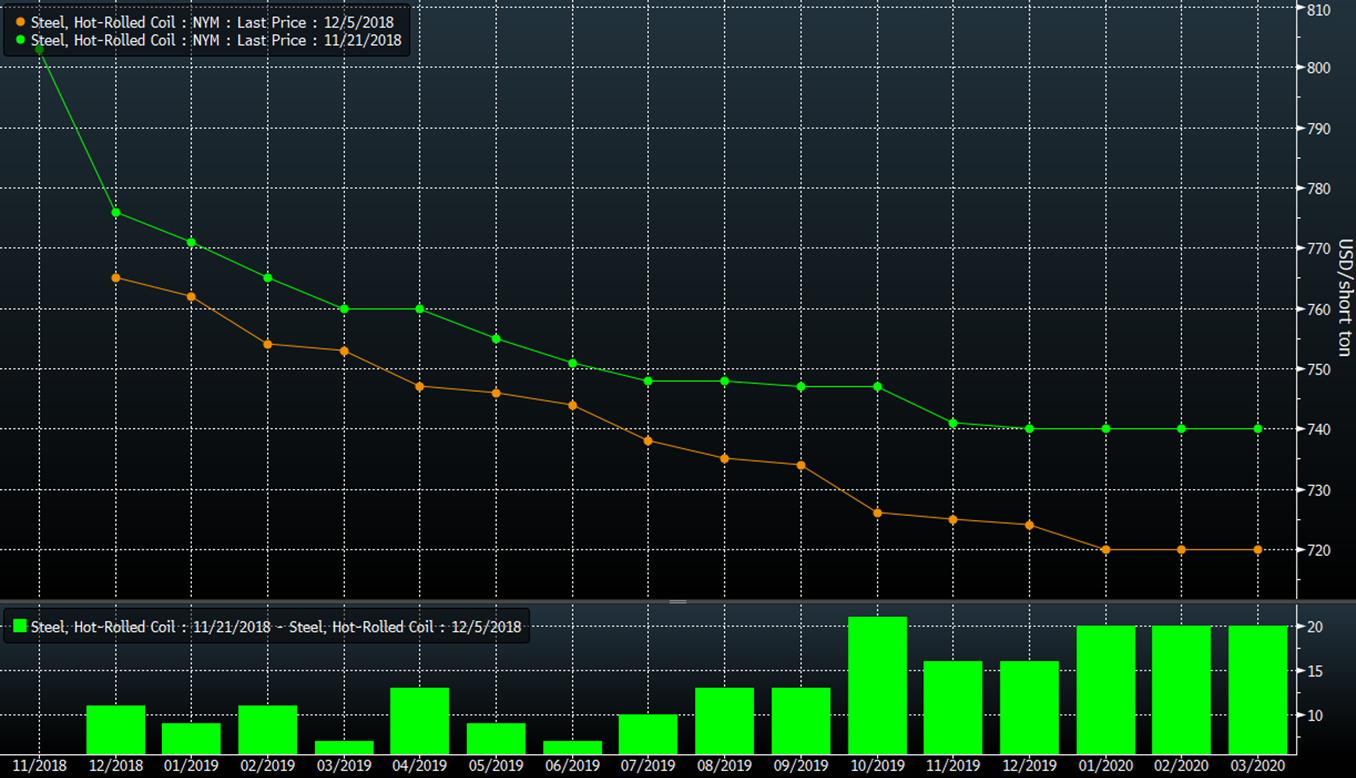

In the chart below, the green line is the Hot Rolled Coil curve on 11/21 versus the orange line, which shows the curve as of 12/5. The bar chart in solid green highlights the dollar move in the curves in the two-week period.

The dropping of mill lead times, an indicator of weak spot booking activity, has kept the buying interest overshadowed by the aggressiveness of the sellers. The scrap futures curve was no different in terms of the push lower. However, the size of the move on scrap was much smaller.

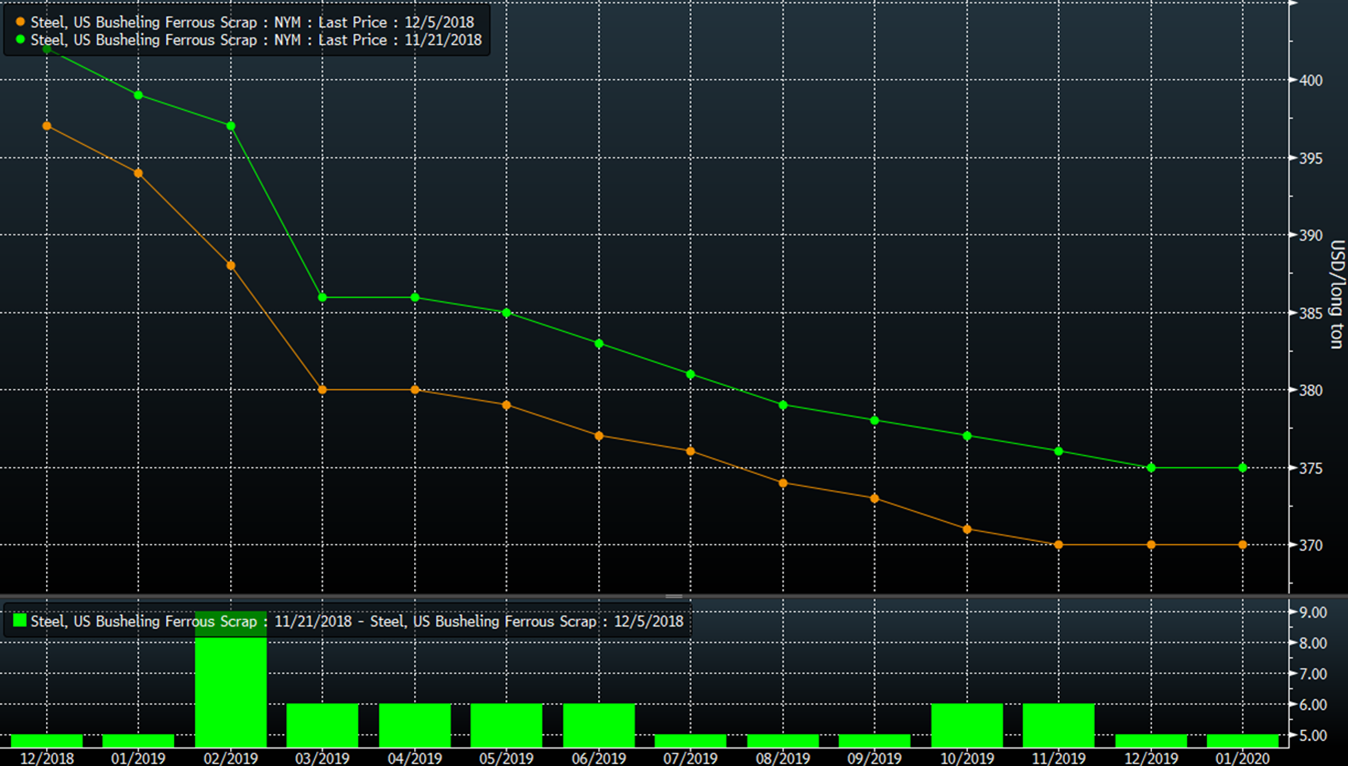

In the chart below, the green line (11/21 curve) being higher than orange line (12/5) captures the pressure on pricing in bushelling scrap futures. It is noteworthy that scrap prices to Turkey on HMS 80/20 have lately been under pressure, as well.

It may come as a relief to mills that the backwardation levels have reduced from the extremes we saw in early Q3. The chart below shows the spread between the generic 1st and 6th month contract. The gradually reducing spread shows the flattening of the curve. If this spread moves to zero, that would imply parity in pricing between spot month and six months out.

The trend of a flattening curve is somewhat similar for some other ferrous markets. Iron ore, which was also steeply backwardated till recently, saw pressure on the front of the curve as mill margins declined. The 1st and 4th month spread for iron ore contracts show a compressing spread, down from the highs we saw in October and early November. The spot prices in iron ore were pulled higher due to demand for high grade ore ahead of production cuts in China. However, with the steel prices coming under pressure, the mills reverted to bargain hunting for cheaper ore, sending prices lower.

Another interesting story in the futures market this week also is tied to the high grade iron ore. This week we saw the launch of a high grade iron ore contract on SGX. The contract that will trade futures indexed on Metal Bulletin’s Fe 65% index was well received with the opening day trading volume topping 150,000 tonnes. This instrument gives an opportunity for mills and miners to manage the price risk on iron ore quality premiums.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should it be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.