Prices

November 29, 2018

Futures: HR and Scrap Forward Curve Steepness Moving in Opposite Directions

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

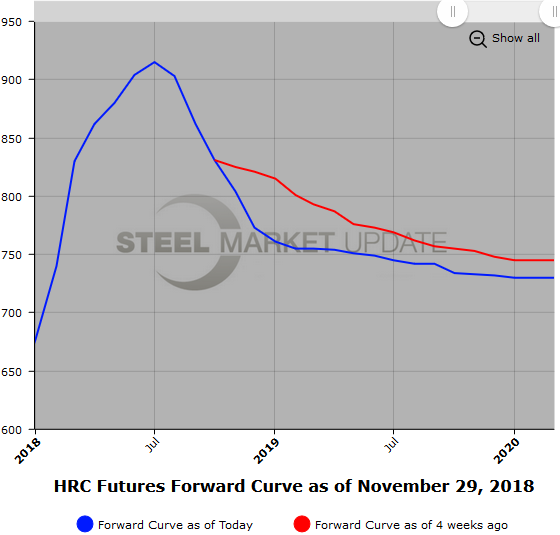

HR spot prices continued to fall this week breaking down through the $800/ST [$40/cwt] level. The HR futures followed suit. Futures prices have been under some selling pressure all month as the curve has shifted lower with Q1’19 HR declining about $49/ST [$2.45/cwt], Q2’19 HR declining about $30/ST [$1.50/cwt] and 2H’19 HR declining about $23/ST [$1.15/cwt]. Cal’19 HR for Nov. 1 was settled at $774/ST [$38.70/cwt] as compared to Nov. 28 at $744/ST [$37.20/cwt]. While the price curve for Cal’19 HR has shifted lower, it is also worth noting that the backwardation between Jan’19 and Dec’19 has shrunk from $67/ST [$3.35/cwt] to $24/ST [$1.20/cwt] based on a comparison of the CME settlements for Nov. 1. and Nov. 28. The flatter forward curve is due to reduced interest by sellers to sell the latter half of Cal’19 at the same discount to the front end of the curve as early November, which could be a signal that the market participants think the HR market is getting near to a medium term low for prices.

November has been an active month in HR futures with upwards of 220,000 ST trading. The month started out slow, but volumes picked up going into the Thanksgiving break. Open Interest in HR futures was last at 19,381 lots or 387,620 ST.

Of note, 1H’19 HRO 820 Calls traded recently at a $20/ST premium. The buyer bought right to be long HR futures above $820/ST in January, February, March, April, May, and June for $20/ST premium. The seller collected the $20/ST premium agreeing to be on the hook, and short, if the market is above $820/ST.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

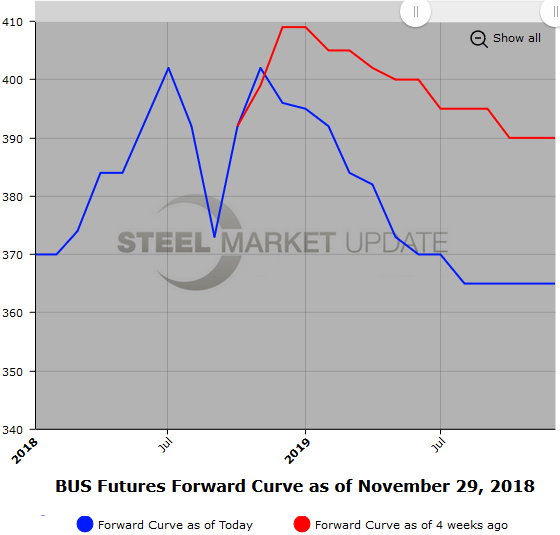

Scrap prices have softened from early strength in November. Early BUS chatter had scrap prices holding steady to slightly higher, however softer HR prices have pressured BUS prices via the metal margin and softer global HR prices. Nov’19 BUS settled at $402/GT and near end BUS prices were trading close to that level until recently. The Cal’19 BUS curve has come under some pressure on light trading. As a comparison, Nov. 1 Q1’18 BUS settlement was $406.33/GT versus Nov. 28 settlement, which was $385.33/GT a $21/GT decline. The backwardation in the Cal’19 BUS curve has gotten steeper since the beginning of November. It has increased from $19/GT back to $28/GT back. The Cal’19 last is roughly $374/$385 per GT dropping from $383/$395 per GT in the last two weeks.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.