Overseas

November 29, 2018

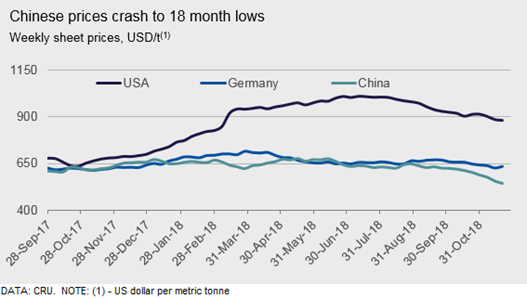

CRU: Global Sheet Prices Cascade Lower

Written by Tim Triplett

Editor’s note: The following global perspective was contributed by the CRU Group’s international team of steel analysts. Steel sheet prices are trending downward in most parts of the world.

North America

Sheet prices in the U.S. Midwest market continued to decline with HR and CR coil prices falling the most. Declines have come alongside weak seasonal demand and adequate inventories while domestic production continues to rise. Furthermore, lower global prices continue to provide buyers with some leverage for imports arriving as soon as March.

The U.S. West Coast sheet market remains in limbo, as many buyers reported uncertainty about the prices they could achieve if they were willing to place more substantial orders. Spot business has been light, but what business has been done for early 2019 has been concluded at flat pricing relative to December. Market sources said that West Coast mills are eager to lift prices, though they are not sure if there will be any justification, as demand remains soft.

Europe

Prices continue to fall across Europe. This week HR coil prices are down by a further €6/t in both Germany and Italy. This makes the total price loss during November €17/t in Germany and €20/t in Italy. The gap between northern and southern Europe remains unusually wide for HR coil and unless Italian prices rebound higher, that looks set to be closed via further, perhaps sharper, falls in Germany. Currently, there seems little prospect of any near-term rebound in Italy. The market remains under pressure from weaker demand at the end of the year, and more recently from the visible and very sharp price falls occurring in China.

China

Chinese sheet prices continued to drop over the past week, ranging from RMB170-220/t across the board, given slow transaction accompanied by bearish sentiment. Most participants hold a “wait and see” attitude and expect prices to see further decline. Market inventories fell 1.4 percent while steel mill stocks continued to climb up quickly by almost 10 percent in a week, reflecting less response from steel mills’ production to plummeting prices, whereas traders’ bearish sentiment over the short-term price outlook kept buying activities limited. Steel mills have started to care more about cost saving over production, but some of them still carried out maintenance as they are not earning anything by selling at current prices. Bad air quality in Hebei and Jiangsu have increased the possibility of another round of supply control over the coming week, which may begin to provide some strength to the spot market. This also drove the HRC futures market up slightly on Wednesday reflecting some confidence restoration. But it is still early to label it as a turning point at this stage, especially for CR and coated sheet with less positivity on the underlying demand perspective.

Asia

Asian sheet prices continued to show a decline for the sixth consecutive week. Recent declines in Chinese prices have soured sentiment in Asian markets, leaving most buyers on the sidelines as they anticipate further price declines. In Vietnam, Chinese prices became competitive again after recent drops. Chinese SAE grade HR coil was traded at $490/t CFR by short-selling traders, while mainstream offers were at about $505-525/t CFR and bids were at about $500 CFR. Chinese SS400 HR coil was sold at levels between $490-507/t CFR. Indian HR coil was offered at $520/t CFR Vietnam, down by $10 week-on-week, and Russian SAE HR coil was offered at about $505/t CFR. Trading, though, remained generally sparse as the latest “collapse” in Chinese prices almost stopped buying in Vietnam, according to traders.