Market Data

November 24, 2018

SMU Market Trends: Many Find Tariffs Troubling

Written by Tim Triplett

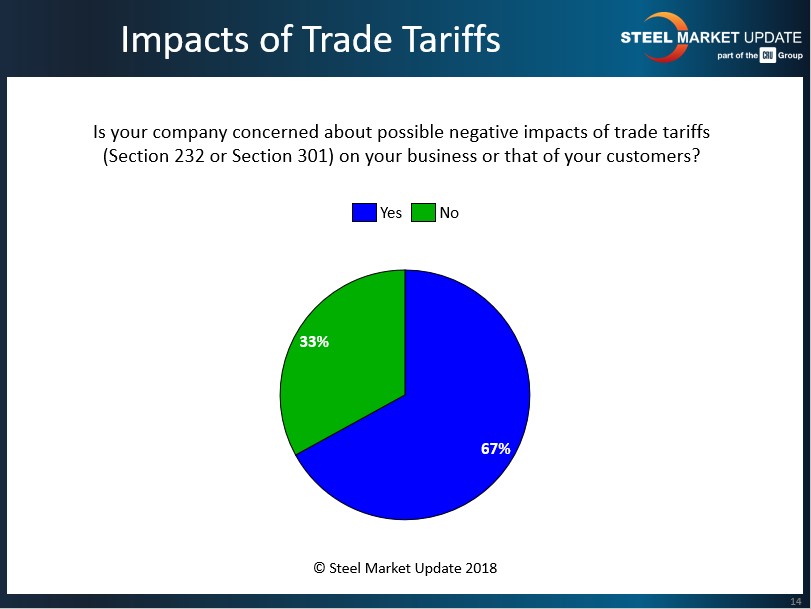

Two out of three respondents to Steel Market Update’s market trends questionnaire this week said they remain concerned about the possible negative impacts of trade tariffs on their business and that of their customers.

The Section 232 tariffs on imports of steel and aluminum remain a serious obstacle to the new North American free trade agreement between the U.S., Canada and Mexico. Various trade groups from automotive and other steel-consuming industries have called for an end to the tariffs on the United States’ closest trading partners, which they argue benefit the steel industry at the expense of downstream manufacturers. The three nations are expected to sign the USMCA deal at the G20 meeting in Argentina Nov. 30. Legislators from the three countries would still have to approve it before it would take effect.

At the same time, the U.S. is in the midst of a trade war with China, using Section 301 to justify tariffs on $250 billion in Chinese imports. The Chinese have responded in kind. U.S. officials hope to persuade the Chinese to address the intellectual property theft and forced technology transfer that American companies face when they do business in China. Some of the Section 301 tariffs on Chinese goods are set to increase from 10 percent to 25 percent on Jan. 1.

Comments from SMU readers reflect their concerns:

• “Looking out 6-9 months, there’s a lot of uncertainty.”

• “Finished goods with a large percentage of steel will be produced outside North America. It’s already happening.”

• “We are waiting for the Canadian/Mexican tariffs to be lifted and wonder what impact that will have on U.S. pricing.”

• “Tariffs have accomplished little. The domestic mills have not handled it properly; they’ve looked short term again instead of long term. When the next recession hits, they will be crying again, especially the integrated mills that continue to be inefficient and out of control on their cost per ton of production.”