Overseas

November 18, 2018

Foreign vs. Domestic Hot Rolled Prices: Spread Increasing

Written by Brett Linton

The following calculation is used by Steel Market Update to identify the theoretical spread between foreign hot rolled steel import prices (delivered to USA ports) and domestic hot rolled coil prices (FOB domestic mills). We want our readers to be aware that this is only a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate, ultimately influencing the true market spread. At this time, we do not include any tariffs in the calculations we provide.

We are now comparing the SMU U.S. hot rolled weekly index to CRU weekly price indices for Germany, Italy and the Far East (East and Southeast Asian port). We also periodically include CRU monthly price indices for Turkey, CIS and Brazil when they are updated.

![]() SMU adds $90 per ton to these foreign prices taking into consideration freight costs, handling, trader margin, etc. This provides an approximate “CIF U.S. ports price” that can then be compared against the SMU U.S. hot rolled price, with the result being the spread (difference) between domestic and foreign hot rolled prices. As the price spread narrows, the competitiveness of imported steel into the United States is reduced. If the spread widens, then foreign steel becomes more attractive to U.S. flat rolled steel buyers. A positive spread means U.S. prices are higher than foreign prices, while a negative spread means U.S. prices are less than foreign prices.

SMU adds $90 per ton to these foreign prices taking into consideration freight costs, handling, trader margin, etc. This provides an approximate “CIF U.S. ports price” that can then be compared against the SMU U.S. hot rolled price, with the result being the spread (difference) between domestic and foreign hot rolled prices. As the price spread narrows, the competitiveness of imported steel into the United States is reduced. If the spread widens, then foreign steel becomes more attractive to U.S. flat rolled steel buyers. A positive spread means U.S. prices are higher than foreign prices, while a negative spread means U.S. prices are less than foreign prices.

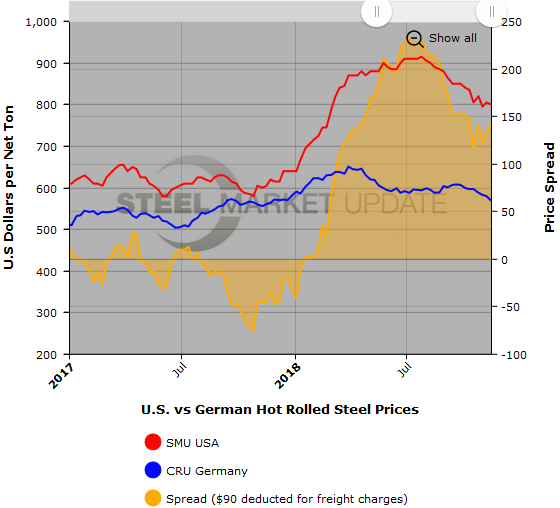

As of Wednesday, Nov. 14, the CRU German HRC price was $568 per net ton, down $12 from the previous week and down $15 from two weeks prior. Adding $90 per ton for import costs, that puts the price at $658 per ton from Germany delivered to the U.S. The latest Steel Market Update hot rolled price average is $800 per ton for domestic steel, down $5 over last week, but up $5 from two weeks ago. The spread between German and U.S. HR prices is now +$142 per ton, up from +$135 last week, and up from +$122 two weeks ago. That means domestic HR is now theoretically $142 per ton more expensive than importing HR steel from Germany. The four-week average price spread is now +$135 per ton, up $6 from last week.

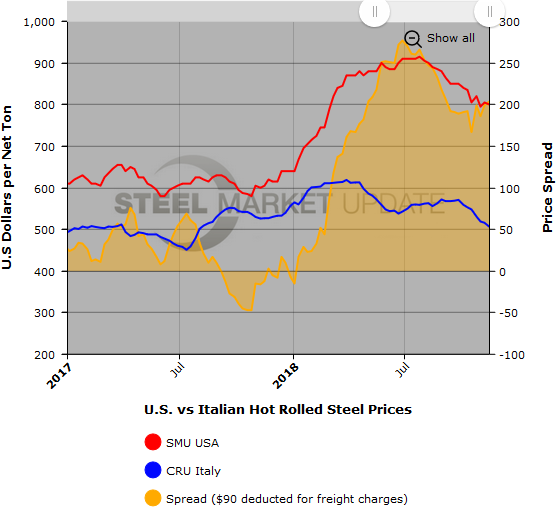

CRU published Italian HRC prices at $506 per net ton, down $10 over last week and down $13 compared to two weeks ago. After adding import costs, we get a delivered price of approximately $596 per ton. The spread between the Italy and U.S. figure is +$204 per ton, up from +$199 one week ago, and up from +$186 two weeks ago. Meaning that U.S. HR is theoretically $204 per ton more expensive than importing steel from Italy. The four-week average is now +$197, up $9 over last week.

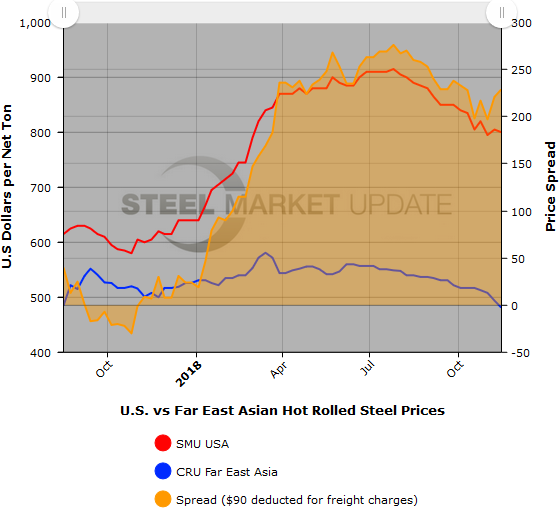

The CRU Far East HRC price fell $13 over last week to $481 per net ton, down $27 from two weeks prior. Adding import costs, that puts the price at $571 per ton. The spread between the Far East and U.S. figure is +$229 per ton, up from +$221 last week, and up from +$197 from two weeks ago. That means domestic HR would theoretically be $229 per ton more expensive than importing steel from East or Southeast Asia. The four-week average price spread is now +$216 per ton, up $8 from last week.

Note: Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill, while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. When considering lead times, a buyer must take into consideration the momentum of pricing both domestically and in the world markets. In most circumstances (but not all), domestic steel will deliver faster than foreign steel ordered on the same day.