Logistics

November 15, 2018

Winter is Coming to the Great Lakes

Written by Sandy Williams

The first major winter storm of the 2018-2019 season is currently making its way up the East Coast, which means it is time to start thinking about the navigation on the Great Lakes. Right now, iron ore and coal ships are busy supplying steel mills in the Great Lakes region with enough inventory for the winter.

Although it is too soon for any disruptive ice to have formed on the Lakes, the U.S. and Canadian icebreakers are preparing their fleets to keep the shipping channels open until the Soo Locks are closed for the season. Shipping season ends first with the closing of the St. Lawrence Seaway, followed in January by the locks at Sault Ste. Marie.

The Canadian Coast Guard has announced the purchase of three used icebreakers from Norway that will augment the aging fleet. It is reported that an additional C$217 million was required to cover tariffs for the import of the vessels. Only one of the vessels will be operational this year, while the other two undergo extensive conversion work at a Quebec shipyard.

Vessels in the Canadian Coast Guard icebreaking fleet average more than 35 years old and have logged increasing downtime for repairs in the last few years.

The U.S. Senate on Wednesday approved a $10.6 billion budget for the U.S. Coast Guard that will help modernize its fleet of cutters and aircraft. The bill also includes EPA policies for the Great Lakes that “will help prevent pollution and ensure that that ballast water does not transport invasive species from one body of water to another along a vessel’s shipping route, while providing greater regulatory certainty for the shipping industry.”

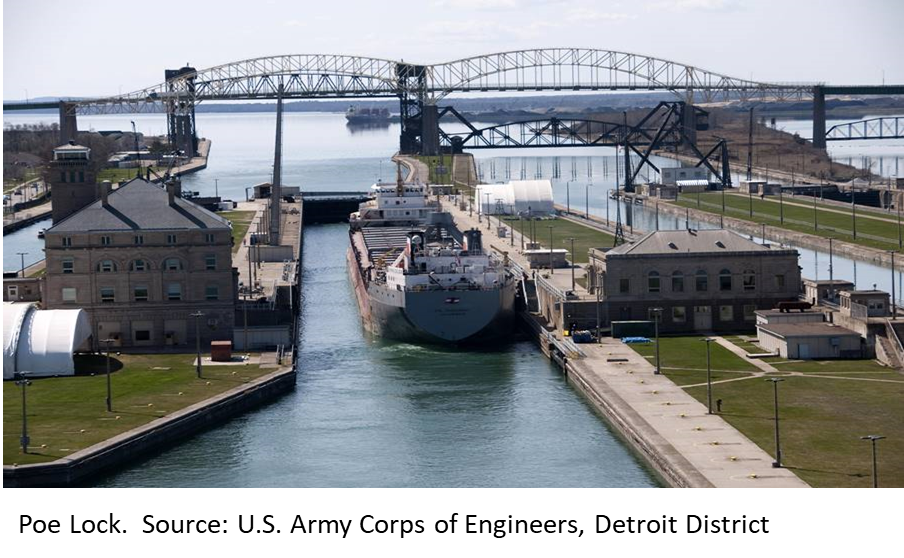

In October, President Trump signed the America’s Water Infrastructure Act of 2018 that authorizes the construction of a second Poe-sized lock at Sault Ste. Marie, Mich. The Poe lock handles about 90 percent of the cargo through the Soo Locks since larger cargo ships cannot transit the smaller MacArthur lock. Two unused locks, the Davis and Sabin, will be combined to create the new 1,200-foot lock.

The $922 million bill, when funded by Congress, will be planned by the U.S. Army Corp of Engineers and will take between seven and 10 years to complete. If funded soon, groundbreaking for the lock could begin next year and be fully operational by 2030.

A concerted push for a new Poe-sized lock has been under way for years. A study in 2015 by the U.S. Department of Homeland Security highlighted the economic crisis that would occur should the Poe Lock in Sault Ste. Marie suffer an unexpected closure during peak shipping season.

The DHS report states, “Depending on what time of year the closure occurred, approximately 75 percent of the U.S. integrated steel production would cease within 2–6 weeks after the closure of the Poe Lock. Approximately 80 percent of iron ore mining operations, and nearly 100 percent of the North American appliances, automobile, construction equipment, farm equipment, mining equipment, and railcar production would shut down.”