Canada

November 15, 2018

Stelco Profits Soar Despite U.S. Tariffs

Written by Sandy Williams

Despite paying CAD $39 million in tariffs on 24 percent of its shipments, Canadian steel producer Stelco turned in a stellar performance in third-quarter 2018.

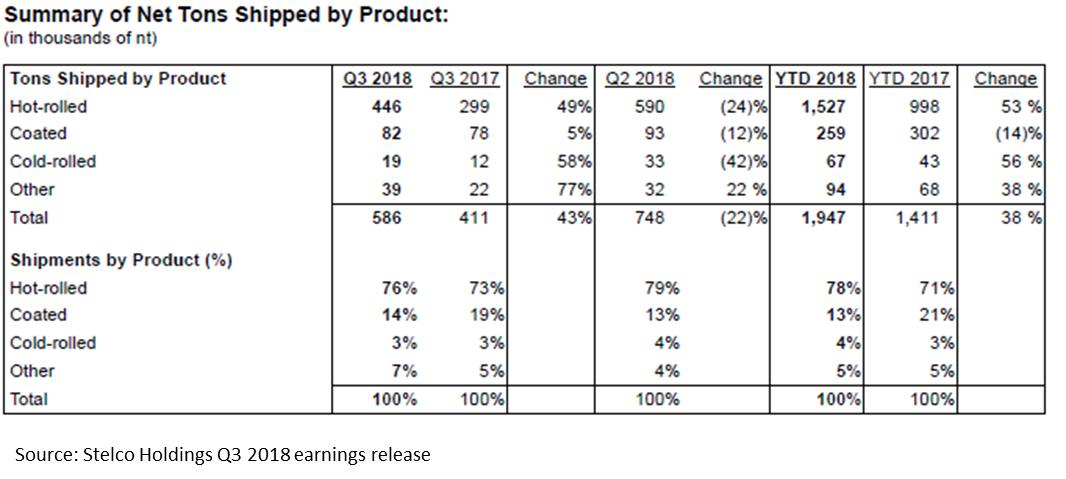

Stelco reported third-quarter revenue of $619 million, 84 percent higher than a year ago due to a 43 percent increase in steel shipping volumes and a 24 percent increase in average steel selling price. Shipments totaled 586,000 net tons at an average selling price of $980 per ton.

“EBITDA was $154 million, which represents what we believe to be the North American industry-leading adjusted EBITDA margin of 25 percent, despite being the only reporting steel company in North America subject to [Section] 232 tariffs,” said CEO Alan Kestenbaum. “Our tariff adjusted EBITDA (calculated by adding back $39 million of tariffs to our adjusted EBITDA figure), was a record high, since being acquired by Bedrock, of $193 million.”

Net income for the quarter was $123 million, recovering from a net loss of $13 million in Q3 2017.

Stelco’s results decreased sequentially due to a planned upgrade outage at its hot strip mill that resulted in $10 million of costs. Compared to the second quarter of 2018, revenue decreased 13 percent and operating income decreased 15 percent. Steel shipping volumes declined 22 percent from the record of 784,000 tons set in the second quarter. Adjusted EBITDA decreased 12 percent due to lower shipping volumes, higher tariff and outage-related costs, which were partially offset by higher selling prices.

Kestenbaum thanked the Canadian government for introducing retaliatory tariffs and safeguard measures in response to the Section 232 tariffs imposed by the United States. “The recently implemented safeguard measures on Oct. 25 are providing market stability by limiting the amount of offshore imports that threaten to be diverted to Canada as a result of the Section 232 tariffs in the United States,” said Kestenbaum.

Kestenbaum played down the impact of the tariff, saying, “In Q4, we will already see a meaningful drop in tariff costs. Stelco plans to increase its sales to the domestic market and has expanded its product offerings to fill voids in the Canadian market caused by the trade measures.”

He added that the company will try to get tariff costs down to zero “either as a result of our ongoing shift in sales…or as a result of ongoing governmental negotiations that will ultimately remove tariffs altogether.”

“I believe as a result of the new NAFTA, or USMCA, it is quite possible that the Canadian industrial markets we serve will actually improve their competitiveness and expand, giving us even more demand than just the void left by the retreating supply from the targeted sources.”

($1.00 CAD = $0.76 USD)