Product

November 8, 2018

CMC’s Buy of Gerdau Assets Raises Prospects of a Rebar Price Hike

Written by Tim Triplett

By CRU Steel Analyst Ryan McKinley

CMC’s expanded footprint across the United States, following its acquisition of Gerdau’s assets, raises the probability that a rebar price increase is on the horizon. That said, price increases may be short-lived as Nucor works to bring two of its newest micro mill projects online in 2019.

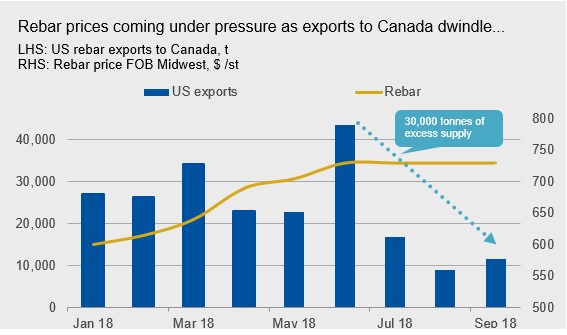

Rebar prices came under pressure this month after reciprocal Canadian duties on imports of U.S. steel resulted in a short-term supply buildup in the northeastern U.S.

However, we now expect a price increase for rebar amid a reduction in the number—and increased bargaining power—of suppliers following the acquisition.

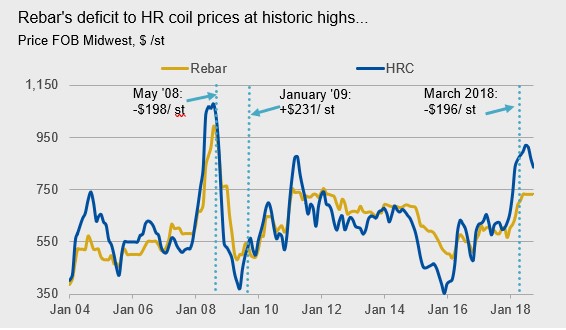

At the same time, the spread between rebar and HR coil has expanded far beyond its historical average after flat product price increases outpaced those for long products.

From 2004-2017, rebar FOB Midwest traded at an average of $3/st lower than HR coil. Even for the spread to return to a 2017 average, rebar prices would need to rise, or flat roll prices fall, by $124/st ($6.20/cwt).

With construction demand poised to rise on seasonally strong demand in the first quarter of 2019 and with a reduction in suppliers, we anticipate price increases to begin after the turn of the new year. Should construction demand prove similar to 2018, the increase may be substantial.

Price increases may be short-lived, however, if Nucor brings two planned micro mills online in the coming year. The announced plants in Sedalia, Mo., and in Frostproof, Fla., combined will bring at least 700,000 st of rebar capacity onto the market. Furthermore, the specific targeting of these markets may disrupt current supply chains. In addition to possible freight advantages, lower overhead at the micro mills will likely result in a decrease in rebar prices once they come online.