Prices

November 6, 2018

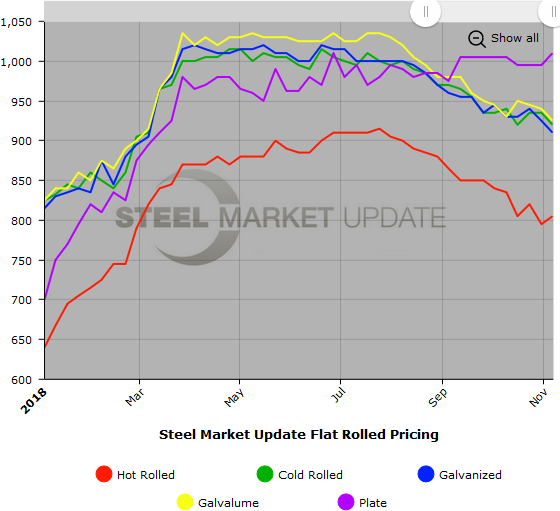

SMU Price Ranges & Indices: Benchmark Hot Rolled Above $800

Written by Brett Linton

Flat rolled steel prices continue to vacillate as we saw the low end of our range on benchmark hot rolled coil improve by $20 per ton. We are aware of a couple end-of-the-year deals that are below our range, but we feel at this point they are limited and not available to the greater market. Our HRC average rose by $10 per ton to $805 per ton.

We are hearing that many steel buyers are sitting on their hands, or not needing to purchase steel right now. Many are waiting to see what is going to happen with the tariffs on Canada, Mexico and the extra 25 percent tariff on Turkey. They are also waiting to see what will happen once the election is over and, as one steel supplier told me this afternoon, many companies have been in an inventory reduction mode for the past two months.

We may be turning the corner on when steel buyers will need to go out and restock. A large trading company told me today they anticipate lower import volumes in November and December. If that is indeed the case, steel buyers could become active once lead times reach late January and into February.

Plate continues to live in its own little world. We are being told most plate mills are in January, which has taken our index pricing higher as the mills are collecting most, if not all, of the $40 per ton price increased announced in late October. The lower end of our range comes from a small number of tons available at one specific plate mill. Otherwise, once we get into January, prices will be at or above $1,000 per ton delivered for plate.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $770-$840 per ton ($38.50/cwt-$42.00/cwt) with an average of $805 per ton ($40.25/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on hot rolled steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $900-$940 per ton ($45.00/cwt-$47.00/cwt) with an average of $920 per ton ($46.00/cwt) FOB mill, east of the Rockies. The lower end of our range fell $20 per ton compared to last week, while the upper end declined $10 per ton. Our overall average is down $15 per ton compared to one week ago. Our price momentum on cold rolled steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $44.00/cwt-$47.00/cwt ($880-$940 per ton) with an average of $45.50/cwt ($910 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, while the upper end fell $20 per ton. Our overall average is down $15 per ton compared to last week. Our price momentum on galvanized steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU price range is $958-$1,018 per net ton with an average of $988 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $45.00/cwt-$47.50/cwt ($900-$950 per ton) with an average of $46.25/cwt ($925 per ton) FOB mill, east of the Rockies. The lower end of our range fell $20 compared to last week, while the upper end declined $10 per ton. Our overall average is down $15 per ton compared to one week ago. Our price momentum on Galvalume steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,191-$1,241 per net ton with an average of $1,216 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $980-$1,040 per ton ($49.00/cwt-$52.00/cwt) with an average of $1,010 per ton ($50.50/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $20 per ton compared to one week ago, while the upper end rose $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on plate steel is Neutral meaning we expect stable prices once the mills open their December order books. The domestic plate mills continue to be on controlled order entry as their order books are strong with limited spot plate tonnage available.

Plate Lead Times: 5-9 weeks, allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.