Prices

November 6, 2018

October Steel Imports Likely to See Big Jump from September

Written by Tim Triplett

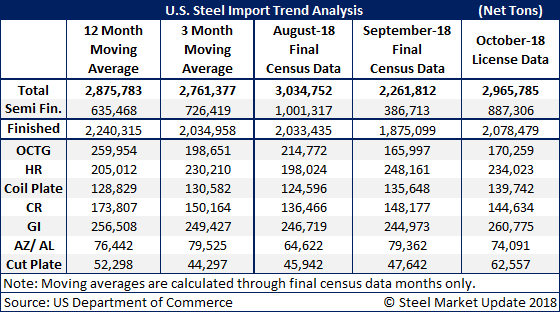

U.S. steel imports for October are likely to fall just below 3 million tons when the Census data is final, based on license data from the Department of Commerce. The total is roughly in line with the 12-month moving average for imports, but up more than 30 percent from September. Imports of semi-finished steel, mostly slabs purchased by domestic mills, more than doubled last month, accounting for much of the total increase. Imports of finished steel products also rose by more than 10 percent from September to October.

Imports of hot rolled, cold rolled and Galvalume steels declined in October versus September, based on October license data, while imports of galvanized, plate and OCTG products increased. Cut plate imports led the way with a big jump of more than 31 percent, while coiled plate imports rose by about 3 percent. Imports of hot rolled declined by about 5.7 percent, while cold rolled dipped by about 2.4 percent.

The jump in steel imports last month can be attributed in large part to the tight supplies of plate products in the U.S. Demand for both coiled and cut plate continue to outpace supply as lead times remain extended and buyers remain on allocation.

To see an interactive history of total steel imports (through final September data), visit our website here. If you need assistance logging into or navigating the website, please contact Brett at Brett@SteelMarketUpdate.com.