Market Segment

November 1, 2018

ArcelorMittal Earnings Fall in Q3

Written by Sandy Williams

ArcelorMittal Group third-quarter net income dropped by nearly half to $0.9 billion from $1.9 billion in the second quarter and declined 25 percent from $1.2 billion a year ago. EBITDA fell 11.2 percent from the second quarter to $1.7 billion due primarily to lower steel shipments and high inflation rates in Argentina, the company said in its third-quarter earnings report.

Crude steel production rose 0.5 percent to 23.3 million metric tons, while steel shipments fell 5.5 percent to 20.5 million tons.

“As anticipated, market conditions in the third quarter remained favorable, resulting in significantly improved EBITDA for the first nine months compared with 2017. We continue to see robust real demand and healthy utilization rates across all steel segments,” said ArcelorMittal CEO Lakshmi Mittal.

“We remain cognizant of the challenges, including continued global overcapacity,” added Mittal, “and we remain concerned with the high level of imports in various markets.”

ArcelorMittal also announced the completion of its purchase of Italian steel mill Ilva by its consortium AM Investco. ArcelorMittal holds a 94.4 percent equity stake in the consortium with Banca Intesa Sanpaolo holding the remaining 5.6 percent.

“It is a great pleasure to welcome Ilva to ArcelorMittal,” said Aditya Mittal, Group President and CFO, and CEO of ArcelorMittal Europe. “We are excited by Ilva’s potential; it is a complementary fit with our existing flat products business in Europe, provides significant scale and is strategically well located. Combining this with our steelmaking expertise, technological prowess, and the extensive investment commitments we have made will enable us to positively transform Ilva’s performance.”

The Ilva name will be changed to ArcelorMittal Italia, and function under ArcelorMittal Europe.

In other action, ArcelorMittal and NSMMC’s joint bid for Essar Steel India has been approved and is waiting formal acceptance by India’s National Company Law Tribunal. Completion of the transaction is expected before the end of 2018.

NAFTA Update

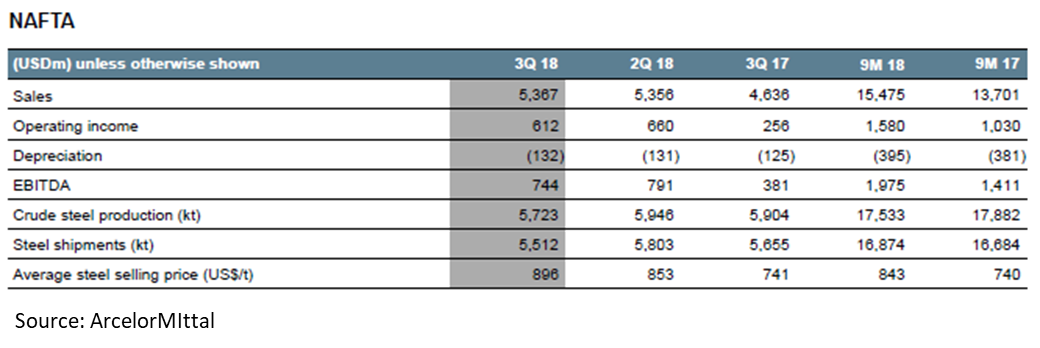

ArcelorMittal’s NAFTA crude steel production slipped 3.8 percent to 5.7 million metric tons in the third quarter due to lower shipments in the U.S. Sales for the segment were stable at $5.4 billion due to a 5 percent increase in average steel selling prices during the quarter. Flat product prices were up 4.3 percent and long products increased 5.2 percent.

Upgrades are progressing at Indiana Harbor, Burns Harbor, Dofasco and Mexico HSM. Indiana Harbor projects are expected to be completed by the end of the year. The new walking beam furnaces at Burns Harbor are scheduled to be completed in 2021.

Two new 2.5-million-ton hot strip mills are being installed at Mexico HSM that will increase ArcelorMittal Mexico production by about 5.3 million metric tons (2.5 million tons, flat; 1.8 million tons, long; and 1 million tons, semi-finished slabs). Completion of the mills is anticipated sometime in 2020.

ArcelorMittal Outlook

“Market conditions remain favorable; the demand environment remains positive (as evidenced by the continued readings from the ArcelorMittal weighted PMI, which signals expansion in demand) and together with the benefits of structural supply-side reform is supporting healthy steel spreads,” said ArcelorMittal in the company outlook remarks.

ArcelorMittal expects global apparent steel consumption to grow from 2.0 percent to 3.0 percent in 2018.