Prices

October 25, 2018

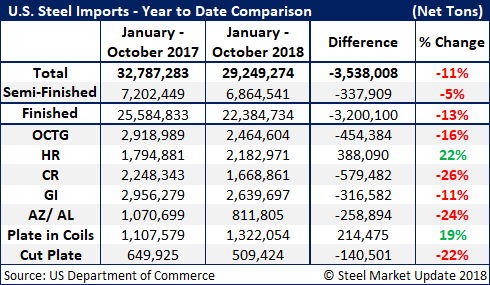

Steel Imports Down 11 Percent for the Year

Written by Tim Triplett

As expected in a market where foreign suppliers must pay a 25 percent tariff (50 percent for those in Turkey), steel imports into the United States are down 11 percent for the year to date. Unexpected were the increases in imports of hot rolled sheet and plate.

Steel Market Update’s analysis of Commerce Department data (see chart) shows the U.S. has imported an estimated 29.2 million tons of steel for the year to date, down 11 percent from the 32.8 million tons imported in the first 10 months of 2017. That includes a 13 percent decline in finished steel imports and a 5 percent decline in semi-finished.

Foreign semi-finished products, including slabs, blooms and billets ordered by domestic mills, amounted to nearly 6.9 million tons or 23.5 percent of the total, up slightly from about 22.0 percent last year. With less foreign steel contributing to the supply in the U.S., domestic steelmakers have increased production, including the rolling of purchased slabs.

Imports of nearly all finished steel products have seen double-digit declines so far this year, including OCTG, cold rolled, galvanized, Galvalume and cut plate. The notable exceptions are hot rolled and plate in coils. HR imports are up 22 percent on the year, while coiled plate imports are up 19 percent.