Prices

October 25, 2018

HRC Futures Under Pressure: Will Prices Bounce or Break?

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

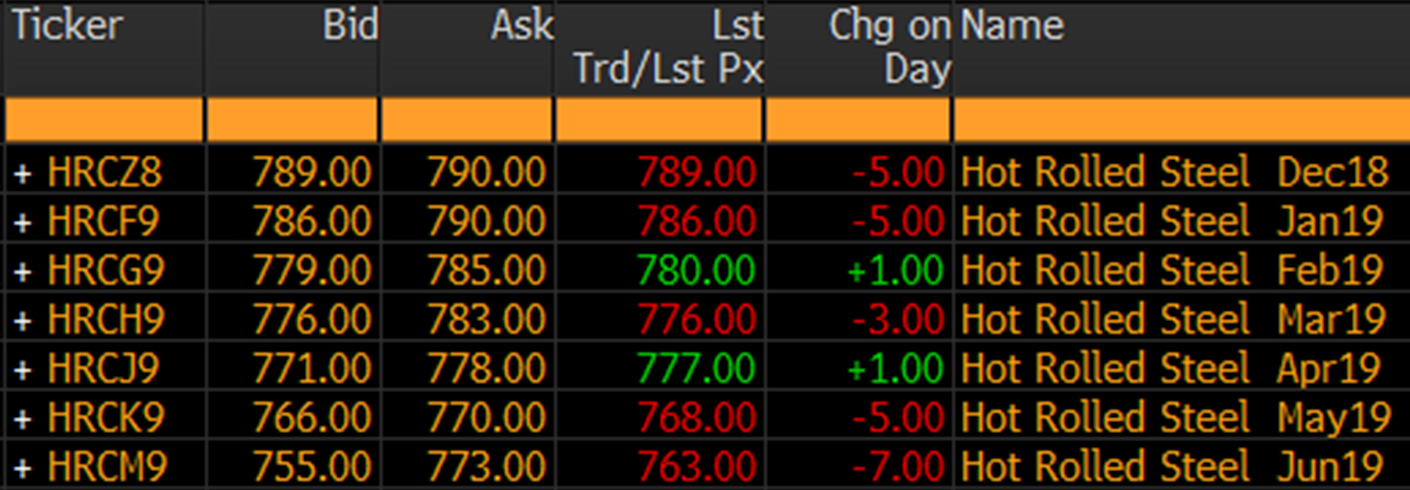

The CME Midwest HRC futures curve took a leg lower yesterday following the announcement of the weekly CRU Index with aggressive sellers sending buyers to the sidelines. Notice no bids!

There was more selling today with the curve falling $10 – $15 over the last two days.

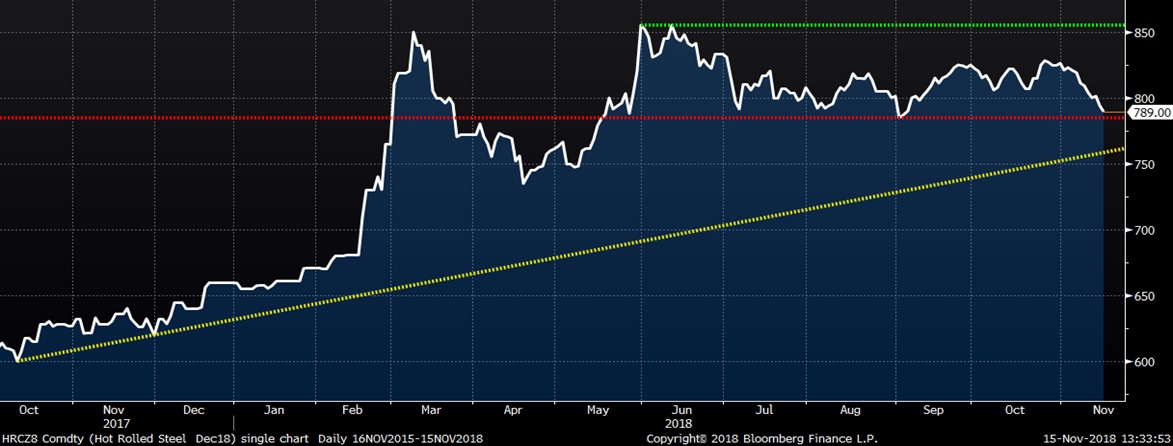

Today, the December HRC future traded $789, the lowest level since early September, but it still remains within the range of the past six months.

December CME Midwest HRC Future

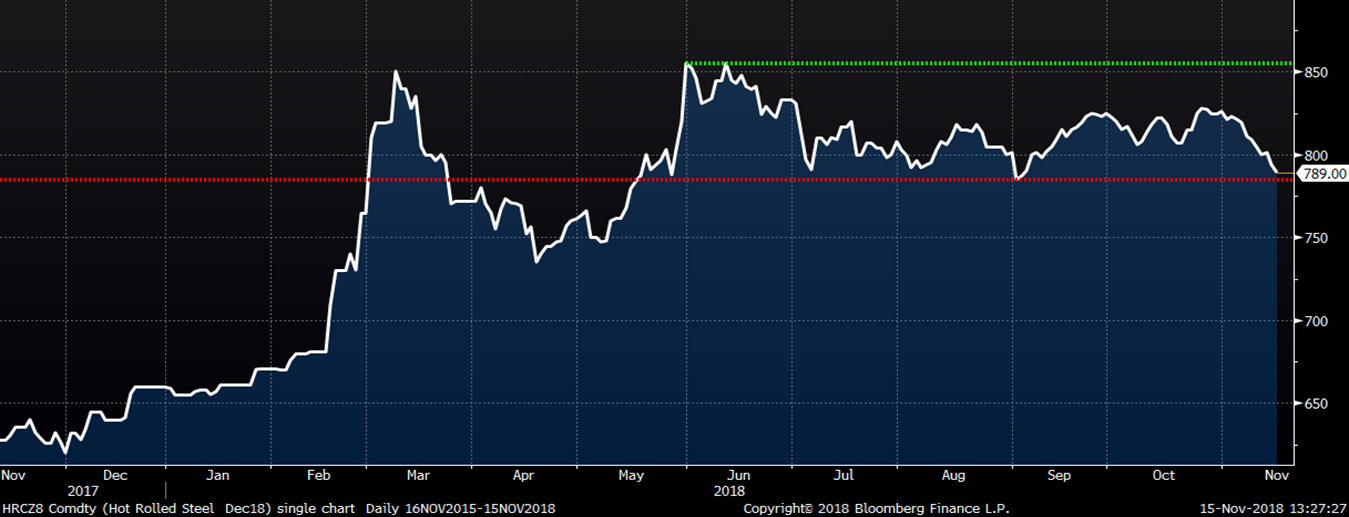

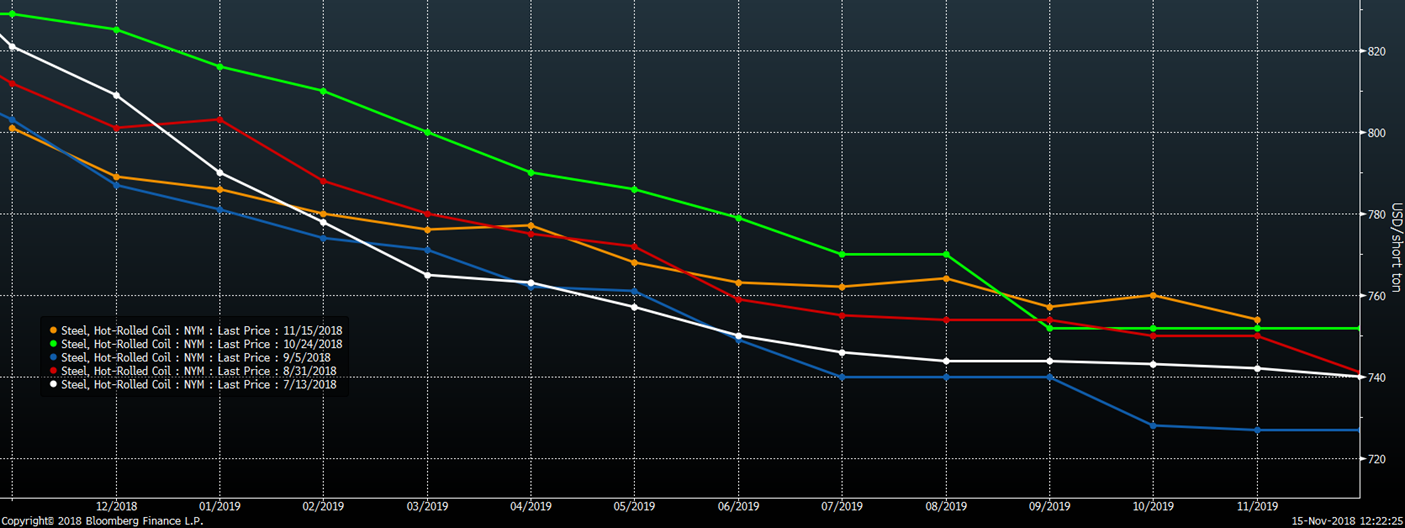

This chart shows the HRC curve’s last trades at midday today (orange) and at settlement for the past four Thursdays. Over the past four weeks, the curve has flattened, while the front of the curve has fallen to its lowest level in that time.

CME Midwest HRC Futures Curve

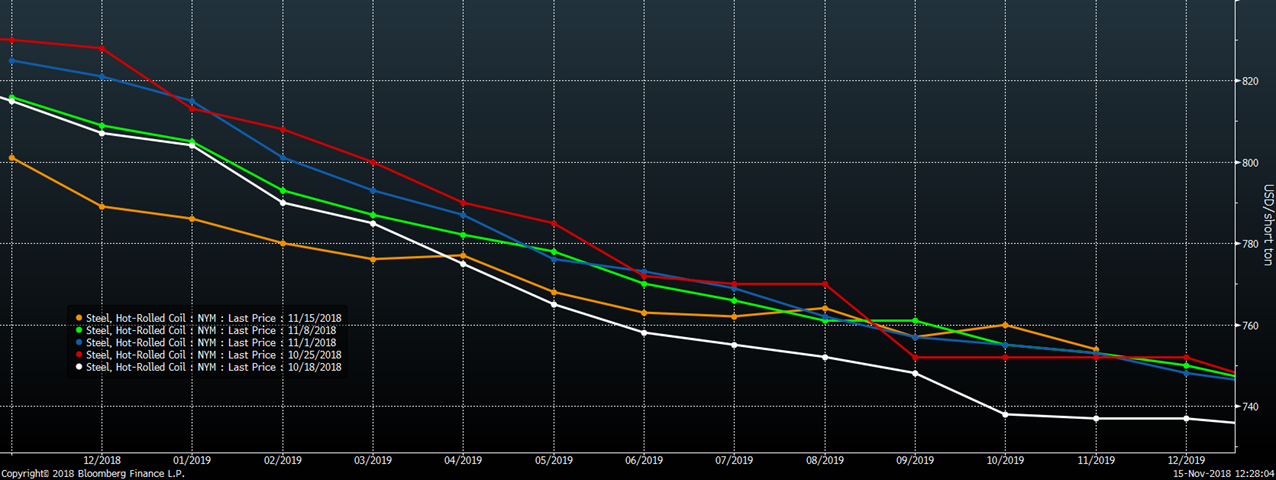

The curve mostly remains within the range of the past five and a half months with the Sept. 5 curve (blue) holding the bottom of the range. However, if the curve falls much further, it will break below the bottom of the range.

CME Midwest HRC Futures Curve

The December HRC future has maintained its uptrend. If it breaks below the low point of the range at $785, then the next level of support looks to be around $760.

December CME Midwest HRC Future

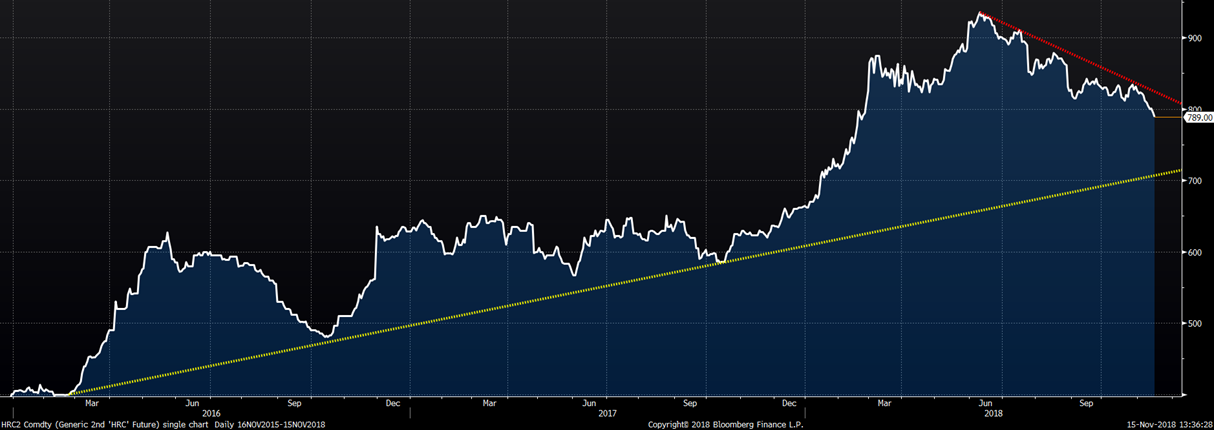

The rolling 2nd month HRC future has also maintained its uptrend from the 2016 low, but is trading at its lowest level since March and is clearly in a six-month downtrend since it peaked at $935 on June 11. The next level of support looks to be near the $710 – $720 area.

Rolling 2nd Month CME Midwest HRC Future

The price of Chinese spot HRC has fallen dramatically in the last 30 days and has erased $117 or 17 percent from its high of $675/mt on June 14.

China Domestic HRC Spot Average Price

Chinese HRC futures have also been under serious pressure with the January 2019 future falling over $100 since mid-August to $520/mt.

January Shanghai Futures Exchange HRC Future

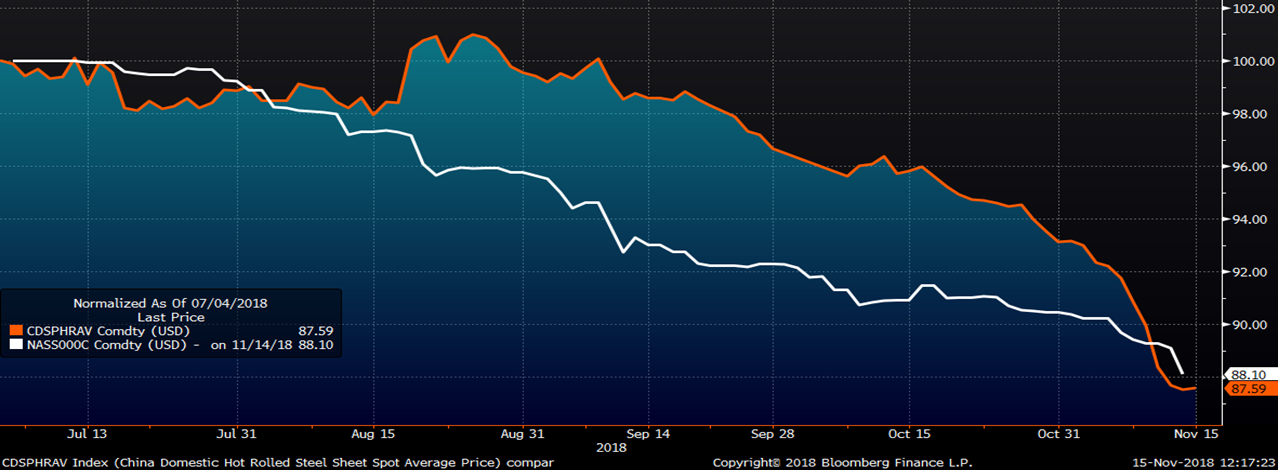

This chart normalizes the Chinese spot and Platts TSI Midwest HRC prices to show their performance in percentage terms since July 3 with both down around 12 percent.

China Domestic HRC Spot Price (orange) & Platts TSI Daily Midwest HRC Index (white)

While these are concerning developments for those long steel, the rally and uptrend is still intact. However, the 26 percent drop in WTI crude oil in six weeks from $76.24/bbl to $56.25/bbl is shocking!

December CME WTI Crude Oil Future

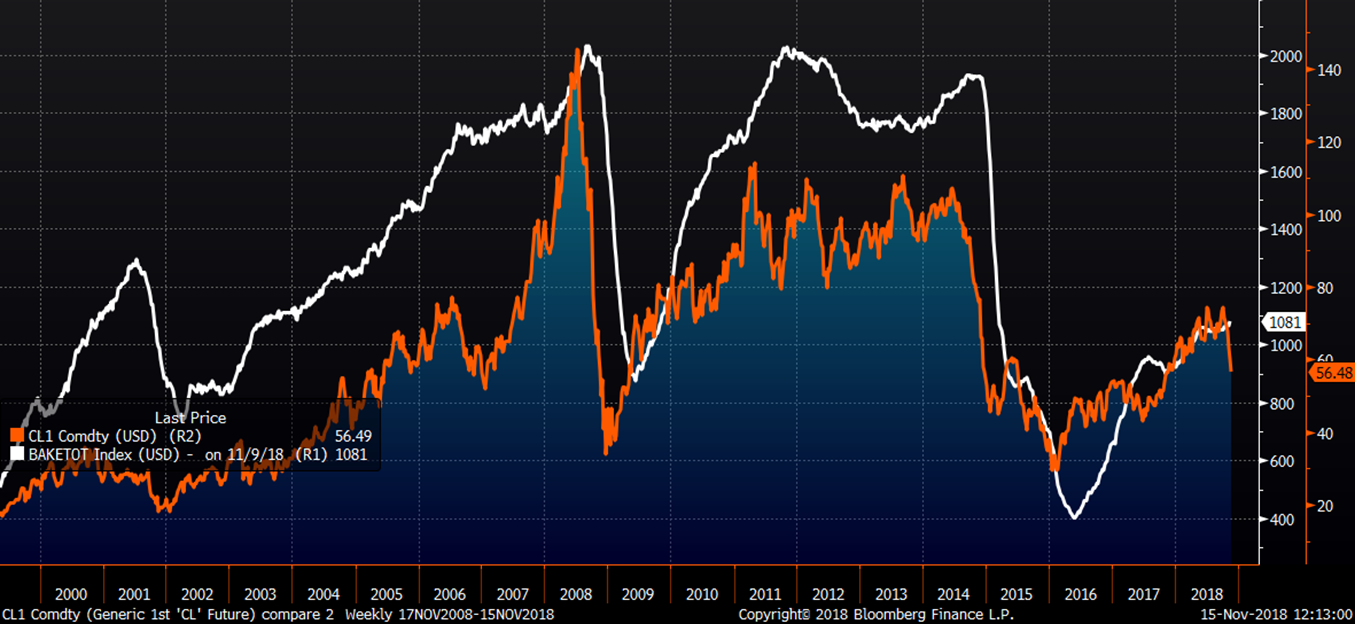

This chart compares WTI crude oil with the Baker Hughes U.S. Rig Count, clearly showing the price of crude oil leads the rig count. This collapse in the price of crude oil predicts a sharp drop in rigs in the coming months. It will be a major negative to 2019 flat rolled and tube demand if the energy sector turns from a positive growth engine to a negative one as it did in 2015.

Front Month CME WTI Crude Oil Future (orange) & Baker Hughes U.S. Rig Count (white)

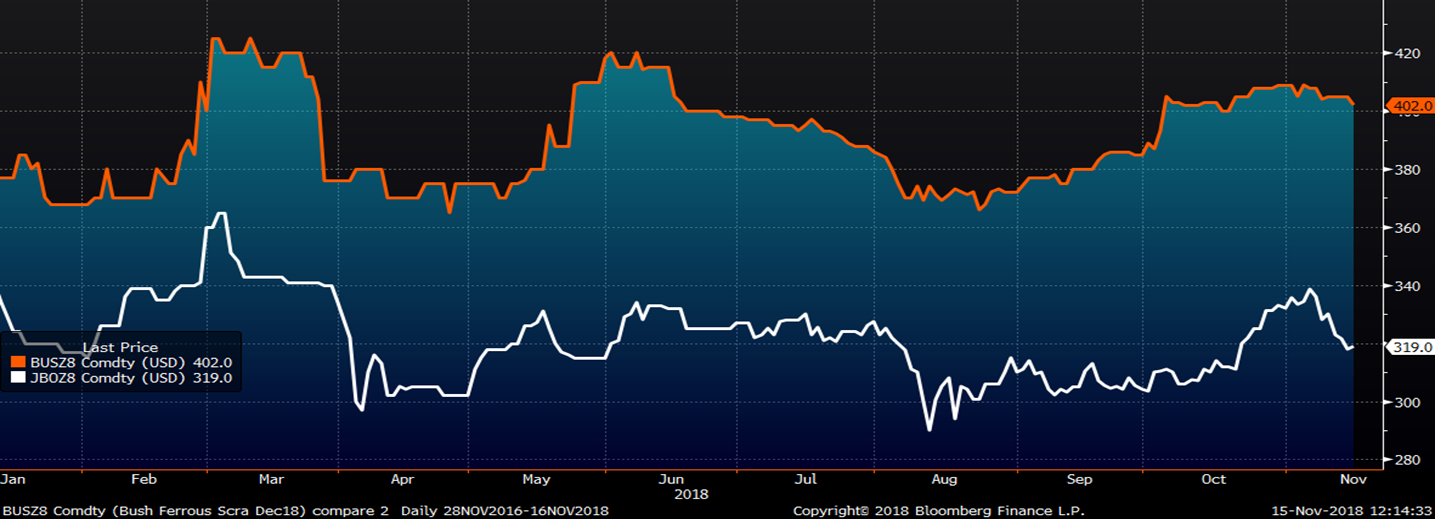

Oil and scrap prices are well correlated. Turkish scrap futures have fallen $19.50 or 5.7 percent since Nov. 5, while busheling hasn’t moved much yet. Between the move in oil, the U.S. dollar, mortgage rates and interest rates rallying higher, other metals such as zinc, copper and aluminum falling sharply, U.S. construction data weakening and the ISM Manufacturing PMI trending lower, FGM has been taking an extremely cautious approach to steel price risk. Especially with mill capacity utilization above 81 percent and increased flat rolled supply coming online and set to come online in 2019.

Dec. CME Busheling Future (orange) & Dec. LME Turkish Scrap Future (white)

Iron ore continues to attempt to rally after breaking through its long-term downtrend. The SGX 2nd month iron ore future rallied to $75 before falling back to $71. The future then staged another rally to $73, but the latest rally failed again trading back down to close today at $71.37.

SGX 2nd Month Rolling Iron Ore Future

HRC futures could see a big bounce or break in the coming days with a swath of data coming out. Today, the November Empire Manufacturing Index rose slightly to 23.3 from 21.1, while the November Philadelphia Fed Business Outlook fell to 12.9 from 22.2. Tomorrow, the October MSCI flat rolled shipment and inventory data is announced. Next Monday, October housing starts and building permits are released.