Prices

October 23, 2018

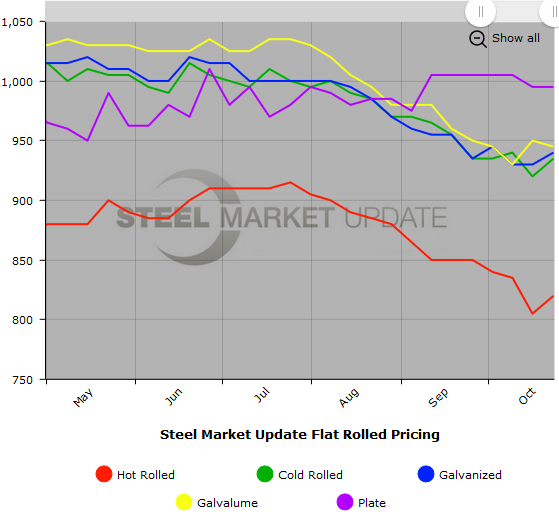

SMU Price Ranges & Indices: Flat Roll Moves Up

Written by Brett Linton

Flat rolled steel buyers are advising Steel Market Update that lead times have extended about one week since the recent price announcements. The mills continue to ask about their competition and to negotiate, which is not a sure-fire sign of strength or conviction in the new increases. Plate is a different animal and continues to be on controlled order entry. Plate buyers are telling SMU that the January numbers (December spot is referenced below) will be close to $1,000 per ton delivered as the new bottom.

The steel prices referenced below are based on data we received from both steel mills and steel buyers during the course of the day today (Tuesday, Oct. 23, 2018).

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $800-$840 per ton ($40.00/cwt-$42.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. The lower end of our range rose $40 per ton compared to one week ago, while the upper end fell $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on hot rolled steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $900-$970 per ton ($45.00/cwt-$48.50/cwt) with an average of $935 per ton ($46.75/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to last week, while the upper end increased $10 per ton. Our overall average is up $15 per ton compared to one week ago. Our price momentum on cold rolled steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $46.00/cwt-$48.00/cwt ($920-$960 per ton) with an average of $47.00/cwt ($940 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $10 per ton compared to last week. Our price momentum on galvanized steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU price range is $998-$1,038 per net ton with an average of $1,018 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU base price range is $46.50/cwt-$48.00/cwt ($930-$960 per ton) with an average of $47.25/cwt ($945 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end fell $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on Galvalume steel is Neutral meaning we expect prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,221-$1,251 per net ton with an average of $1,236 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-10 weeks

Plate: SMU price range is $960-$1,030 per ton ($48.00/cwt-$51.50/cwt) with an average of $995 per ton ($49.75/cwt) FOB delivered to the customer’s facility. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is Neutral meaning we expect stable prices once the mills open their December order books. The domestic plate mills continue to be on controlled order entry as their order books are strong with limited spot plate tonnage available.

Plate Lead Times: 6-10 weeks, allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.