Prices

October 12, 2018

SMU Imports Report: Great Lakes Leads in HDG Sheet

Written by Peter Wright

The Great Lakes region has received the greatest volume of hot-dipped galvanized sheet imports so far in 2018.

Each month, Steel Market Update produces an import analysis by region for two of the six flat rolled product groups (HRC, CRC, HDG, OMC, CTL plate and coiled plate). This month, the focus is on coated products. The intent of these regional updates is to bridge the gap between the monthly license data summaries and the detailed monthly reports for premium subscribers on import volume by port and source.

![]() Year to date through August, the region receiving the most HDG sheet was the Great Lakes with 37 percent of the total. This was also the only region to experience a year-to-date increase in volume compared to 2017. The Gulf was in second place with 27 percent and the North Atlantic third with 14 percent. The tonnage into the North Pacific and across the Rio Grande was minimal (Figure 1).

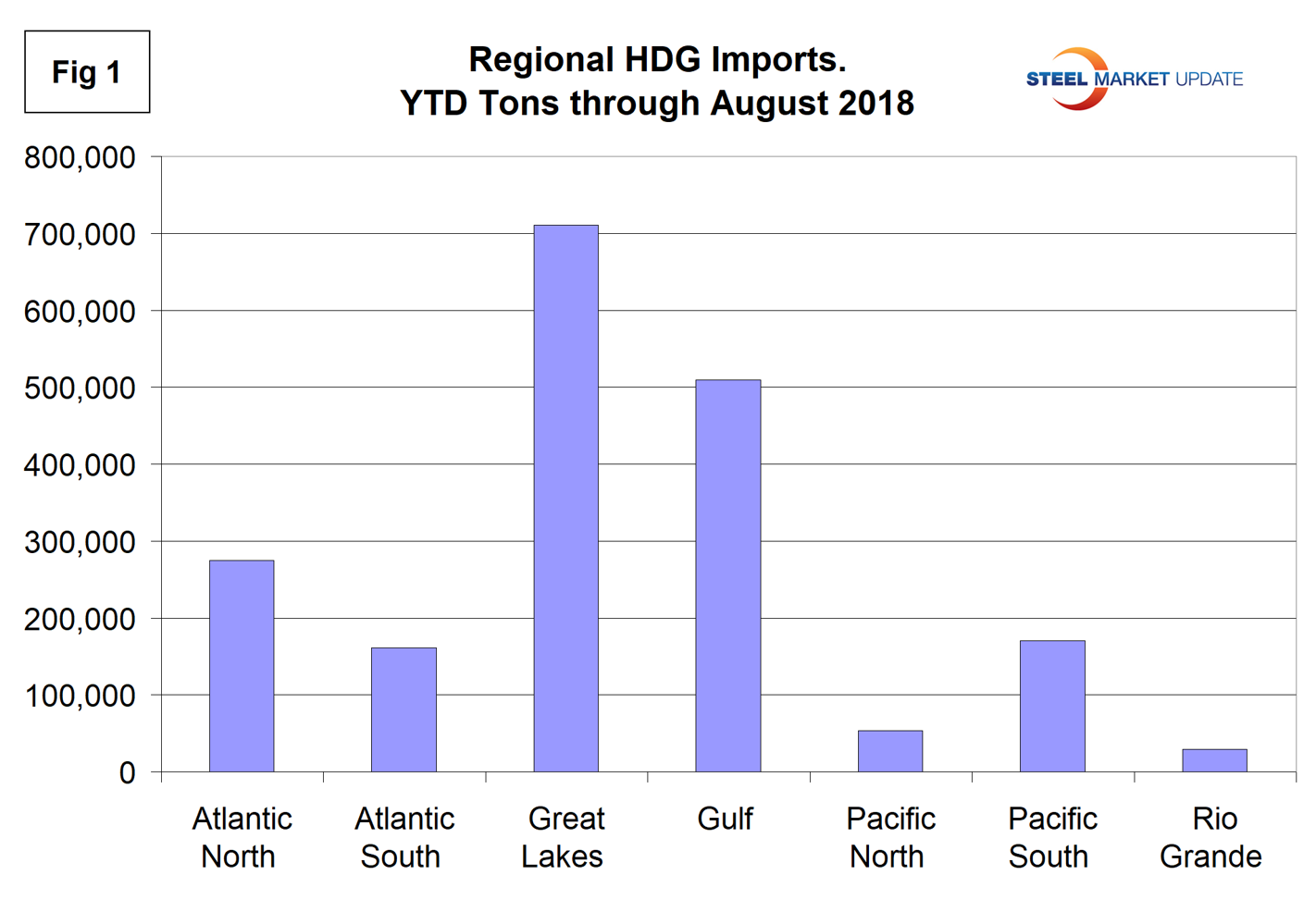

Year to date through August, the region receiving the most HDG sheet was the Great Lakes with 37 percent of the total. This was also the only region to experience a year-to-date increase in volume compared to 2017. The Gulf was in second place with 27 percent and the North Atlantic third with 14 percent. The tonnage into the North Pacific and across the Rio Grande was minimal (Figure 1).

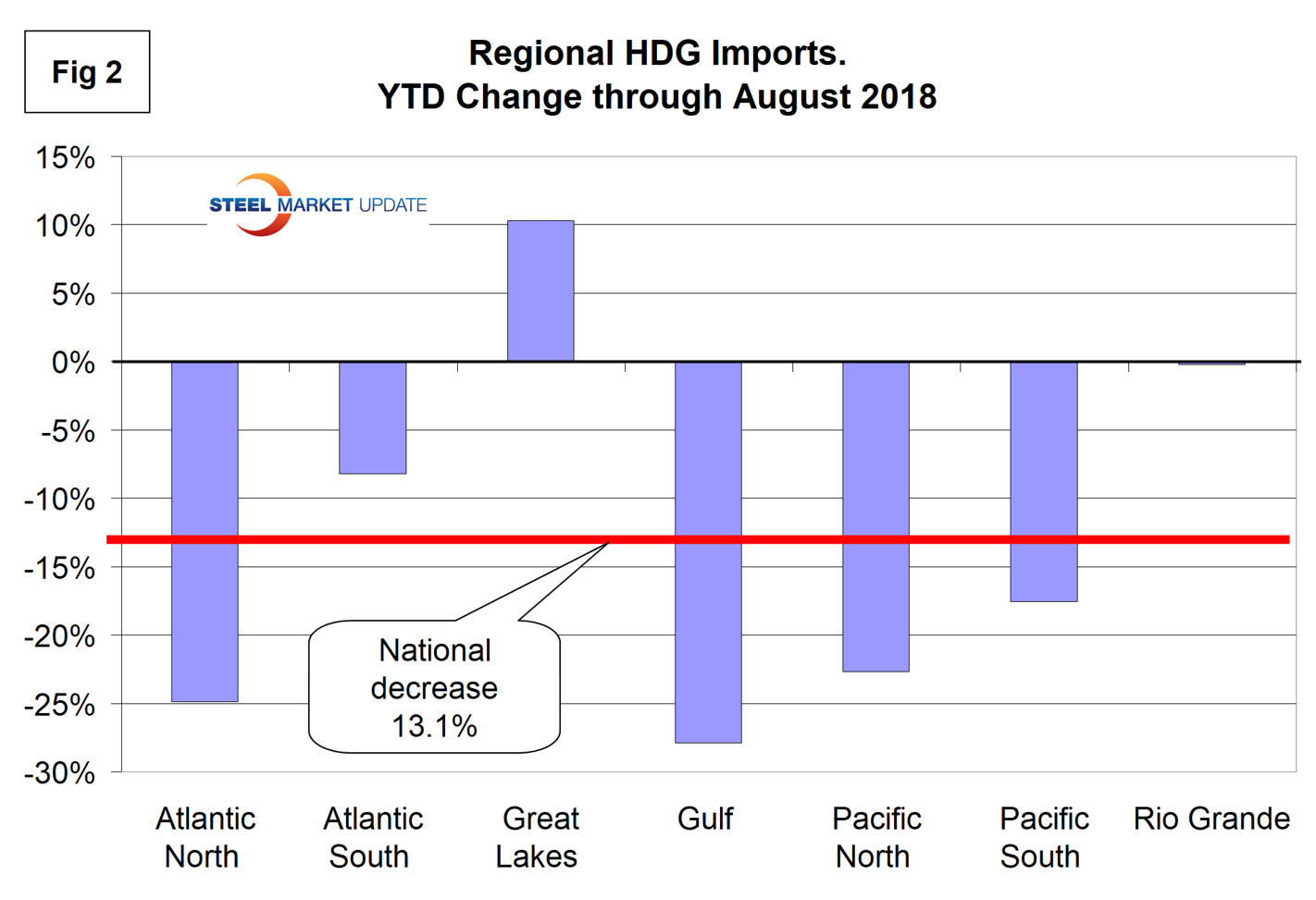

Imports into the U.S. as a whole were down by 13.1 percent compared to 2017, but the Great Lakes were up by 10.3 percent. The Gulf saw the greatest decline at 27.9 percent followed by the Atlantic North, down by 24.9 percent, and the Pacific North, down by 22.7 percent. Figure 2 shows the percent change by region in 2018 compared to 2017.

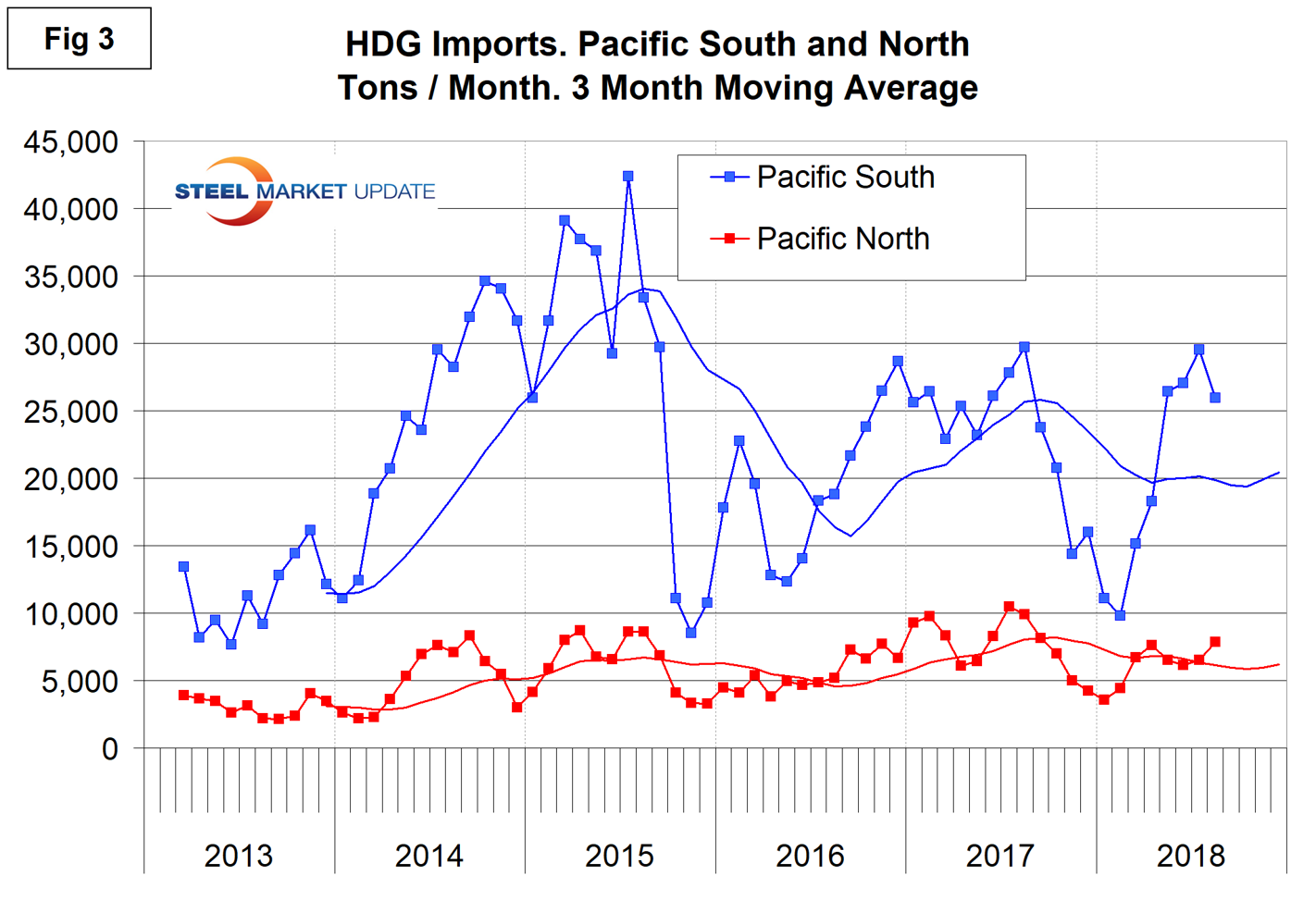

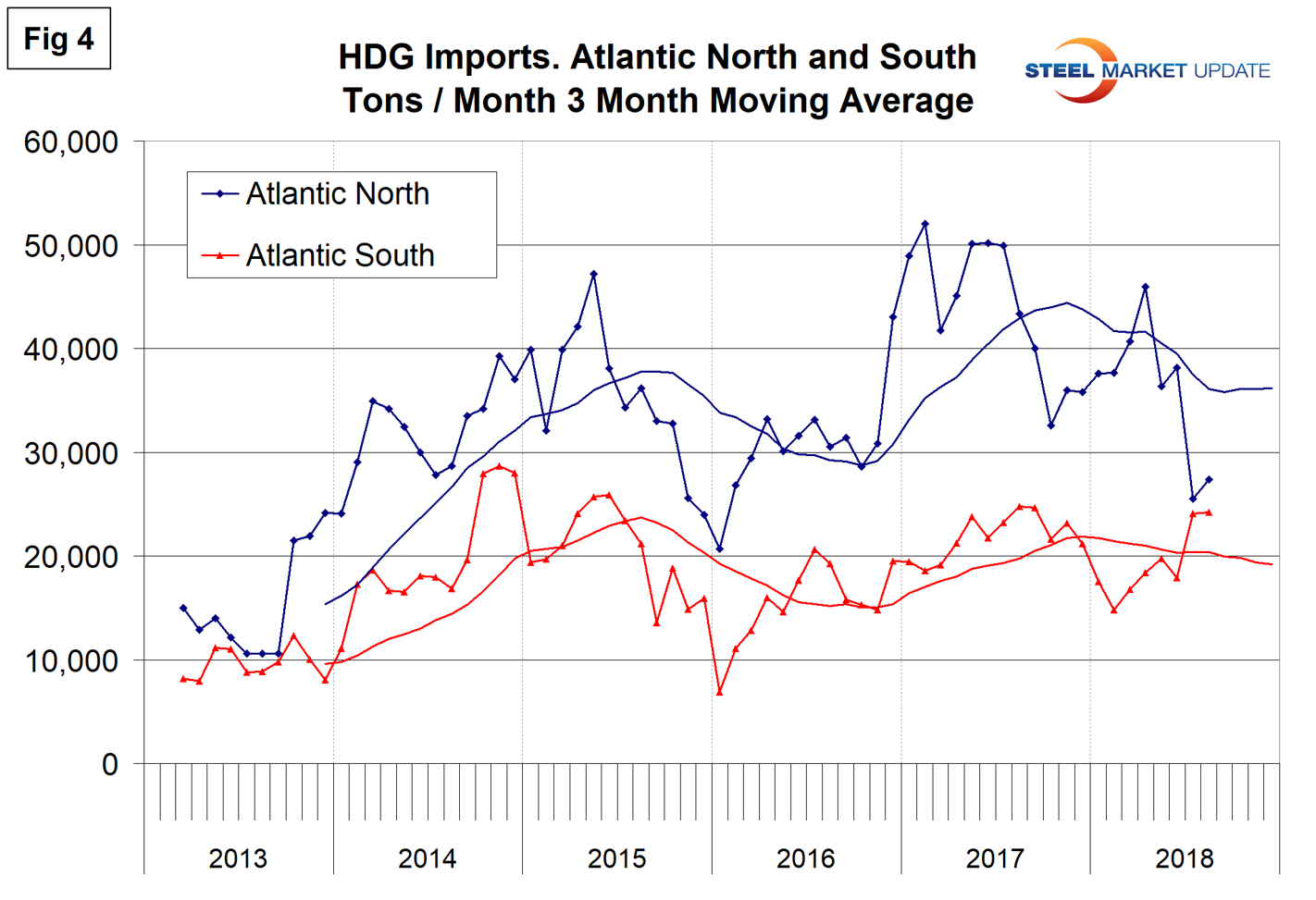

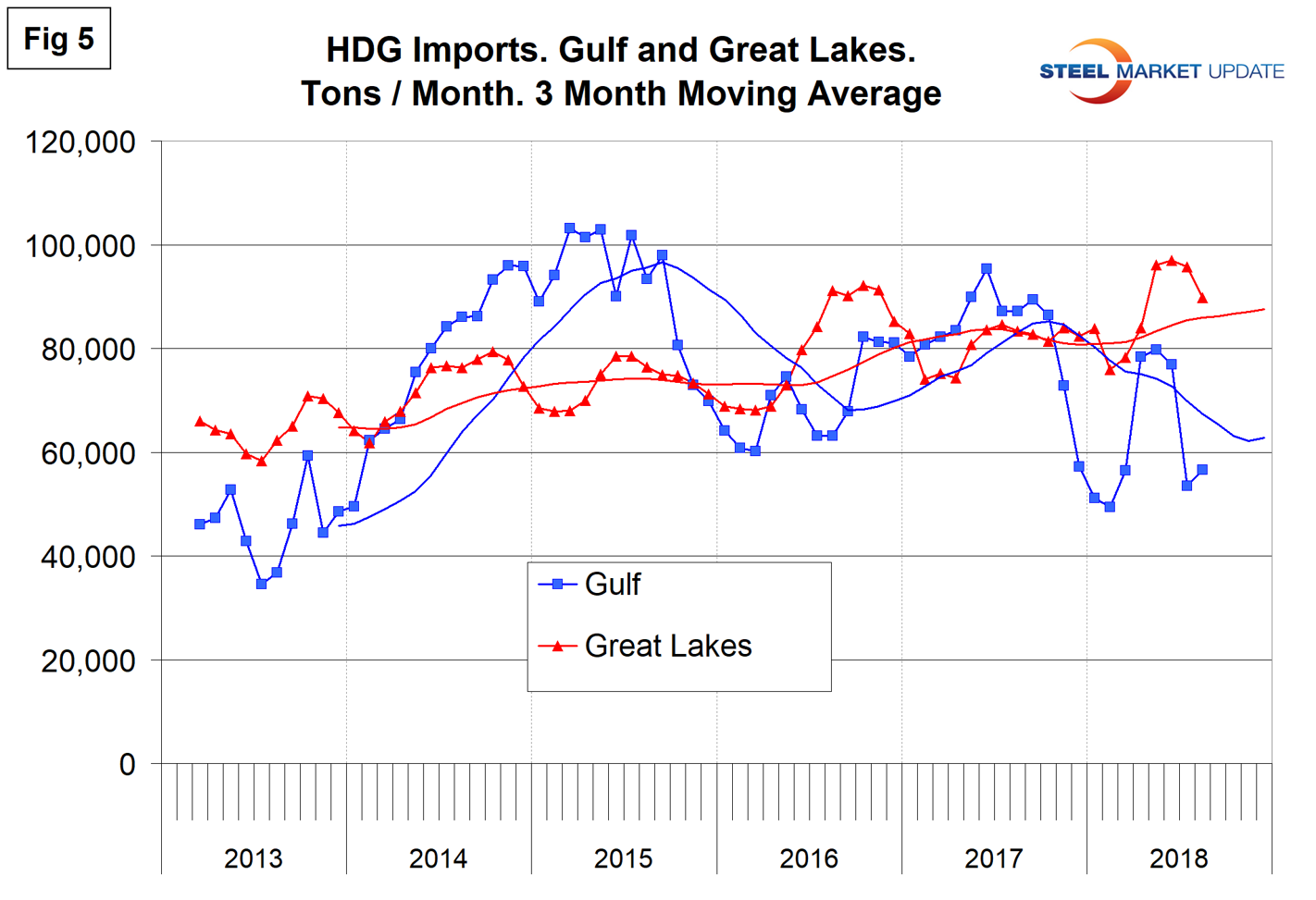

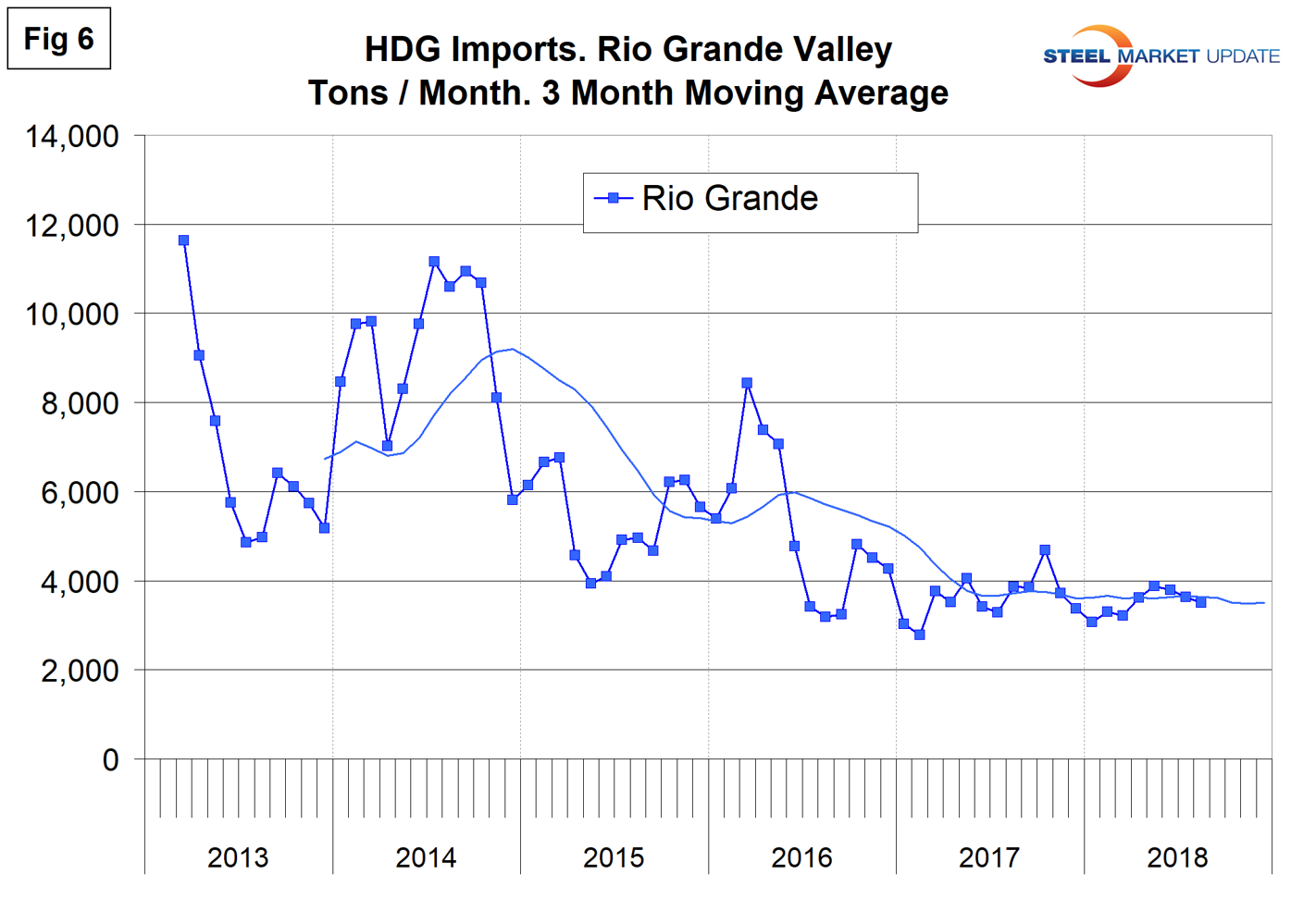

Figures 3, 4, 5 and 6 show the history of HDG imports by region since March 2013 on a three-month moving average basis.

Imports through the Pacific South ports of San Diego and LA increased strongly from February through July of this year before declining in August. Volumes into the Pacific North ports of San Francisco, Columbia Snake and Seattle have been much lower and more consistent throughout the time frame of this study.

HDG sheet imports into the North Atlantic ports have been decreasing this year as the South Atlantic has been increasing to the point that volumes are now similar.

Import volume into the Gulf had a peak in April, May and June this year before declining in July and August to the level experienced in the first quarter. Imports into the Great Lakes have been trending up this year.

Tonnage out of Mexico, mostly through Laredo, has been trending down for four years.

Premium subscribers have access to detailed reports by district and source nation on SMU’s website. These reports show, for example, that the port of Houston has seen a 25 percent volume decrease of HDG this year and that Vietnam supplied by far the most tonnage, followed by Russia.

Sources: Information in this report has been compiled from tariff and trade data from the U.S. Department of Commerce and the U.S. International Trade Commission.