Prices

October 11, 2018

Futures: Mills' Mid-Week HR Spot Price Increases Lead to HR Futures Trading Pause

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

The mid-week spot price increase announcement by mills to $860/ST has curbed activity in the futures as participants try to digest the medium-term implications. Some in the markets think that inventories might be on the thinner side, which could create some upward price pressure if there is a rush to rebuild. The medium-term HR spot price mean reversion could be temporarily on hold with the latest news should prices stick. Current futures interests suggest lack of conviction in terms of market direction.

In addition, HR futures trading was slow this past week as it also coincided with LME Week in London, but volume month to date was still healthy as over 76,000 ST traded. The bulk of the HR futures trading was in Nov’18-Mar’19 with a couple of days trading over 20,000 ST.

Front month HR future is $830 bid. Spot prices shed another $5/ST this week as per the HR indexes to suggest spot prices are trading around $835/ST. The backwardation in the futures curve shape and slope is a little changed from the beginning of the month with Nov’18 through Feb’19 up roughly $3 to $4/ST. Currently, Q1’19 HR is trading at a $34/ST discount to Q4’18 HR, a touch wider than at the beginning of the month, and the Q2’19 HR is trading at a $22/ST discount to Q1’19 HR, also a few dollars wider. The latter portion of the curve is basically unchanged.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

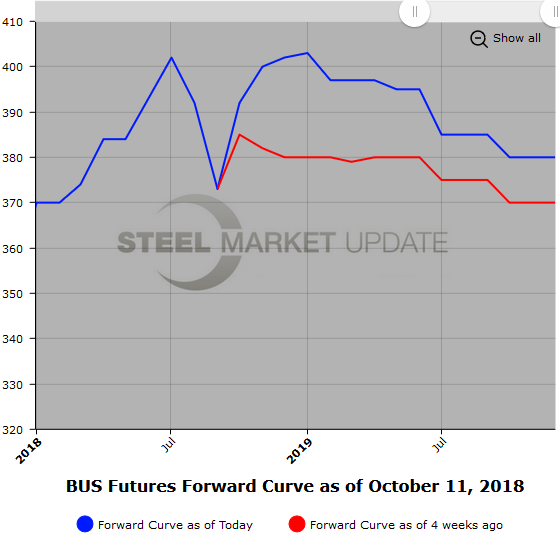

Prime scrap recovered the Sep’18 price drop from Aug’18 of roughly $20/GT with Oct’18 settling back at $392/GT. Nov’18 and Dec’18 bids are coming in above latest settlement at $395/GT and $400/GT for decent volume. Nov’18 through Sep’19 BUS market is $391/$402 per GT.

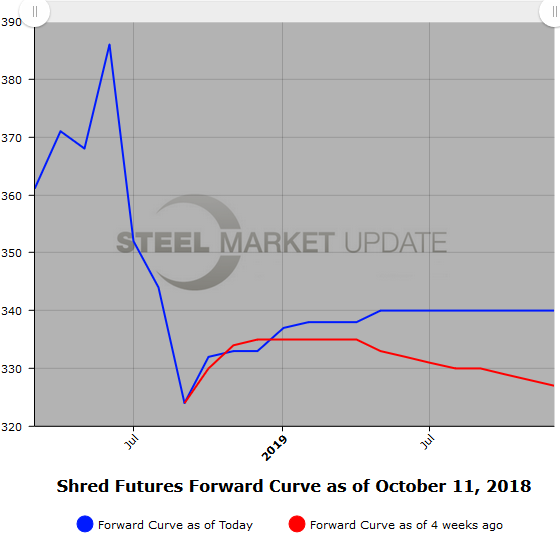

Shred (USSQ) retraced $10/GT off the price drop from Aug’18 to Sep’18 USSQ to settle at $331/GT for Oct’18. Current Nov’18, Dec’18 and Q1’19 USSQ buying interests are at $330/GT with offers $10/GT higher.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.