Government/Policy

October 9, 2018

CSI, NLMK, Evraz Challenge Exclusion Objections

Written by Sandy Williams

California Steel Industries, NLMK and Evraz have filed rebuttals to objections made by U.S. Steel, Nucor and AK Steel to their petitions requesting exclusions for steel slab imports necessary for production. The slab converters charge that domestic mills have misled Commerce in their objections, overstating the current availability of domestic slab and the capacity to produce it.

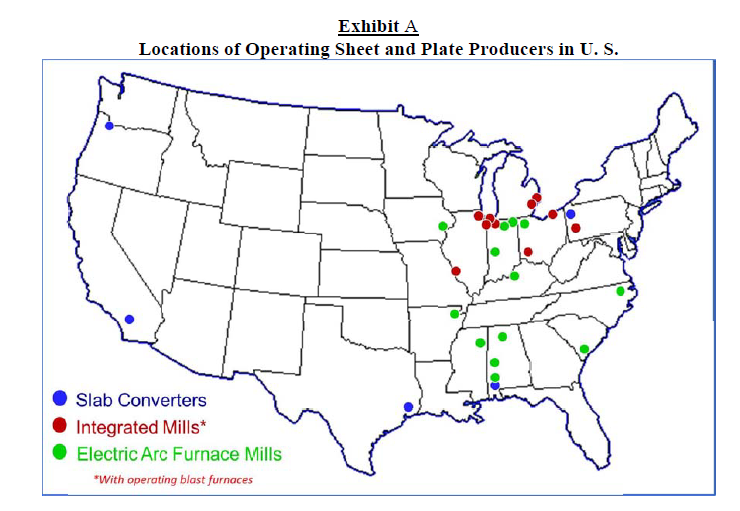

In its reply to the objection filed by Nucor, CSI said it is well documented there is a lack of commercial supply in the U.S., which was exacerbated by shutdowns of integrated mills. The domestic steel industry dropped from 35 operating integrated mills in the early 1980s to just three integrated domestic steel companies with a combined total of 10 blast furnace mills. The reduction in integrated mills was due largely to competition from low-cost minimills like Nucor, said CSI.

CSI refutes the claim that the domestic steel industry has the current capacity to produce 77.2 million tons of steel slab. To arrive at the 77.2 million ton mark, Nucor’s strip minimills would have to be included, which do not make discrete slabs that can be taken off the rolling mill line and sold to a slab converter, said CSI. Nucor admits it does not sell slab for this reason.

“In 2017, integrated slab casting capacity in the U.S. was 34.6 million metric tons, while U.S. rolling mill capacity was 48.5 million metric tons–so, if those mills had a good business opportunity to roll more steel, they would have to import slabs, as they have in the past. AK Steel in 2014 imported 460,000 tons of slabs. Both U.S. Steel and Nucor have also imported slabs over the past two years,” said CSI.

CSI said it has tried to buy domestic slabs, but its only supplier is U.S. Steel, which has limited availability. CSI recently secured a contract with U.S. Steel that will fulfill 8-12 percent of CSI’s current annual slab requirement for 2018. Numerous attempts to buy slab from ArcelorMittal were unsuccessful, and AK Steel has never offered slabs for sale to CSI despite claiming it has the capacity to produce the product. Any “excess” slab-making capacity would be used within AK Steel’s own rolling mills.

Attempts to buy from Brazil, which does supply slabs, have been frustrated by the Section 232 quotas in place that cut off sales in early September. CSI’s other suppliers from Mexico and Japan are subject to 25 percent tariffs on their steel imports.

NLMK has had similar difficulties trying to secure slabs domestically, even losing orders after U.S. Steel ignored requests for slabs for second-quarter 2018. Wrote NLMK in its rebuttal of objections by U.S. Steel, “NLMK’s real-world experience is that U.S. Steel’s interests lie in supplying its internal demand for slabs, and it is a demonstrably unreliable supplier to companies like NLMK USA, with which it competes. Other domestic mills similarly are focused on supplying their own operations, not those of competitors.”

The objecting domestic mills have claimed that granting exclusions for slabs would open the possibility of widespread circumvention. NLMK tailored its exclusion request to potential market needs and domestic supply shortfalls. It uses all of the steel slabs it acquires and does not sell them to other producers, said the company in its rebuttal.

Nucor filed an objection to Evraz’s request to import heavy slab for the production of steel plate and pipe at its mill in Portland, Ore. In its rebuttal, Evraz noted that Nucor only produces slabs up to 5.3 inches thick, less than the 6 inches or more that Evraz requires.

Evraz is a supplier of armor plate to the Defense Department, as well as a steel supplier for wind towers, railcars and marine vessels. The company employs over 300 people at Oregon Steel.

“Nucor argues that Evraz should be forced to reduce or eliminate its production of downstream steel mill products – cut-to-length plate and HR coil – so that those products can instead be made in Nucor’s facilities,” said Evraz in its rebuttal.

“Denying the exclusion request on this basis would result in reducing the volume of steel plate, HR coil, and pipe produced in the United States. Evraz operations that convert imported slab to HR coil and plate, as well as the employees that perform these operations, would be idled. Nucor’s proposal would result in a net loss in U.S. output and employment, and would impair U.S. investment. This result is contrary to the entire purpose of Section 232 to preserve U.S. producers that supply key Defense Department and energy sector requirements.”

Evraz and CSI also noted that geographic considerations support the need for imported steel. There are no slab producers on the West Coast as illustrated in the exhibit below.

As of Oct. 1, U.S. Customs and Border Protection reports that over $2.3 billion is owed by importers of steel and $600 million by importers of aluminum due to the Section 232 tariffs. A New York Times analysis in August reported that exclusion requests by steel users were denied in every instance when an objection was filed by domestic steel producers Nucor, U.S. Steel or AK Steel.