Market Data

October 7, 2018

SMU Market Trends: Have Steel Prices Found the Bottom?

Written by Tim Triplett

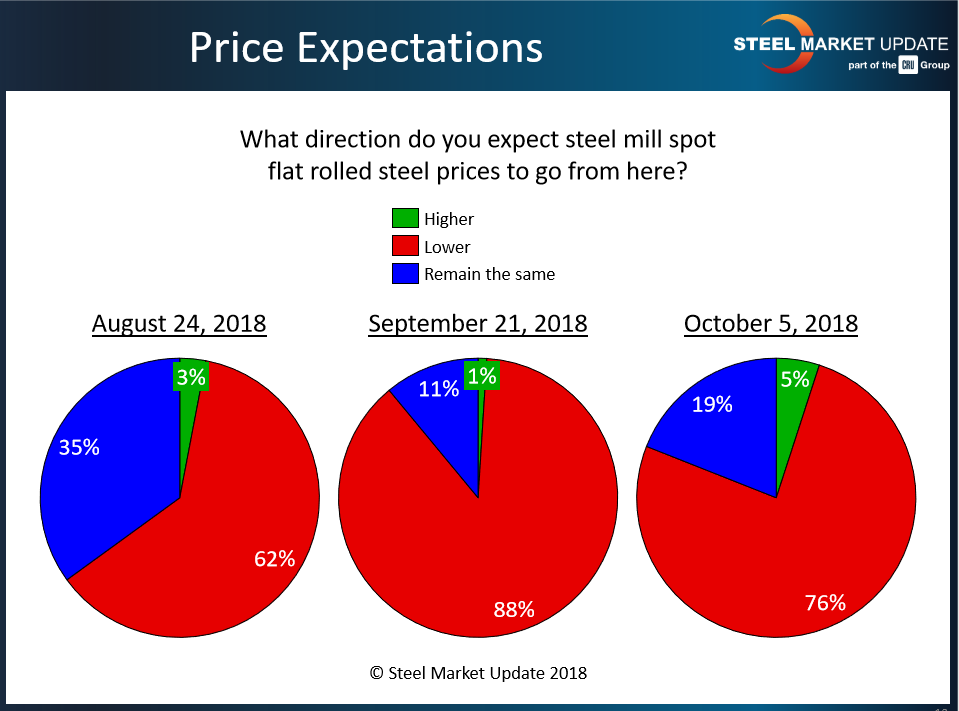

Twice as many of the respondents to Steel Market Update’s latest market trends questionnaire expect flat rolled steel prices to remain the same or move higher. About 24 percent feel the downward price trend has bottomed, compared with 12 percent in last month’s returns. Steel Market Update’s current Price Momentum Indicator is pointing toward lower steel prices. There are questions as to whether the “new normal” of having benchmark hot rolled at or above $800 per ton will hold. Earlier this week, as we collected data on pricing, we did capture some numbers under the $800 bottom that had been holding for some time. There is a question in our mind about how we should handle a mill like JSW Ohio when it comes to indexing prices? Once they bring up their electric arc furnace sometime in the next two months and begin regular production (which is not guaranteed to happen at the same time; this furnace has been down for a while), we will then include them as a legitimate steel mill competitor in the market.

The predominant expectation in the marketplace, based on our analysis of manufacturing company and service center steel buyers, is for flat rolled prices to moderate further. By far the largest group of respondents, 76 percent, still expect steel prices to move lower. Corroborating that data, about 68 percent say they are reducing inventories in anticipation of lower spot prices over the next few months.

This sampling of respondents’ comments shows mixed predictions:

• “Spot prices will keep trending lower, but the bottom is near. In a few weeks, they will bottom out. Already domestics are making imports noncompetitive and domestic mills will fill up.”

• “Prices will move lower. There’s the same amount of people chasing increased tons.”

• “We are seeing pricing on the downswing by $1 to $2.”

• “We have locked up Q1 2019 pricing at lower numbers than we are currently paying in Q4. Whether it remains in a downward trend will depend a lot on the USW situation and if workers strike or not.”

• “Prices will move lower in the U.S. In Canada, if tariffs come off, I can see pricing go higher.”

• “We have recently purchased hot rolled coil with steel base of $40. We are currently receiving HRC quotations ranging from $41 to $43 with most of the steel mills. Opportunities to negotiate steel buys below $40/cwt base may get tougher with the expected October scrap buys up $10 to $20.”

• “There will be some deals done over the next couple weeks, but then I expect minimal deals and the mills to firm pricing and buyer panic to set in.”

• “Prices are lower, but not low enough.”

• “Prices will be flat for another month, then move higher.”