Prices

October 5, 2018

Upside Price Risk Mounts for Steel Industry as Buyers' Strike Extends into Third Month

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Chief Market Risk Officer, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

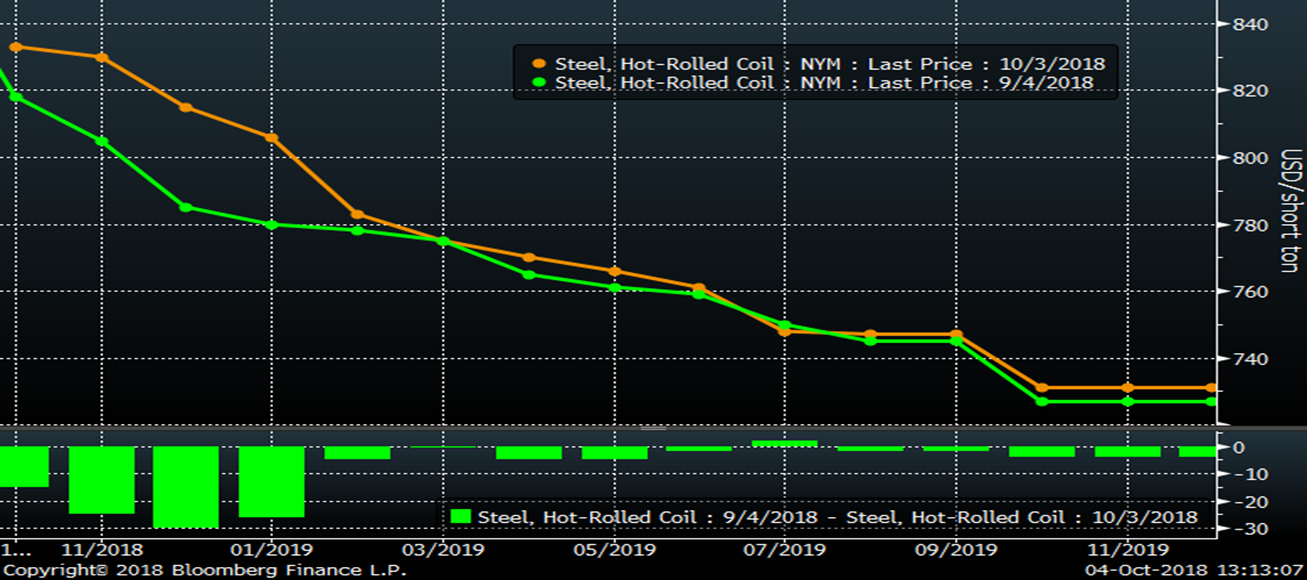

The CME Midwest HRC futures continue to be rangebound and steeply backwardated. The chart below shows the curve settlements on 10/3/18 and 9/4/18. November, December and January 2019 have gained $20-$30 in that time, continuing to reward those buying the front of the curve. There has been almost no change in futures prices starting in February 2019 onward.

CME Midwest HRC Futures Curve

Despite another month of consistently strong economic data (ISM PMIs, construction spending, auto sales, employment, GDP, etc.), the flat rolled market continues to be under pressure with anemic volumes in the spot market. NAFTA was resolved, but there was no change to the steel tariffs for Canada or Mexico. In fact, during President Trump’s Monday news conference regarding the USMCA, he reiterated tariffs will continue and that the goal is to protect the U.S. steel industry in the name of national security by using tariffs with the end goal of implementing quotas.

“So — and we need steel. We need steel for defense. What are we going to do? Go and say, “Oh, we’ll get our steel from an — like another country?” We can’t do that. Excuse me. We can’t do that. So we need steel and we need it badly for defense. So I’m very proud of what’s happened with the steel industry.”

“Just so you understand what was going to happen: They (China) were going to knock out every steel plant we had, and then they were going to double and triple the price and we couldn’t have done anything about it. It’s a very dangerous thing. And we’ve employed a lot of people. And billions of dollars is now flowing into our treasury.”

– President Trump, USMCA news conference 10/1/18

It’s perplexing to see falling prices and lead times for spot flat rolled when there has been no resolution or change in Section 232 tariffs/supply constraints and continued economic strength. The explanation for much of the weakness is likely due to a buyers’ strike that has lasted at least eight weeks. But why are buyers striking?

From a steel buyer’s perspective, the right strategy during this time has been to delay purchases as long as possible and buy as little as possible. For buyers that have been doing this, they have been rewarded week after week with lower prices and shorter lead times. However, there doesn’t seem to be the same weakness in demand in the manufacturing industry i.e. for finished products. As each week goes by, this strategy is rewarded, but the number of tons not bought are adding up and increasing risk across the industry.

This has become a very crowded trade!

RFQs in relatively larger size in both the physical and futures market have started to trickle in over the past week. A V-shaped recovery is likely to occur once a floor is reached. It is likely to occur when some massive orders are placed with domestic mills pushing lead times out and then being followed by compounded demand from both the sum of the tons not bought during the “strike” and lead times being pushed out simulatenously. I believe buyers who faced compressed margins earlier in the year are trying to make up for those “losses” and are playing a very risky hand. This is likely the catalyst that drives the next leg of this rally and defines the next group of significant winners and losers, with those first movers on physical purchases and those buying HRC futures being the winners.

Trying to figure when it happens is a fool’s errand, but it is clear that unless the economy and manufacturing industry are heading into a recession, the strength in demand will eventually overwhelm the weak hand of the “buyers’ strike.” Also, every day that goes by, (buy side) anxiety builds as buyers are accruing a growing number of tons to be purchased, thus increasing their upside price risk exposure.

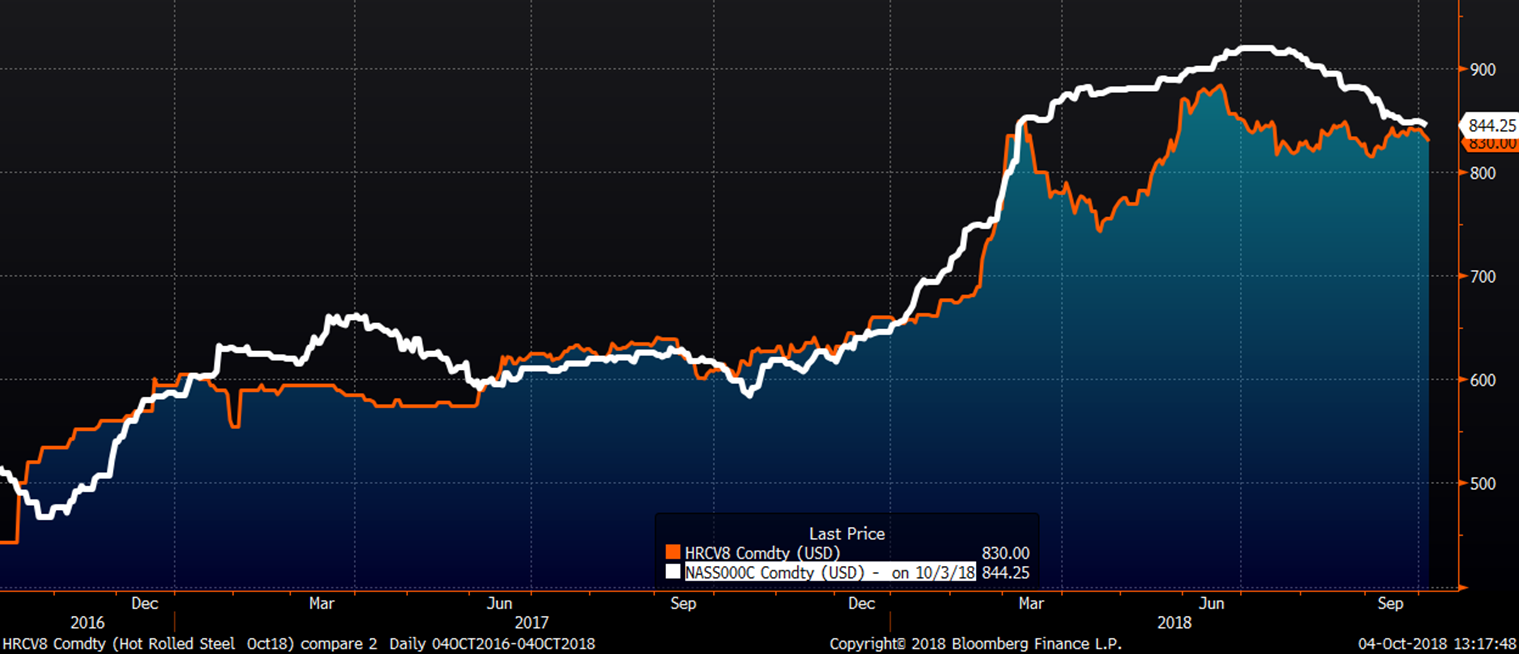

October CME Midwest HRC Future (orange) & Platts TSI Midwest HRC Index (white)

So, what are the trade opportunities in HRC futures for importers, mills, OEMs and service centers? The best trade continues to be in the favor of OEMs to buy the backwardation. This has worked all year and continues to be attractive, especially for those OEMs that can lock in margins on fixed sales for their products. As difficult of a year as it has been for OEMs and buyers in the spot market, it has been a phenomenal year for those OEM buyers that bought futures to hedge upside price risk.

The metal spread, i.e. buying scrap or iron ore and selling HRC, has decreased, but continues to be a very profitable trade for domestic mills at $425/st in Q4 and $380/st in Q1 2019.

As far as service centers and importers go, hedging downside inventory or carry trade (import) risk continues to be an uphill battle and not attractive due to the curve’s steep backwardation. The only move out there is to short the front of the curve and buy the back months with Q4 $40 and $60 above Q1 and Q2 2019, respectively.

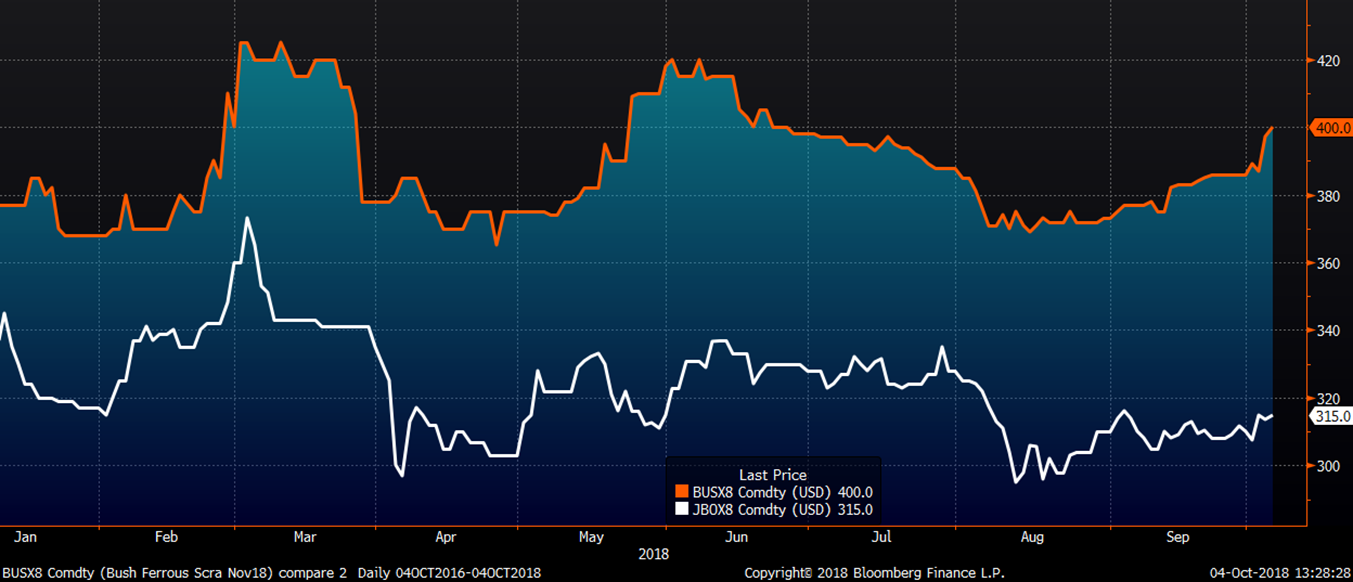

Scrap futures have rebounded since the Turkish financial market and currency scare in mid-August. The October Turkish Scrap future settled today at $326.50, recouping almost all of its losses, while the November future settled at $313. The November CME U.S. busheling future settled at $400 today, up $14 since Friday.

November Busheling (orange) & Turkish Scrap Futures

China is on holiday this week with iron ore futures barely trading. The 2nd month ore future continues to trade in a very tight range, moving higher toward the long-term down trend line.

2nd Month Iron Ore Future