Prices

September 27, 2018

August Preliminary Steel Imports Near 3 Million Tons

Written by John Packard

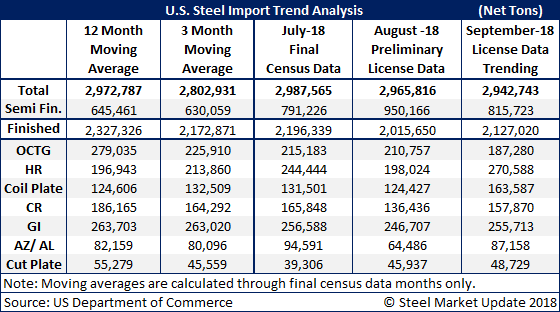

On Wednesday, the U.S. Department of Commerce released preliminary steel import license data for August and updated license data for September. The latest August figure has total imports at just under three million net tons, less than 1 percent lower than July levels. Compared to our monthly averages, August preliminary data is 6 percent less than the 3-month moving average (average of May, June, and July), and a hair below the 12-month moving average (average of August 2017-July 2018). September imports are trending at the same levels as August and July, right at or slightly below 3 million net tons.

Almost one-third of total August imports were of semi-finished products (primarily slabs), up 20 percent over July levels. After removing semi-finished products from the mix, we are left with just over 2 million tons of “finished imports” in August, lower than what was imported in July and also beneath the monthly averages. The September trend has slabs slightly lower than August and finished steel imports slightly higher on the back of hot rolled, which is 80,000 net tons higher in September than August.