Prices

September 18, 2018

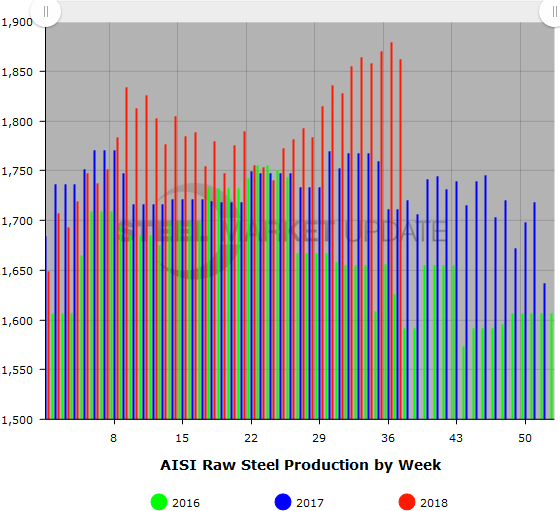

Weekly Raw Steel Production: Utilization Dips Back Below 80 Percent

Written by Brett Linton

U.S. raw steel production slipped by a slight 0.9 percent last week, nudging the mill capability utilization rate back below 80 percent once again. The American Iron and Steel Institute reported an average utilization rate for the week ending Sept. 15 of 79.4 percent, down from the 80.2 percent level in the prior week. But steel production remains near the 80 percent benchmark desired by the industry, and some flat rolled mills report operating rates in excess of 90 percent of their capacity.

Raw steel production for the Sept. 15 week totaled 1,862,000 net tons, up 8.8 percent from the 1,711,000 tons produced in the same period last year, when capacity utilization was at 73.4 percent.

Adjusted year-to-date producton through Sept. 15 totaled 66,738,000 net tons at a capability utilization rate of 77.4 percent, up 4.3 percent from the same period last year when the capability utilization was 74.4 percent.

Following is production by district for the Sept. 15 week: North East: 226,000 net tons; Great Lakes, 689,000 net tons; Midwest, 197,000 net tons; South, 674,000 net tons; and West, 76,000 net tons, for a total of 1,862,000.

Note, mill capability for third-quarter 2018 is approximately 30.8 million tons, compared to 30.6 million tons for the same period last year and 30.5 million tons for second-quarter 2018.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.