Prices

September 13, 2018

Flat Rolled Imports by District of Entry and Source Nation, August 2018

Written by Peter Wright

Steel Market Update is sharing the following Premium-level content on flat rolled imports with Executive-level members. For more information about upgrading to a Premium-level subscription, contact info@steelmarketupdate.com.

This analysis breaks down the imported tonnage of six flat rolled products into the district of entry and the source country. We believe that misinformation (or lack of) about local import volumes is often used to influence purchase decisions. Our intent with this analysis is to describe in detail what is going on in a company’s immediate neighborhood and thus provide a negotiating advantage for our premium subscribers.

Premium members will find reports on our website that break down the import tonnage through August into the port of entry and country of origin in metric tons. Products analyzed in this way are HRC, CRC, HDG sheet, OMC sheet, CTL plate and coiled plate. This data set is large; therefore, we will make no attempt to provide a commentary. Each reader’s interest will be different and he or she simply needs to select one of the six products, then find the nearest port or ports of entry to see how much came into their locality each month and from where. Monthly data is provided back to January 2015. It is clear from these detailed reports and from our companion reports by region that the change in tonnage entering a particular district in many (or most) cases is completely different from the change in volume at the national level.

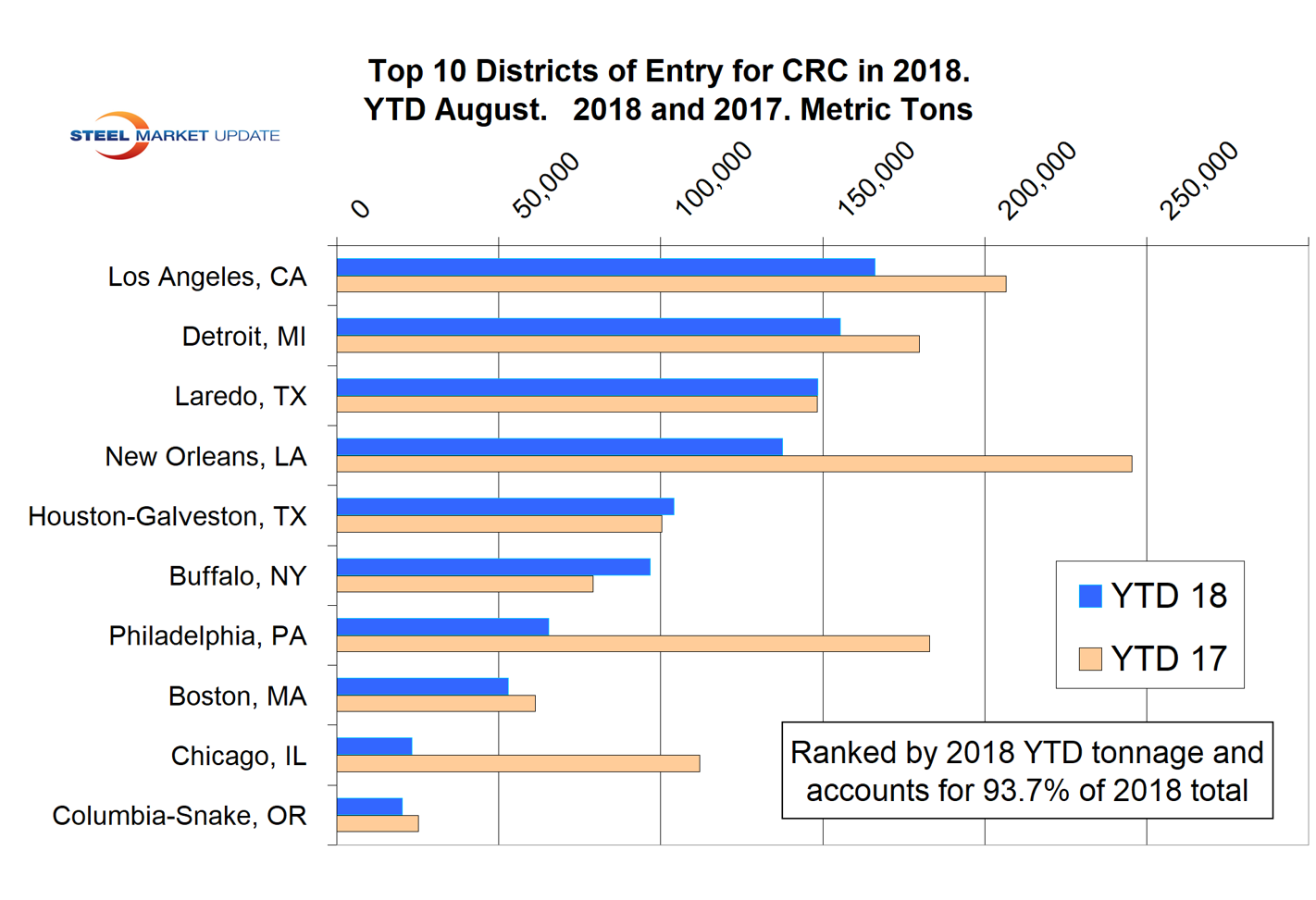

Here are some examples to illustrate why this information can be actionable: Total cold rolled coil imports through August year to date were down by 28 percent from 2017. New Orleans was down by 44 percent, but Buffalo was up by 22 percent. Cut-to-length plate imports were down by 22 percent nationally, but Buffalo was up by 6 percent and Houston was down by 50 percent. Examples like these are to be found throughout the six reports by product. The discrepancy between the change at the national and local levels is why it’s important for both market understanding and negotiating position to know what’s going on in your own backyard.

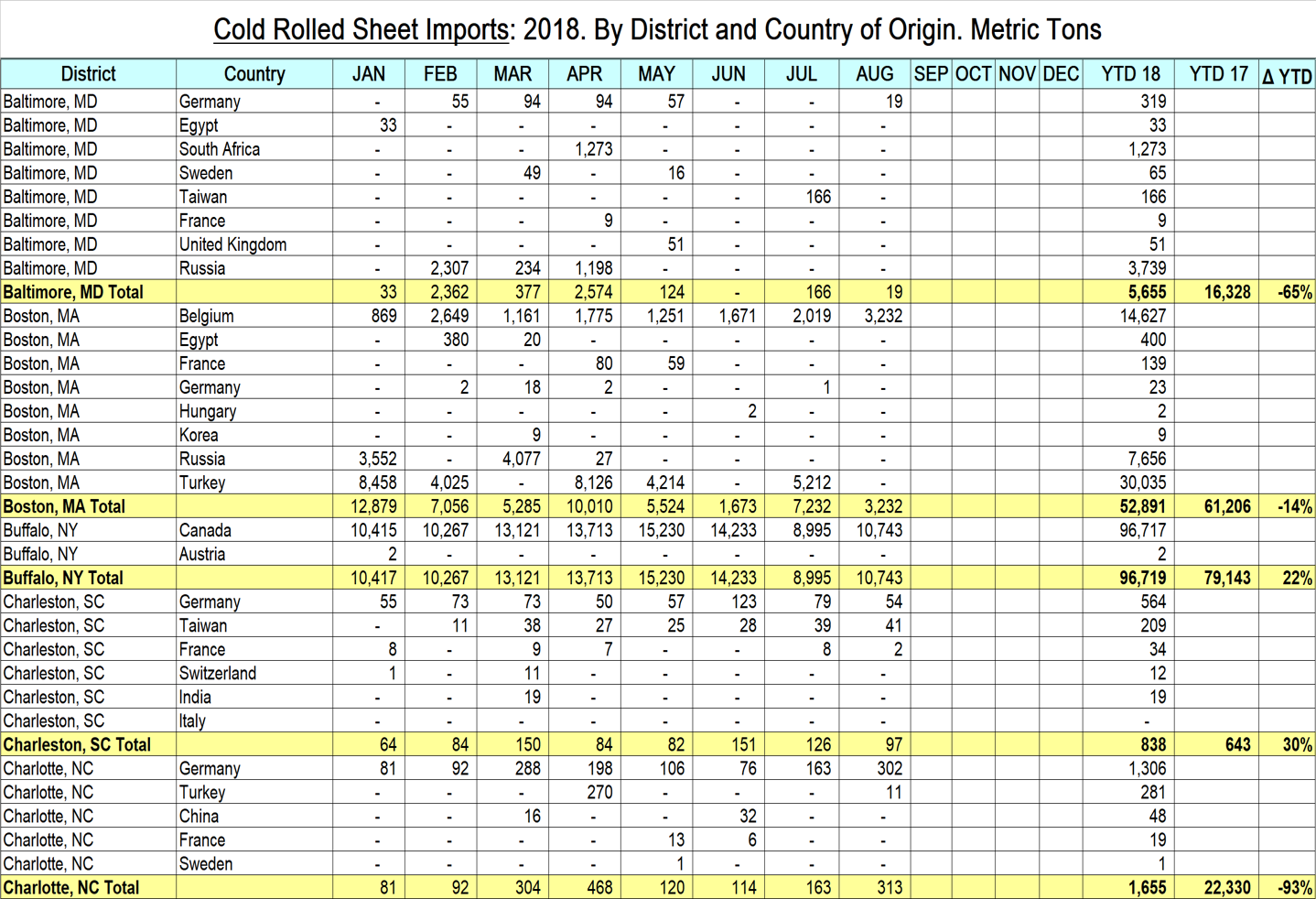

The table included here is a small part of the detailed analysis of the CRC sheet tonnage. The bar graph shows the tonnage that entered the top 10 districts through August year to date for 2017 and 2018 ranked by 2018 tonnage. These 10 districts accounted for 93.7 percent of the total so far in 2018. Los Angeles had the most volume in 2018 and was down by 20 percent compared to 2017. Australia has been by far the highest volume source into LA in 2018 followed by Vietnam and Russia.

The data in these detailed reports is compiled from tariff and trade data published by the U.S. Department of Commerce and the U.S. International Trade Commission. Our national level import reports are sourced from U.S. Department of Commerce, Enforcement and Compliance, aka the Steel Import Monitoring System. In the development of these reports by district and source country, we have discovered that the SIMA data for HRC and CRC contains some high-alloy steels such as stainless and tool steel, which have been misclassified at the ports. These alloy steels are not included in our detailed reports, which results in a small discrepancy between the two data sets, for CRC in particular and for HRC to a lesser degree.