Prices

September 6, 2018

Hot Rolled Futures: Strong Demand Undercurrent?

Written by Gaurav Chhibbar

Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this new role, he and his firm design and execute risk management strategy for clients along with providing process and analytical support.

In Gaurav’s previous role, he was a Trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. He can be reached at Gaurav@MetalEdgePartners.com for queries/comments/questions.

The week started with folks still digesting all the info from the SMU conference. The muted HRC price view for 2019 from experts and the expectation of a correction in scrap pricing clearly had market participants worried. As the trading started off, the selling pressure was felt across the curve. Dec traded at $785, about $100 below the benchmark index. Potential for cheap imports and added supply pushing HRC prices down in the U.S. was a plausible argument proposed by those selling. However the most interesting part of the curve remains the current month.

The September futures are trading at low $860s, underpinning the theory of a steep correction in the index this month. The index would have to correct by nearly $40 in the next three weeks for the September contract to average at $860. While there are rumors of some mills transacting at aggressive levels, the same hasn’t been reflected in the HRC index. Buyers for futures continue to cite the low inventory levels at service centers and strong ISM numbers as evidence of the strong demand undercurrent.

The ISM Purchasing Manager’s Index is a closely tracked indicator, followed by markets to indicate expansion or contraction of manufacturing activity. A reading above 50 indicates expansion. At current levels, the PMI is at the highest it has been since May of 2004.

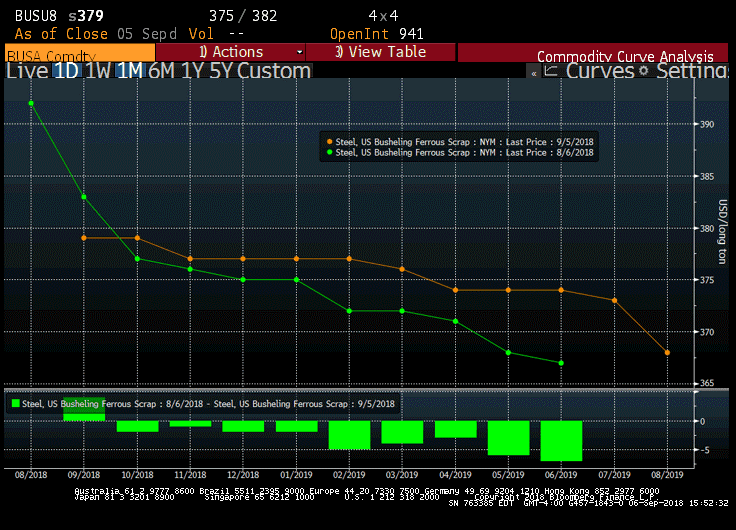

Scrap futures have remained uneventful over the past couple of weeks, although the curve has recovered month over month. Some activity on the Metal Margins has taken place at the $380 level for 2H 2019. The Metal Margin is the spread between HRC and Scrap and is derived from the forward curves of HRC-Scrap.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction.

Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions.

The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.