Prices

September 4, 2018

SMU Price Ranges & Indices: How Low Can Prices Go?

Written by Brett Linton

Once again flat rolled steel prices fell as steel buyers held back orders sensing blood in the water (lower prices). As one service center owner put it to Steel Market Update this afternoon, “The question is how weak can it get?” We were told the market had been acting like it had a “slow leak” but that has changed. Hot rolled has weakened and SMU has seen information suggesting there are $800-$820 deals out there (not counting JSW Ohio). We picked up a number of price points at $840 and we decided to call that the low end of the market right now. However, steel buyers need to be aware there may be further weakening ahead.

We are making a change in the .060″ G90 coating extra used when calculating that product for our index. The new extra will be $3.90/cwt, which is the extra used prior to the increases which came about late last and earlier this year.

Plate prices remained fairly stable and buyers continue to advise of tight supply for plate products.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $830-$900 per ton ($41.50/cwt-$45.00/cwt) with an average of $865 per ton ($43.25/cwt) FOB mill, east of the Rockies. The lower end of our range declined $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $15 per ton compared to last week. Our price momentum on hot rolled steel is Lower meaning we expect prices to decline over the next 30 to 60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $940-$1,000 per ton ($47.00/cwt-$50.00/cwt) with an average of $970 per ton ($48.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged over one week ago. Our price momentum on cold rolled steel is Lower meaning we expect prices to decline over the next 30 to 60 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $46.50/cwt-$49.50/cwt ($930-$990 per ton) with an average of $48.00/cwt ($960 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $18 compared to one week ago. Our overall average is down $18 per ton compared to last week. Our price momentum on galvanized steel is Lower meaning we expect prices to decline over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,008-$1,068 per net ton with an average of $1,038 per ton FOB mill, east of the Rockies. Note that we have adjusted our .060″ G90 extras from $86 per ton down to $78 per ton to reflect the recent adjustments in mill coating extras.

Galvanized Lead Times: 3-9 weeks

Galvalume Coil: SMU base price range is $48.00/cwt-$50.00/cwt ($960-$1,000 per ton) with an average of $49.00/cwt ($980 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is Lower meaning we expect prices to decline over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,251-$1,291 per net ton with an average of $1,271 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-10 weeks

Plate: SMU price range is $940-$1,010 per ton ($47.00/cwt-$50.50/cwt) with an average of $975 per ton ($48.75/cwt) FOB the customer’s facility. The lower end of our range declined $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $10 per ton compared to last week. Our price momentum on plate steel is for higher prices once the mills open their October order books. The plate mills are on controlled order entry and are expected to remain that way over the next 30 days or longer.

Plate Lead Times: 5-8 weeks, allocation/controlled order entry

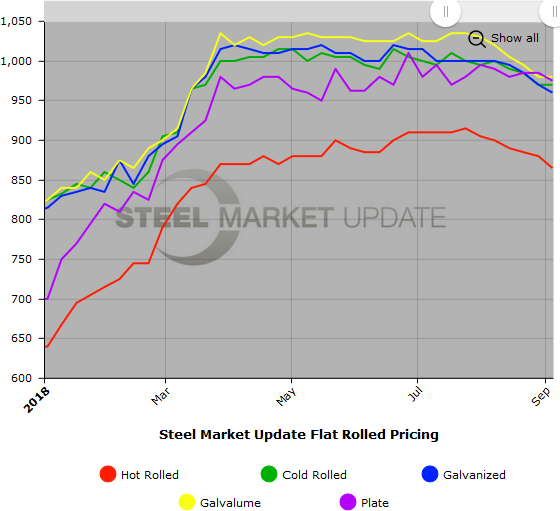

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.