Prices

August 28, 2018

Raw Material Prices: Iron Ore, Coking Coal, Pig Iron, Scrap and Zinc

Written by Peter Wright

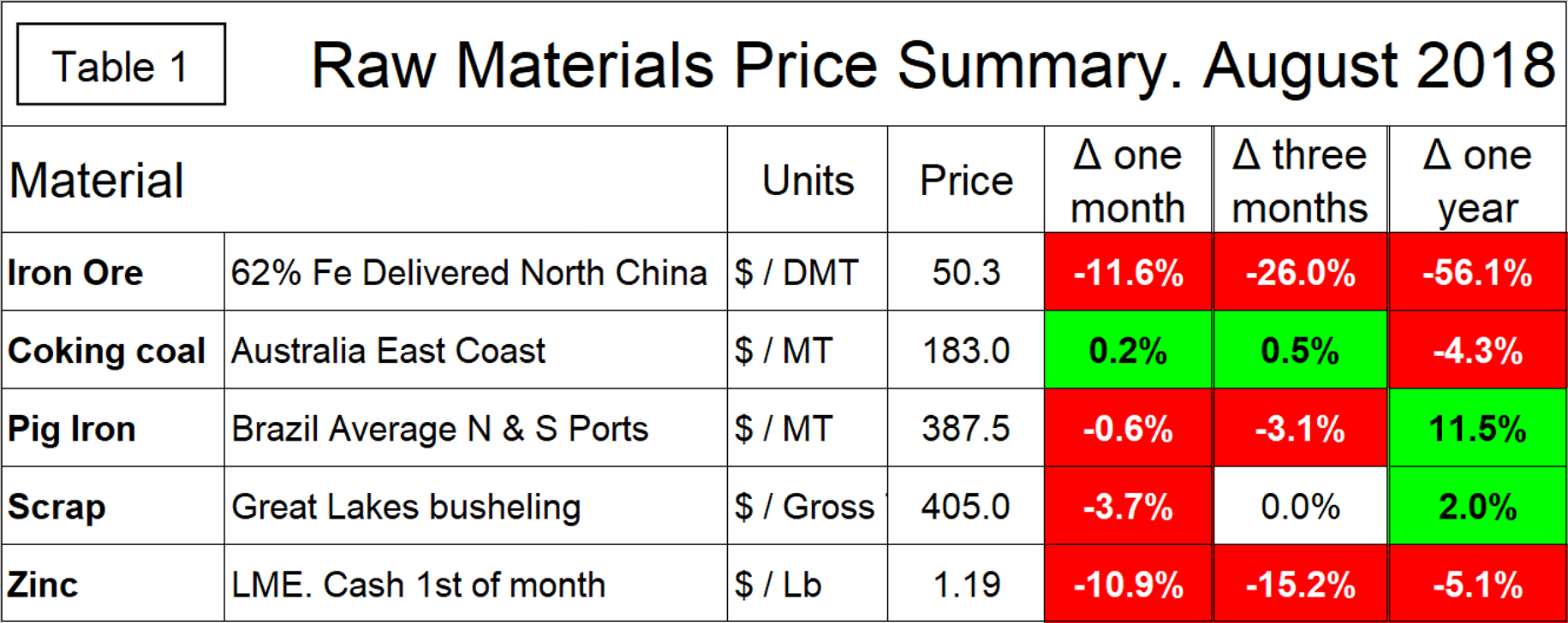

Table 1 summarizes the August prices of the five materials considered in this report and the month/month, three months/three months and year/year change. In the last month, coking coal FOB Australia’s East Coast eked out a small gain as the other four experienced price declines.

At the Jackson Hole meeting of the Fed on Friday, Chairman Jerome Powell said: “While inflation has recently moved up to near 2 percent, we have seen no clear sign of acceleration above 2 percent, and there does not seem to be an elevated risk of overheating.” According to The Heisenberg, a currency analyst that we follow, that’s as dovish as you’re going to get from Powell, given the current economic backdrop. This contributed to a decline of the dollar on international FX markets, largely negated Thursday’s gains and put the greenback on track for its largest weekly decline since the week ended July 6. Meanwhile, commodities erased Thursday’s losses and then some, extending gains as soon as Powell’s comments hit the tape.

Iron Ore

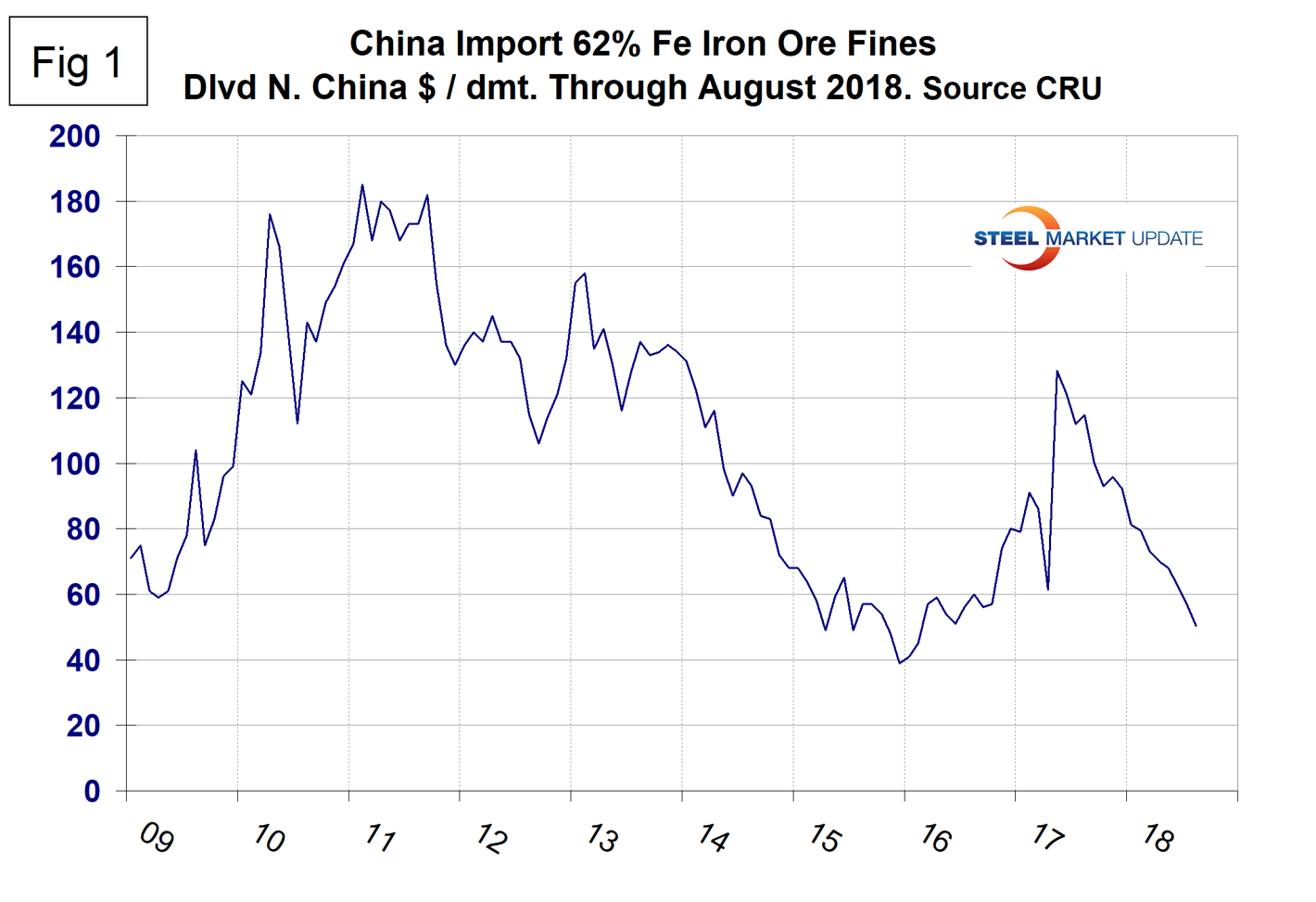

The weekly average spot price of 62% fines delivered North China was $50.30 per dry metric ton in mid-August. In one month, the price declined by 11.6 percent and is down by 56.1 percent year over year. The price has declined by 61 percent from its recent peak in May last year.

Figure 1 shows the price of 62% Fe delivered North China since January 2009.

Coking Coal

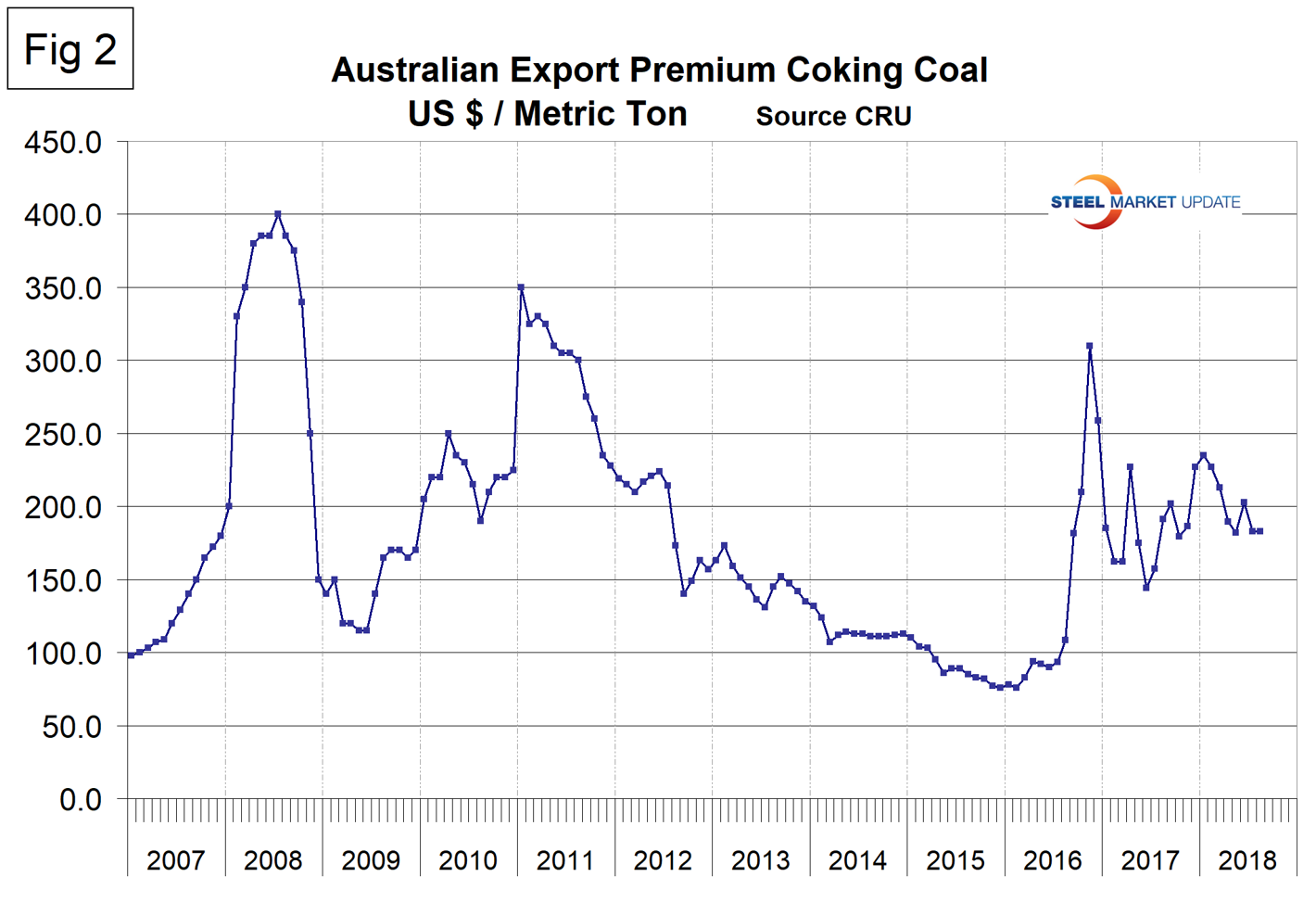

Coking coal prices have been erratic in the last two years. From February 2016 to November 2016, the price of premium low volatile coking coal more than quadrupled from $76 to $310 per metric ton. Since then, the price has stabilized in the $200 range and in August stood at $183. (Figure 2).

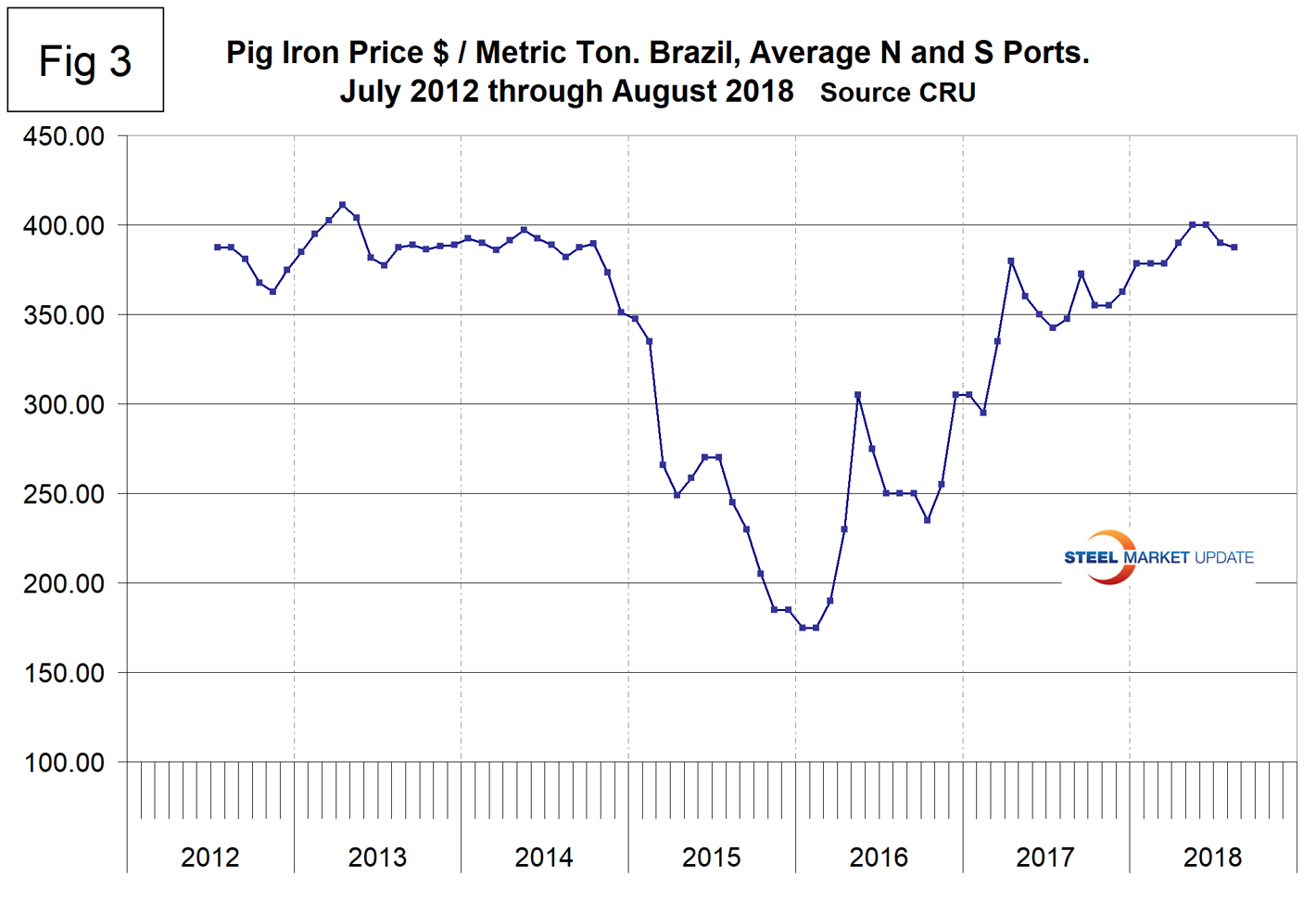

Pig Iron

Most of the pig iron imported into the U.S. currently comes from Russia, Ukraine and Brazil with additional material from South Africa and Latvia. In this report, we summarize prices out of Brazil and average the FOB value from the north and south ports. The price steadily increased from the $175 low point in January and February 2016 to $400 in May and June 2018 before declining to $387.50 in August. In the last three months, the price of pig iron has declined by 3.1 percent (Figure 3).

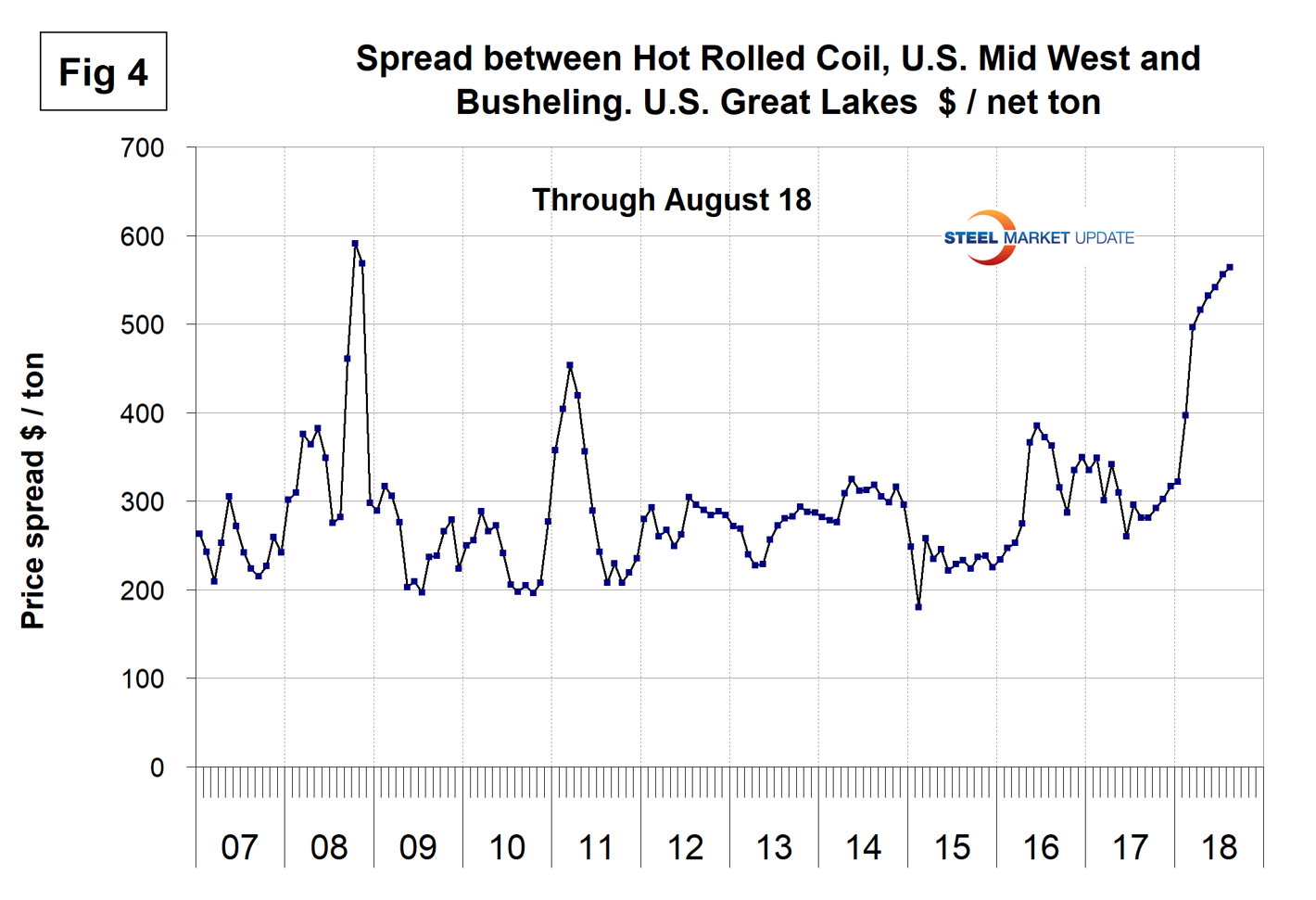

Scrap

To put this raw materials commentary into perspective, we include here Figure 4, which shows the spread between busheling in the Great Lakes region and hot rolled coil Mid West U.S. through early August 2018, both in dollars per net ton. The spread at $563.79 is now higher than at any time since the bubble of Q3 2008 and has increased every month since September 2017 when it stood at $278.48.

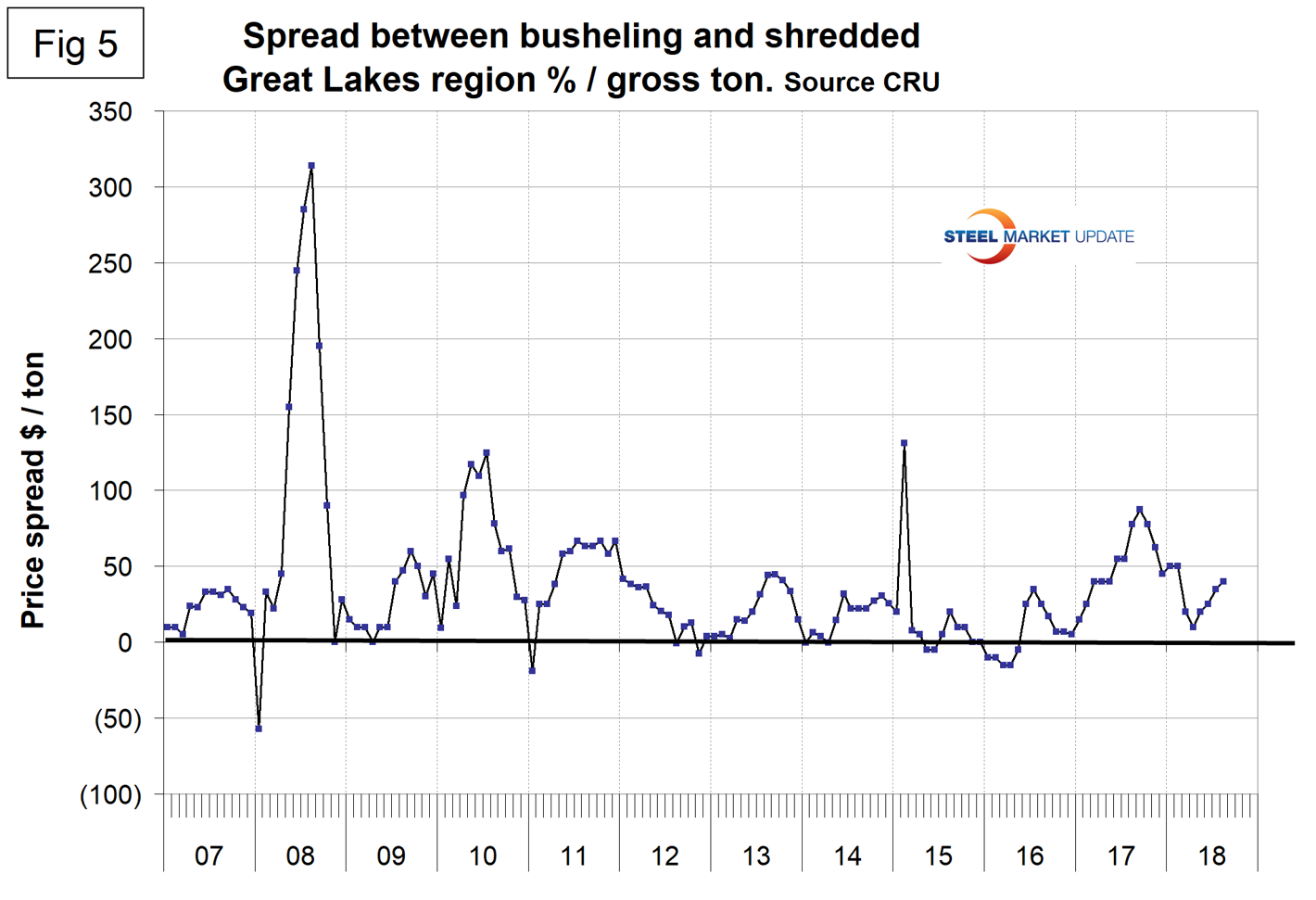

Figure 5 shows the relationship between shredded and busheling both priced in dollars per gross ton in the Great Lakes region. In May through July, shredded was unchanged at $370.00 per gross ton, up from $265.00 in October 2017, but fell by $20 in August. Busheling was unchanged in May at $390 per gross ton, rose $5 in June, $10 in July and gave back $15 in August. The busheling premium over shredded rose from $10 in April to $40 in August.

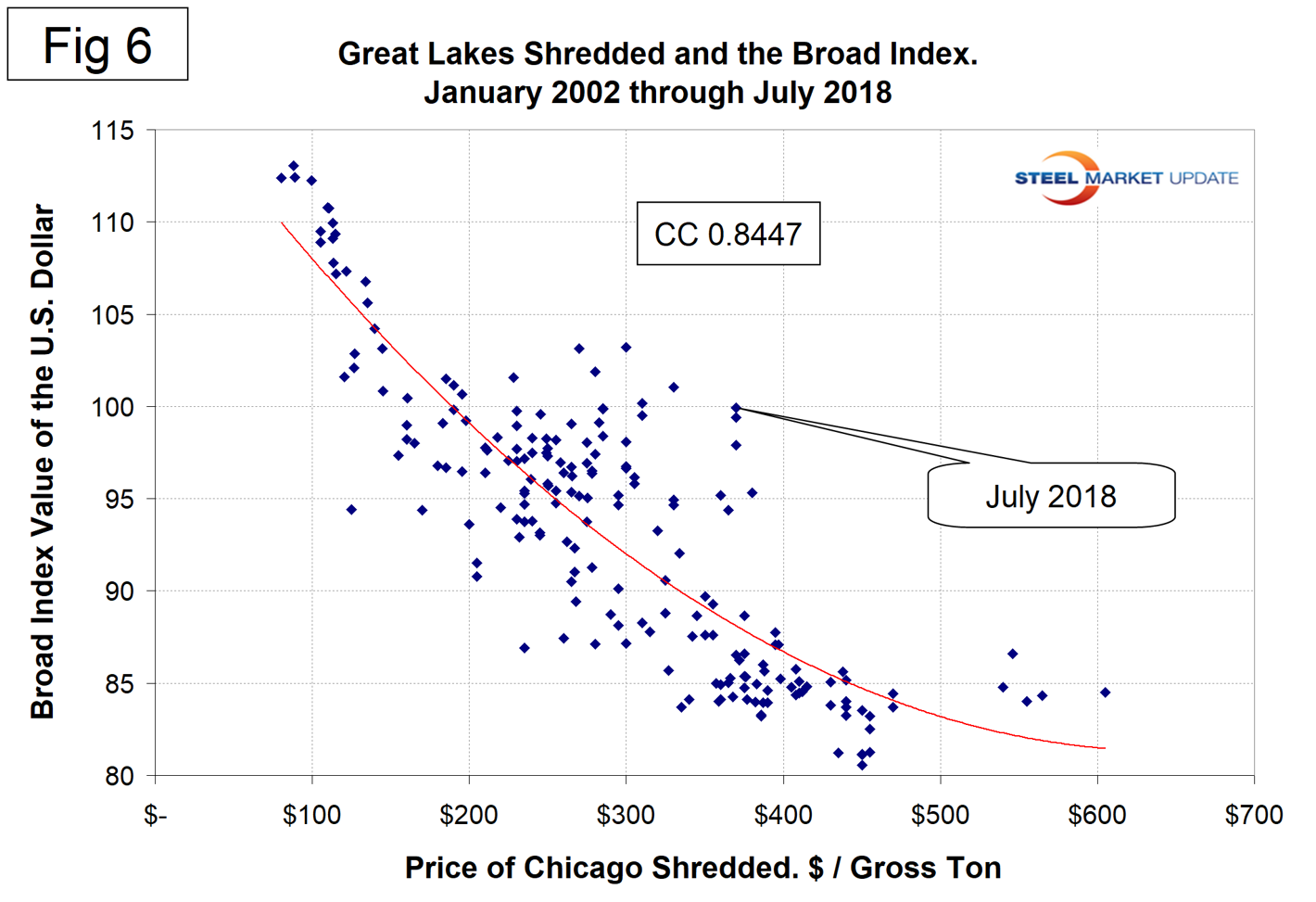

Figure 6 is a scatter gram of the price of Chicago shredded and the Broad Index value of the U.S. dollar as reported by the Federal Reserve. The latest data for the Broad Index was July. This is a causal relationship with a correlation of over 84 percent.

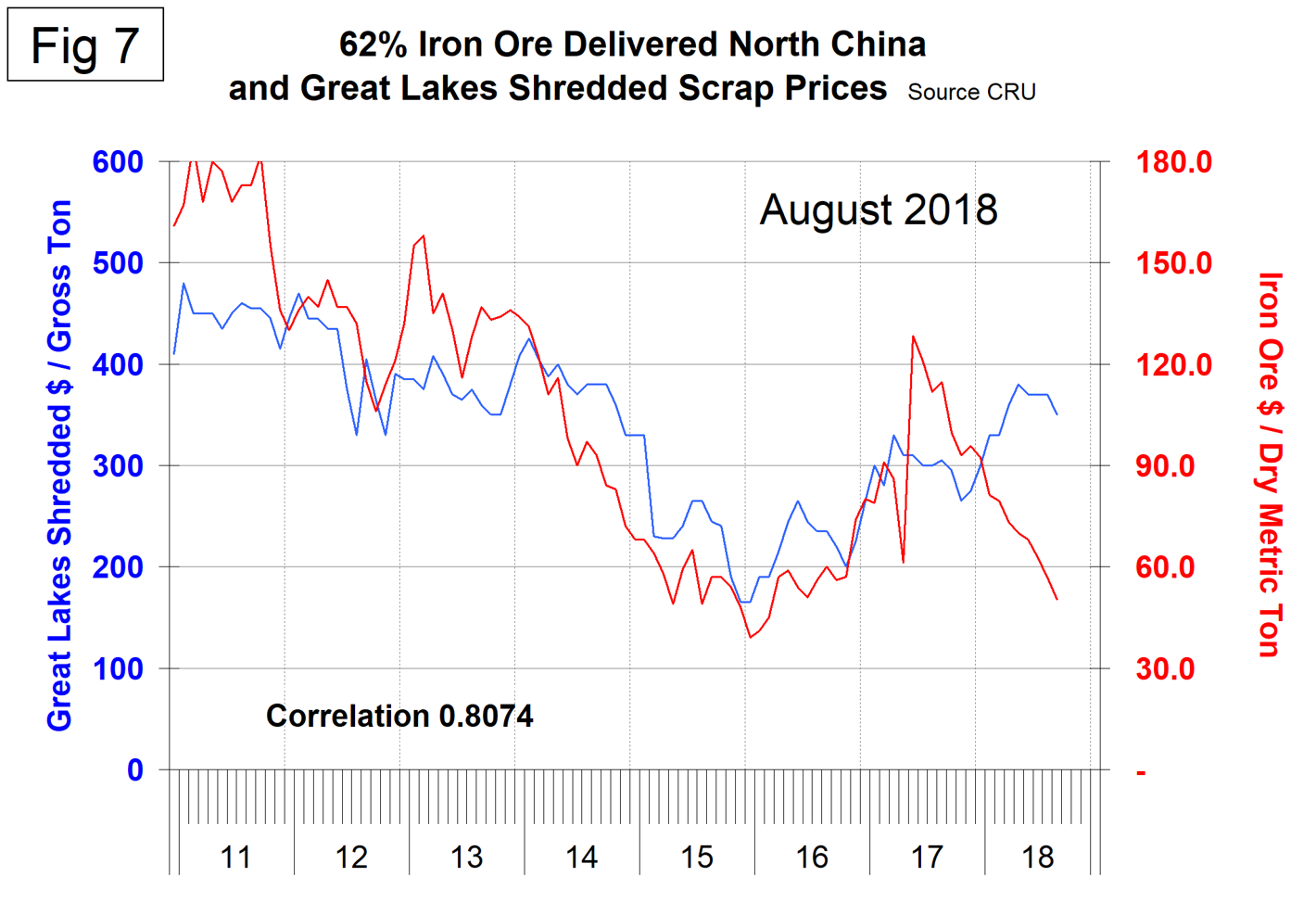

There is a long-term relationship between the prices of iron ore and scrap. Figure 7 shows the prices of 62% iron ore fines delivered N. China and the price of shredded scrap in the Great Lakes region through early August 2018. The correlation since January 2006 has been 80.7 percent. There has been a very unusual divergence in these prices in 2018.

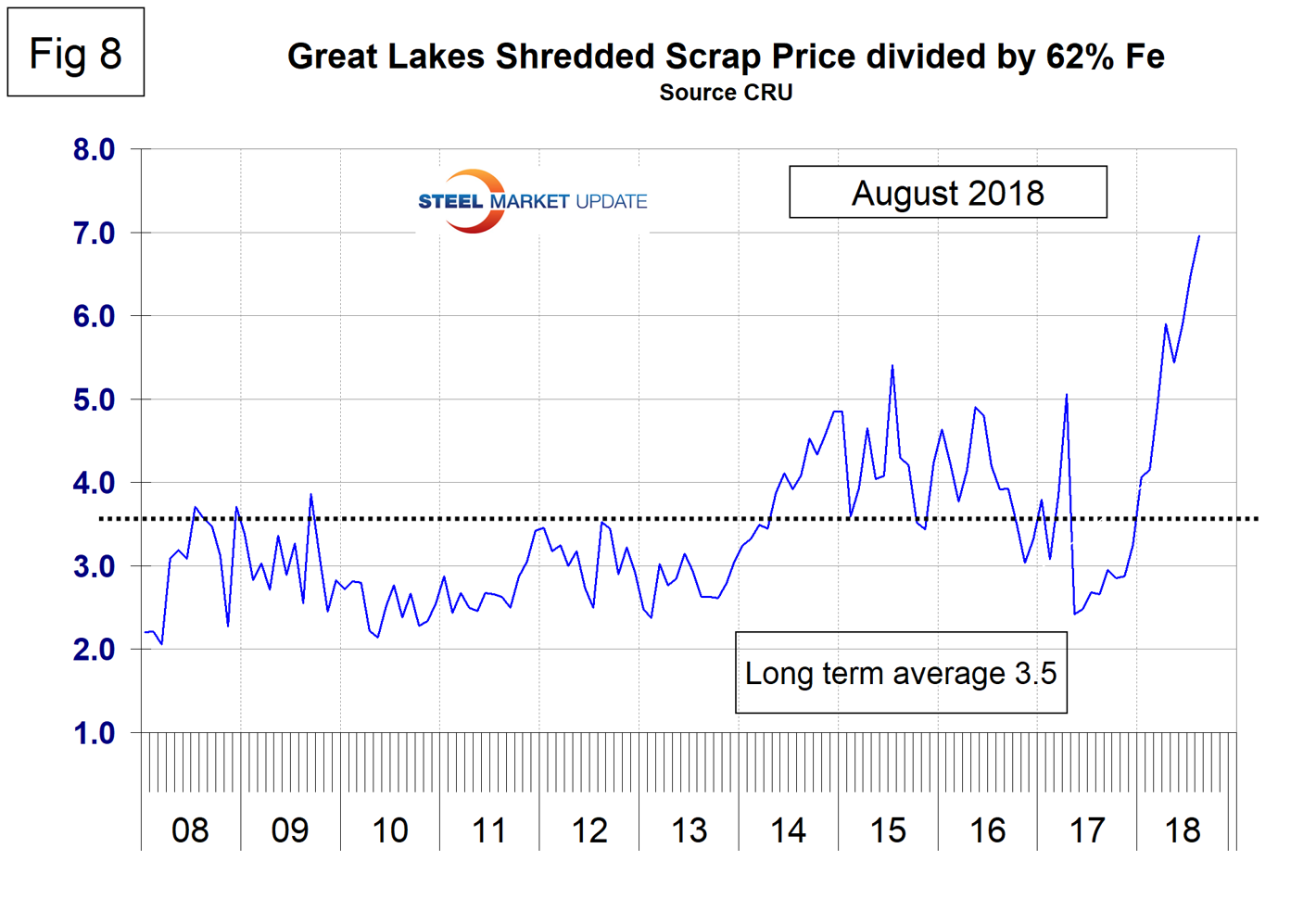

In the last 10 years, scrap in dollars per gross ton has been on average 3.4 times as expensive as ore in dollars per dry metric ton (dmt). The ratio has been erratic since mid-2014, but as the price of ore has fallen and scrap has risen the benefit for integrated producers has increased. In August the ratio at 7.0 is the highest since our data stream began in January 2006 (Figure 8). Since Chinese steel manufacture is 95 percent BOF, this ratio has allowed them to be more competitive on the global steel market. In the last four years, there have been times when China could supply semi-finished to the global market at prices competitive with scrap.

Zinc

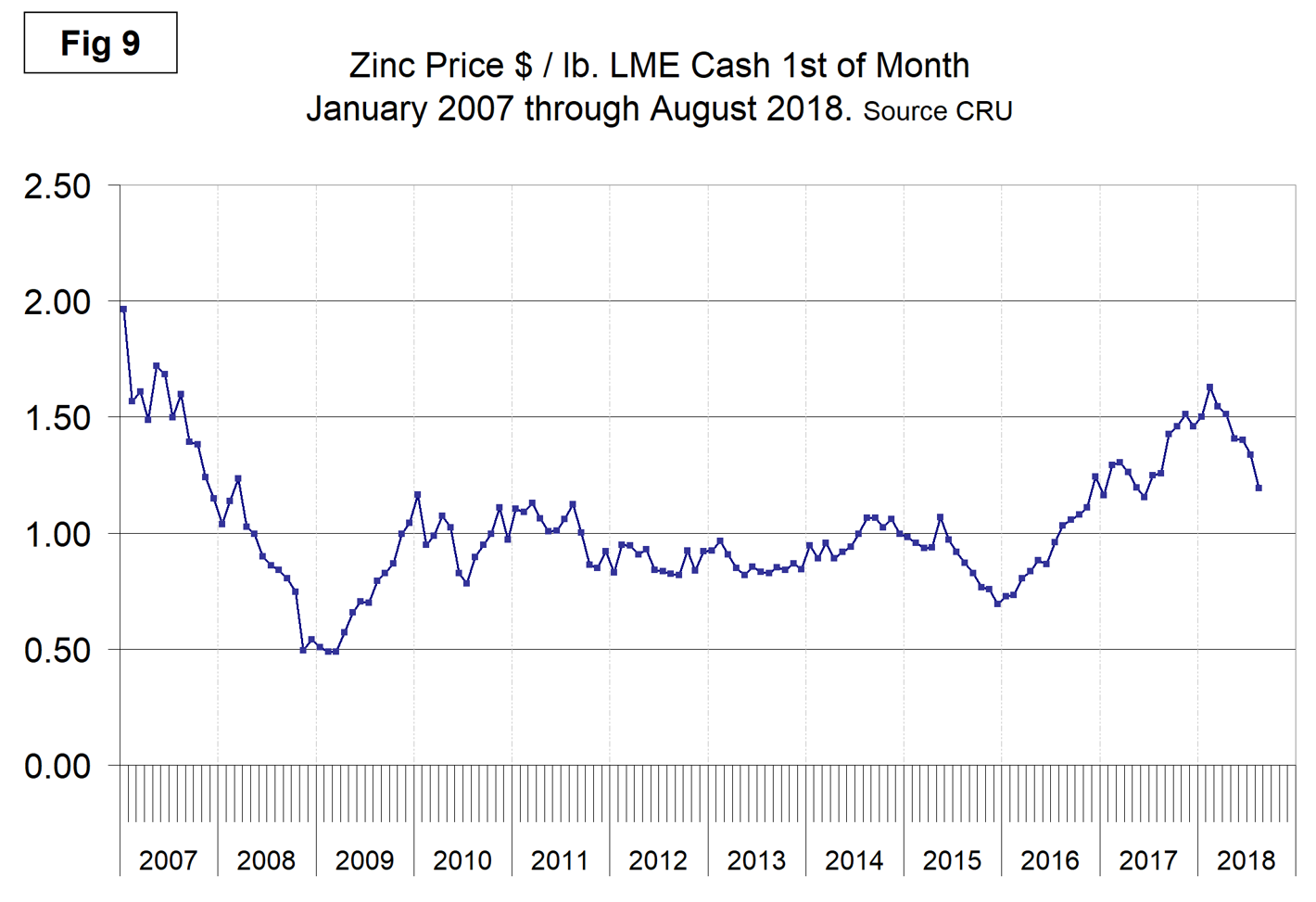

The LME cash price for zinc on the first of each month is shown in Figure 9. The price of zinc on Aug. 1 was $1.19 per pound, down from a high of $1.63 on Feb. 1. According to Bloomberg, zinc is the worst-performing base metal this year on the London Metal Exchange. “Continuously increasing LME inventories and weak Chinese demand added to worsening zinc fundamentals,” said Casper Burgering, an economist at ABN Amro Bank NV. “Supplies of zinc concentrates will continue rising. As a result, zinc prices will weaken further.”

Zinc is the fourth most widely used metal in the world after iron, aluminum and copper. Its primary uses are 60 percent for galvanizing steel, 15 percent for zinc-based die castings and about 14 percent in the production of brass and bronze alloys.

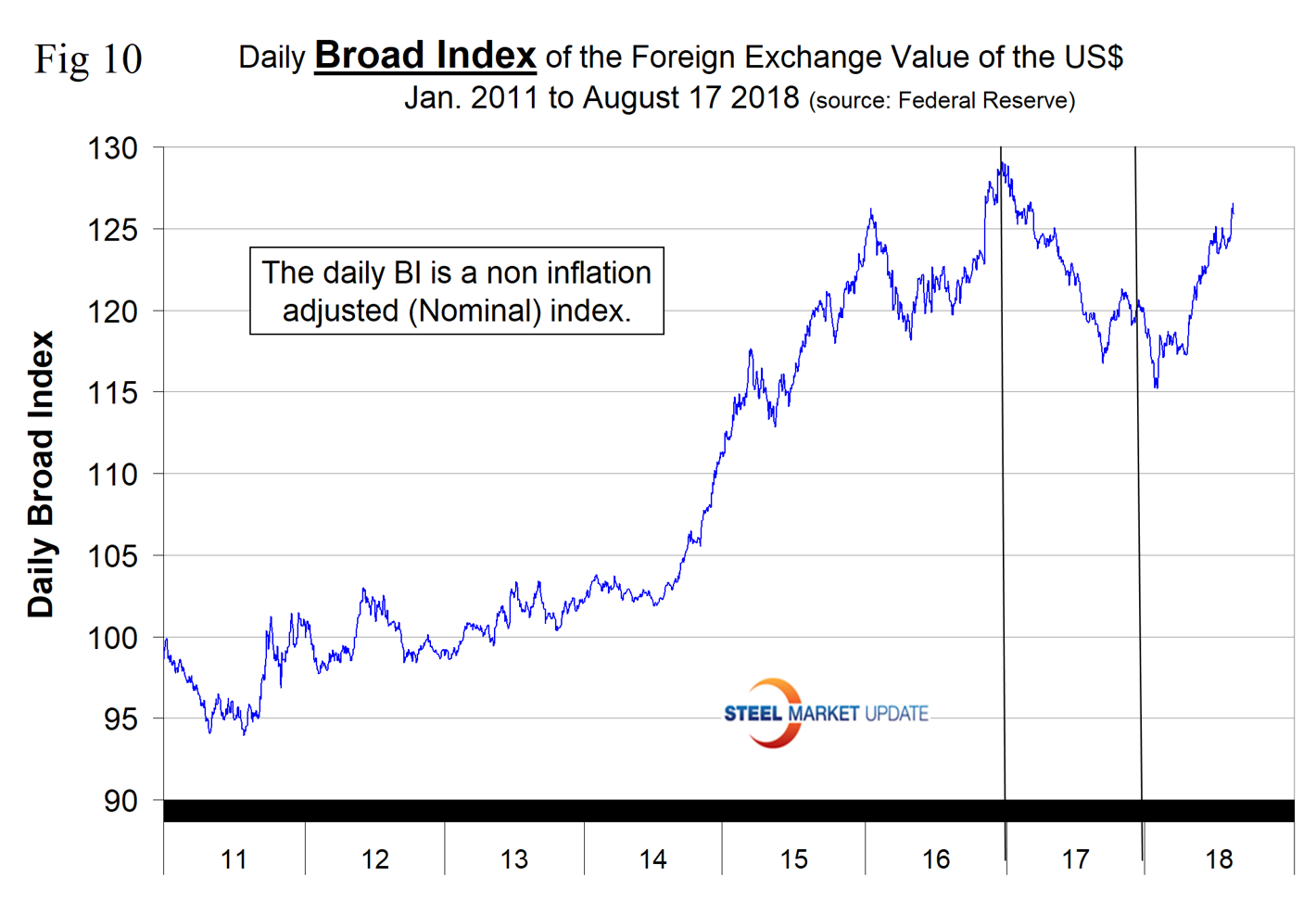

SMU Comment: There is an inverse relationship between commodity prices and the value of the U.S. dollar on the global currency markets. After falling for most of 2017 and through Feb. 1, 2018, the dollar has experienced a sharp upward revival and through Aug. 17 was up by 9.3 percent (Figure 10). Supply and demand fundamentals are the primary drivers of raw materials prices, but a rising dollar puts downward pressure on the price of those global commodities that are priced in dollars, as is clearly shown by the relationship between scrap and the dollar index described above in Figure 6.