Market Data

August 21, 2018

Pandering to the China Bears: How Much Zinc Supply is Too Little?

Written by Tim Triplett

Editor’s note: The following was contributed by Analyst Ryan Cochrane of the CRU Group.

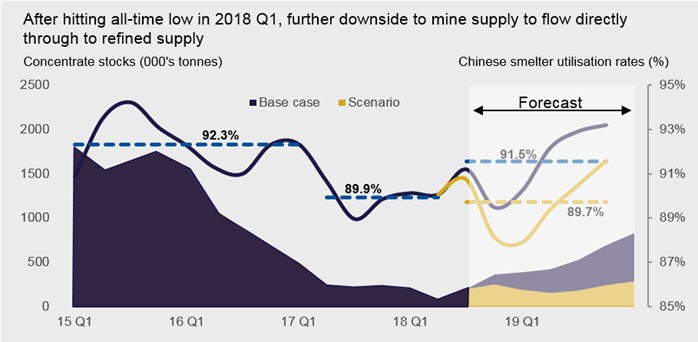

Global concentrate inventories first reached critical levels in 2017 Q1, leading to Chinese smelter utilization rates falling below 90 percent and remaining at depressed levels since.

Without much buffer concentrate stock remaining, the relationship between mine supply and Chinese smelter output has continued to strengthen. A key consideration (and uncertainty) for the global concentrate and metal market over the course of this year and next is to what degree Chinese mine supply recovers.

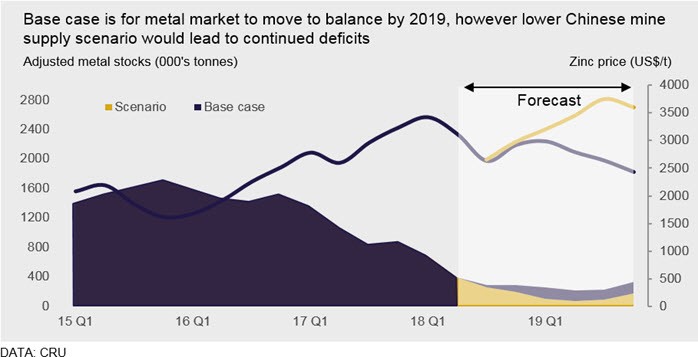

Our base case sees smelter utilization rates improving from 2018 H2 through the end of 2019 as robust mine supply growth from the rest of the world and modest (3.8 percent in 2018 and 4.7 percent in 2019) growth from China supports rising concentrate availability. In this article, we stress test the global concentrate (and metal) market against a scenario of falling Chinese mine supply over the next 18 months. In effect, we identify the required shortfall of Chinese (or indeed ex-China) mine supply to affect genuine tightness in global metal markets. While we consider this scenario unlikely, such an outcome (all else being equal) would drive further metal deficits through 2019 as smelter utilization rates in China would remain below 90 percent. Such a scenario would see metal stocks fall to levels not seen since the 06/07 price spike.

Chinese Mine Supply has Grown Only Modestly Since 2017

Last year was a difficult one for Chinese mine supply, with CRU’s roundup for output at 4.17 Mt (up just 2 percent year-on-year) despite significant gains in the zinc price. Environmental restrictions left many operations partially idled or shut across the country as inspections took place. With strict environmental enforcement expected to remain in place over the medium term, an increasingly important question with respect to the global concentrate (and metal) market remains to what extent Chinese mine supply can rebound this late in the zinc price cycle. By the zinc price peak in February 2018, Chinese miners had enjoyed nearly 24 months of margin expansion. Despite this, environmental inspections and restrictions have held back mine supply growth. Our roundup of major Chinese operations in 2018 H1 support a mixture of positive and negative growth stories with our estimate for H1 growth up 2 percent year-on-year. More detailed analysis on our Chinese mine supply projections is provided in the Chinese mine supply section of our July Zinc Market Outlook.

Base case – Chinese Mine Supply Recovers Gradually in 2018 H2

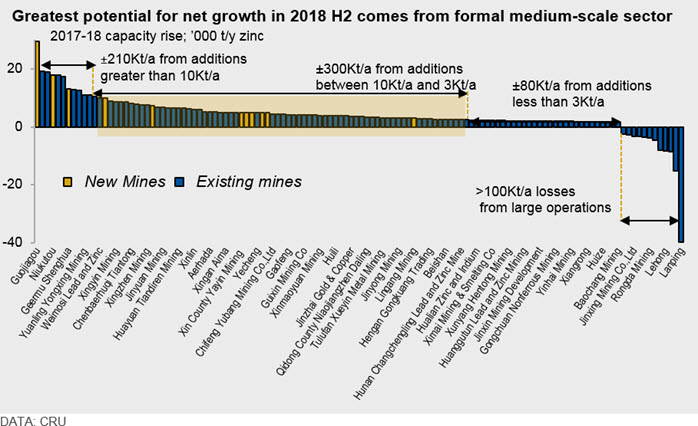

The potential for capacity additions in 2018 remains comparable to past periods of solid supply growth, although the bulk of net growth is expected from medium-sized assets, which were impacted by environmental restrictions in 2017.

The chart below highlights that the top 14 projects could add over 200,000 t/y this year. Somewhat offsetting this are the production losses (±100,000 t/y) expected largely due to the processing of lower grade ore.

A further 60 named operations (highlighted in yellow) could add 300,000 t/y through small incremental gains of between 3,000 to 10,000 t/y. Importantly, excluding new projects, this category of operations represents many medium sized operations that were affected by the raft of inspections and restrictions carried out in 2017. As we understand that these operations survived closure, it is likely that some lost production will be recovered through 2018 H2.

Our base case production forecast for 2018 allows for a further 140,000 t/y of disruption to our capacity (4.47 Mt) projections, which translates to our production forecast of 4.33 Mt in 2018. This represents a 3.8 percent year-on-year gain. Similarly, we expect further modest growth through 2019, with our mine supply forecast at 4.53 Mt.

Between 2015 and 2018 H1, there has been a strengthening positive correlation with (falling) global concentrate inventories and Chinese smelter utilization rates – particularly between 2017 Q2 and 2018 Q2, as utilization rates were constrained as global concentrate inventories (and spot treatment charges) fell to historic lows.

We expect the concentrate market to remain balanced in 2018 as buffer stock is insufficient to see any further material drawdowns.

• An additional 1 Mt of zinc in concentrate becomes available in 2019 with notable gains from Dugald River, Gamsberg and New Century Tailings.

• Our numbers show that over 80 percent of this growth will arise from outside China.

• Rising concentrate availability (and increased imports) will drive Chinese smelter utilization rates to an average of 91.5 percent (on a trailing 12-month average) over the next six quarters.

• Concentrate inventories to build after 2019 Q1, even with rising Chinese smelter utilization rates.

• Zinc prices to find support through 2018 Q4 and 2019 Q1 as a seasonally driven deficit tightens Chinese refined market.

• The metal market to return to balance in 2019, putting downward pressure on zinc prices. Treatment charges to rise sharply.

Scenario – Chinese Mine Supply Continues to be Constrained and Actually Falls in 2018

This scenario envisages mine supply falling to 4.13 Mt in 2018 (down from 4.17 Mt in 2017) and remaining flat in 2019 at 4.15 Mt. The net effect of this scenario from our base case would be a reduction of 583,000 metric tons of zinc in concentrate over the six quarters between 2018 Q3 and 2019 Q4.

We have assumed that smelters continue to operate on a hand-to-mouth basis during the period and produce as much as feedstock allows. The consequences of this scenario are:

• Treatment charges would remain depressed as concentrate availability constrains Chinese smelter utilization rates to below 90 percent.

• Metal market deficits would persist longer and be more acutely felt than in our base case. This would drive global metal stocks to levels not seen since 2007 (when peak metal tightness occurred) and drive a rally in zinc prices.

• The metal market would return to balance only towards the end of 2019, solely through growth in ex-China supply.

• Zinc prices would receive meaningful price support and surpass the highs achieved in 2018 Q1.

Significant Mine Supply Underperformance Required to Drive Genuine Metal Market Squeeze Over Next 18 Months

This analysis reveals that in order to create genuine metal market tightness globally, an under supply of nearly 600,000 metric tons (or ±100,000 tons per quarter) compared to our base case is required over the next six quarters. This represents a significant under performance in forecast mine supply, either in China or elsewhere, and would require more than both Gamsberg and New Century Tailings to significantly underachieve.

It is also interesting to note that under our base case, just 19 percent of incremental (> 1Mt) global mine supply growth in 2019 is expected to come from Chinese mines, meaning the concentrate market is increasingly reliant on growth from outside China.

To meet the needs of its ever-expanding smelting capacity, China will therefore become a larger sink for global custom concentrate imports. Because of this, Chinese smelters will also continue to be subjected more acutely than ex-China smelters to the vicissitudes of concentrate availability and thus remain the “swing” producers. This supports the view that Chinese miners will continue to seek ownership of high quality zinc deposits/mines outside China.