Prices

August 16, 2018

Hot Rolled Futures: What a Tweet Storm!!

Written by Gaurav Chhibbar

Gaurav Chhibbar is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this new role, he and his firm design and execute risk management strategy for clients along with providing process and analytical support.

In Gaurav’s previous role, he was a Trader at Cargill spending time in Metal and Freight markets in Singapore before moving to the U.S. He can be reached at Gaurav@MetalEdgePartners.com for queries/comments/questions.

Friday last week saw a flurry of activity. Shortly after a tweet informed the market that the president intended to double tariffs against Turkish steel and aluminum, the futures reacted.

As the bears scrambled to cover some shorts, the market was strongly bid and saw the nearby levels move up by $5 to $15.

Part of this activity can be attributed to those who had shorts in place to hedge imports from Turkey or other origins.

Another category of buyers were likely those players looking to fix prices for their index-linked steel purchases and making use of the steep backwardation. Whether sellers come back to drive down the curve or not remains to be seen. In the meantime, many other fundamentals need to be closely watched.

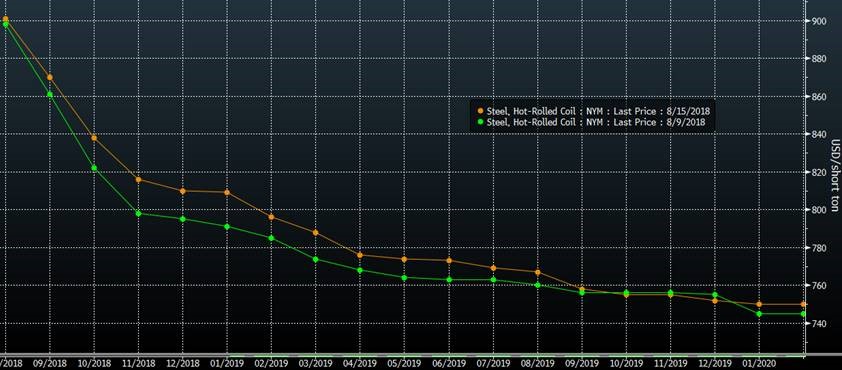

The below chart shows the week over week dollar change more clearly on HRC futures as the near end of the curve got pulled up more than the back end.

For now, the futures market obviously expects a positive price impact to the U.S. steel pricing due to the additional tariffs on Turkish products as reflected by the upward price movement.

The impact of the weaker Lira and the additional tariffs on Turkish steel were also visible on the LME traded Scrap contract, with the curve being pushed down in the anticipation of weaker scrap demand.

While weaker raw material prices are a concern for steel pricing in the future, another factor that needs attention is the impact of currencies.

Despite the import barriers, some currencies deserve attention. The USD has strengthened considerably against most currencies.

Other than the Mexican peso and Canadian dollar, another economy that impacts steel pricing is Brazil.

The chart below shows a weaker Brazilian real versus the U.S. dollar. A weaker currency allows for the country to be more competitive in export markets.

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice,” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information.